There is a lot we don’t know.

-but is looks constructive.

Your Bi-weekly update on edible oils & fats by AvenoAugust 28th, 2020

We wish we knew what is really happening in

Indonesia and elsewhere, and if it is going to rain on the soybean crop, if

palm stocks will rise due to higher production numbers and lower exports. We

would like to know when China will end building strategic reserves of food

which took the market by surprise. It is very difficult to read the market as

the pace of demand recovery is unclear. Luckily, we are not in the business of

predicting prices but in the dynamic business of oils and fats.

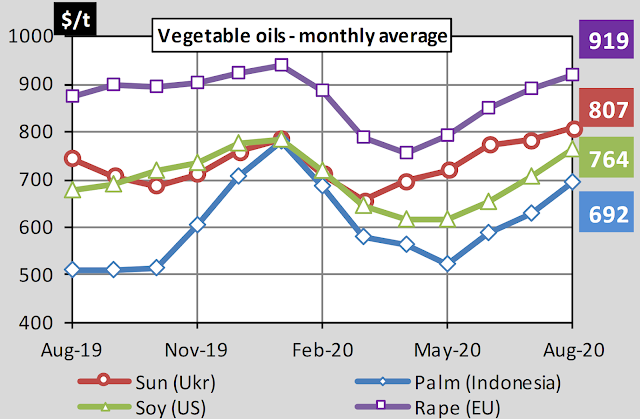

Market evolution in the past 2 weeks

January position, refined, in euro:

Source: European Commission / IGC, Monthly average close August 27th

Palm oil yields will suffer, from reduced fertilizer application last year, probably up to 2021. And labor shortages remain a problem. But some analysts expect lower palm oil prices in the coming period as they expect rising stocks due to lower demand from China and India. Exports of Malaysian palm oil products for Aug. 1-25 dropped 16.4 percent. China seems to have shifted back to soy, rape and sun oil (note China mostly imports palm olein, not palm oil). The further Indonesian implementation of biodiesel plans remains a black box and they use about 7 million tons of palm for biodiesel in 2020.

Soy market was calm with slight price fluctuations. The weather in the Midwest is closely monitored and weather models predict a slightly wetter situation in the coming weeks, following tropical storm Laura. China remains committed to its Phase 1 deal with the US and thus buying additional agricultural products. We still expect a bumper crop. Brazil is expanding the soybean production (not even counting the unofficial acreage). Restocking may or may not be over but in view of global record production some expect a burdensome carry-out at the end of season 20/21.

Expect tight non-gm-rapeseed supplies in EU as we just about finish the lowest harvest in 14 years. France announced earlier in August an additional 20% tax incentive to use rapeseed oil in biodiesel production. This is to get rid of high biodiesel stocks and to discourage palm oil usage. EU stays reliant on imports as we progress through the season. Australia looks great and timely rains could boost the crop to exceed 3.5 million tons at harvest during LH Oct-Nov-Dec. Canada’s harvest is starting, yields look good, but strong demand from EU and China, supports prices there as well.

Red flag: if a second wave of covid results in lockdowns, biodiesel consumption will drop and it will be hard to sell the GM rapeseed oil from imported rapeseeds.

The prices of sunflower seed increased further due to limited availability and crop deterioration. Market sentiment changed completely from slightly bearish to bullish. Further direction will depend of what comes out of Argentina, what Russian export policies will be, what China and India will be buying, what the final global crop will be and eventually what soy, rape and palm prices will do. Looks a very complicated situation.

The euro remained supported by the EU relief package. But equity markets and the dollar rose after the Federal Reserve announced their plans for employment and their inflation policy.

Petroleum prices found support when Gulf Coast producers shut down 80% of the offshore crude oil production as hurricane Laura approached the region. The EIA also reported lower-than-expected US crude inventory. In countries where there are no biodiesel mandates, we see biodiesel production decrease. In New Zealand, dairy giant Fronterra dropped biodiesel use because it is no longer economically viable.

It is AVENO’s privilege to serve you, please know we are always here to help.

Please pass us your orders on time so that they can be delivered in due time.

Don't forget to check out our other bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched this bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/newsletter

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched this bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/newsletter

Sign-up for Aveno's newsletters!

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.