Change of focus: from supply to demand destruction in food and nonfood markets.

Your Bi-weekly update on edible oils & fats by Aveno

April 24th, 2020

Since mid-March, global edible oil markets are marked by market distortions as a result of the Covid-19 virus pandemic, as well as a decreasing demand for petroleum products. This situation shook up old certainties and future developments are subject to considerable uncertainties. Low commodity prices are generally an indicator of an economy in bad shape and often a bad economy will leave consumers with less disposable income, especially in “emerging markets”. According to Oil World this may even reverse the growth trend of per capita consumption of oils and fats. No one could ever have anticipated this pandemic's scale and impact on businesses across the globe and when in unchartered territory, smart explorers don't run, they walk cautiously.

The eyecatcher of last fortnight

Source: Trading Economics

Source: Trading Economics

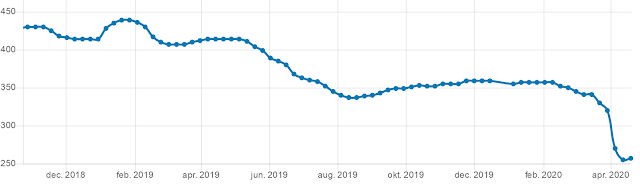

The ‘virus’ and the Saudi-Russia oil war hit petroleum markets hard. This week we witnessed a negative-price-nightmare for crude oil in the U.S. of A. Crude oil futures of West Texas Intermediate petroleum dropped to nearly minus $40! There is just too much crude nobody wants at this moment. But sooner or later fundamentals always find a balance and the longer the price stays cheap, the less producers can make a living out of pumping oil. Eventually, helped by deliberate production cuts and the ‘natural adjustment’ of production, supply will fall to levels closer to demand. Eventually demand and prices will recover and with rising tensions in the Middle East, petroleum may skyrocket again, taking everybody by surprise.

Right or wrong focus?

In these uncertain times the world starts to focus on the overall (direct and indirect) fading demand, from biodiesel to food service and everything in between.

The French Groupe Avril announced they temporarily closed three of their six biodiesel plants as in the past weeks a 60% decrease in diesel-vehicles on the roads slashed demand for biodiesel blending. Avril is also a rapeseed crusher and vegetable oil producer and the volumes intended for biodiesel production became available for other markets: "We are trying to find outlets to export the oil” they said. Apparently, China bought oil and it was reported that some 100.000 tons of crude rapeseed oil will be shipped from EU in the coming months. Needless to say, that also other European biodiesel producers have cut production. This is a rather bearish picture for rape oil; or at least a more balanced picture.

Source: European Commission / IGC, Monthly average crude oils close April 23rd

While some focus on too much rapeseed oil others focus on the availability of rapeseed. Many mills are sold out exceptionally early this year and another shortage in rapeseed supply is expected for the 2020/21 marketing year. Expectations of another sub-standard rapeseed harvest (starting in June if all goes well) make oil mills try to procure supplies for the coming season well in advance. But farmers are not selling because the corona crisis causes uncertainty, the planted area is not big, the price level is not attractive, the crop development is uncertain because there has been some winterkill in certain regions and because of the dry weather experienced in some growing areas. This is potentially a very bullish picture.

For palm oil there is a predominant bearish picture: low petroleum prices make the Malaysian and Indonesian biodiesel projects unattractive, less disposable income in the emerging markets kills demand, soon we will enter the higher production season and stocks will grow, etc.…. and in the vegetable oil market pricing is strongly influenced by the level of palm oil prices, thus weighing on the whole oils & fats complex.

Butter price evolution.

In week 16, just after Easter, the average EU-28 butter price of €295/100 kg had lost 10% in four weeks. Below graph shows the evolution of the official Dutch butter price from the “ZuivelNL/DairyNL”-organization which seems to have bottomed out around Easter at €255 and which since then gained €2/100 kg.

Source: Nieuwe Oogst

Brent crude petroleum price (April 24th): $ 22.06/barrel

1 EURO (April 23rd) = USD 1.0772

Don't forget to check out our other bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched this bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/newsletter

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/newsletter

Sign-up for Aveno's newsletters!

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.