Is the world drying up?

Your Bi-weekly update on edible oils & fats by Aveno

September 11th, 2020

September 11th, 2020

Market sentiment turned more bullish as the world faces more dry weather.

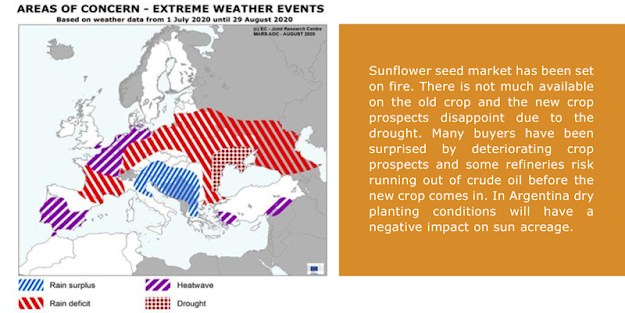

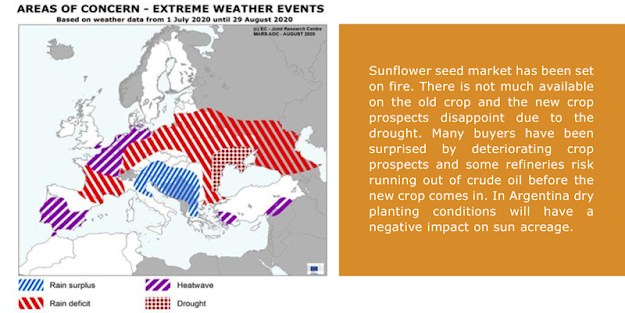

It seems that “La Niña” (weather phenomenon causing below average rainfall) is getting stronger. Therefore, the chance of prolonged drought in southern Brazil and Argentina increases and it also increases the risk of lower yields. In Brazil dryness is likely to delay plantings until October.

Despite some very welcome rainfall in the Midwestern U.S., conditions of soybeans have been revised downwards due to prolonged dryness. In the coming weeks the weather seems to remain dry in the Midwest and there are already some concerns about frost. Freezing temperatures in North Dakota and northern Minnesota may have caused damage. All eyes are on the next USDA report with crop forecasts.

source: European Commission

Soybean prices continued to rise and China continues to buy heavily in the US.

Global consumption of soybeans is expected to increase in season 2020/21, led by increases in China where expected growth in meat production, following a recovery from African Swine Fever, is due to boost demand for soymeal. Managed funds also continue to buy soybean futures, taking their long positions close to levels not seen since 2016 and 2018.Hopes or expectations of rising palm oil production weigh somewhat on the palm markets.

Palm oil production is staying behind normal numbers and demand from China, India, Pakistan and Africa remained strong. Increased palm oil use for soap and cleaning products compensated somewhat the lower demand for biodiesel production. Market is watching every report on stocks evolutions in producing countries and hopes on a production increase in coming weeks.Besides undergoing weather markets, uncertainty remains about global evolution of the coronavirus spread and possible re-confinements which may hurt economies and kill demand which could make prices collapse. All going well it could further support prices. This goes for all oils and fats.

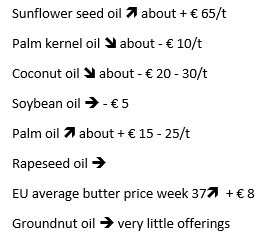

Market evolution in the past 2 weeks

(January position, refined, in euro):

Source: European Commission / IGC, Monthly average, close September 10th

The economy, USD and mineral oil.

The ECB decided to keep interest rates and its coronavirus-stimulus program unchanged because policymakers believe it to be efficient and effective. Discussions on the appreciation of the Euro seemingly didn’t prompt the ECB to intervene.

Economic worries weigh on petroleum market sentiment, but bulls could have a last laugh.

OPEC-leader Saudi Arabia surprised by cutting petroleum prices for targeted customers as fears grow for dwindling demand. In the U.S. both the EIA and API reported an unexpected rise in U.S. crude inventories, adding to the worries that rising global coronavirus infections could slowdown fuel demand recovery. It is becoming increasingly clear that market fundamentals, especially on the demand side, are not improving as quickly as previously thought.As all storage tanks on land are filled to the brim and as a faltering economic recovery causes rising stocks, traders are calling on oil tankers for temporarily floating storage at sea as earlier this year.

So far, it seems that low mineral oil prices have not hindered much the momentum of renewable energy. Where there are no mandates, biodiesel production has decreased but the demand for renewable energy (need for greenhouse gas reduction) continues to grow even when fossil fuels are facing historical demand destruction. Biodiesel can also benefit, certainly where mandated.

Optimists believe the bulls might laugh last as lack of investments in mineral oil production and economic recovery may lead to a sudden supply squeeze which could cause petroleum prices to soar.

It is AVENO’s privilege to serve you, please know we are always here to help.

Please pass us your orders on time so that they can be delivered in due time.

Don't forget to check out our other bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched this bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/newsletter

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched this bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/newsletter

Sign-up for Aveno's newsletters!

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.