Market in wait-and-see mode

Your Bi-weekly update on edible oils & fats by AvenoSeptember 25th, 2020

In the past week the general market sentiment turned from bullish to less bullish as resurging coronavirus cases and new restrictions threaten to cripple the

economic recovery and dampen demand. Buyers, held hostage by the pandemic, have trouble predicting their future demand.

Still, prices were supported by strong Chinese demand and by the seemingly “price inelastic demand” for (mandated) biodiesel production, notwithstanding the huge gap between gasoil and rapeseed oil prices.

In the forthcoming mid-autumn festival, China’s Golden Week Holiday, from 2nd to 8th of October, Chinese businesses will be managing relationships and exchange mooncakes for the occasion.

Source: European Commission / IGC, Monthly average, close September 24th

Soybean harvest in the U.S. is in full swing and early yield reporting has been better than expected in some states. Soybeans futures dropped below $10/bushel after the 2-year high reached last week.

So far China's continued hunger supported bean prices. Chinese pig population has increased considerably and stocks are being replenished as much as possible. This is demand for soybean meal which means that China will also produce soybean oil which could ease the need for palm olein and rapeseed oil.

It is still dry in southern Brazil and Argentina but rain, predicted for the coming weeks, is more than necessary for good sowing conditions. In Argentina, owners of soybeans are still reluctant sellers.

Rapeseed was supported by firm soybean prices but availability of seeds in Europe has improved a bit. In Canada the ongoing harvest is less than 50% completed and reported yields are in line with the three-year average. In South Australia the crop is reported to be in good condition following recent rains but Western Australia remained dry. China is expected to increase imports of Canadian rapeseed and Europe will be importing Canadian seed till the end of this year and switch imports to Australian seed in early 2021.

Sunflower seeds are still expensive but most players seem to have covered their shorts. We saw a big correction as sunflower seed oil started losing demand and as sellers wanted to cash the high prices before possible demand destruction from Covid-19 and coming harvest pressure kicks in. After skyrocketing, the six-port market lost $150/t in one week!

Palm oil production may peak and palm oil underwent price sentiment of other oils: plantations in Indonesia and Malaysia entered the seasonal peak production period, but it remains to be seen how big the production increase will be this season and if buyer’s appetite for palm will remain as high as we saw in the recent past.

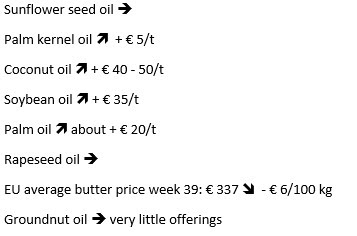

Market evolution in the past 2 weeks

(January position, refined, in euro):

USD and mineral oil.

It is AVENO’s privilege to do business with you, and it would be our pleasure to continue serving you. If we can be of further assistance, please let us know.

Don't forget to check out our other bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched this bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/newsletter

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched this bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/newsletter

Sign-up for Aveno's newsletters!

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.