Kicking the can further down the road

Your Bi-weekly update on edible oils & fats by Aveno

August 20th, 2021.

The Delta rules

Since end July, petroleum prices fell 13% from $76.29/bbl. In its august report, due to the rapid spread of the more contagious delta variant of the coronavirus, the International Energy Agency (IEA) lowered its petroleum demand forecast for this and next year.

In Asia, governments are once again imposing strict lockdowns. In Malaysia, the most affected country, daily infections tripled compared to July. Also, Thailand, Vietnam, the Philippines and Indonesia have infections, hospitalizations and death toll increasing to levels above those of the first outbreak. Beijing canceled all major events, such as trade fairs, and closed some ports due to the rise of corona in China. In EU some countries are imposing restrictions, vaccinations and or testing to citizens for certain activities or events.

In Southeast Asian countries, PMI indices, which forecast industrial activity, are falling. In Indonesia, Malaysia and Thailand, the economic barometer fell below 50 points, indicating a contraction of the economy. Delta rules!

Every cloud a silver lining?

An economic slowdown could sound good as demand and prices of commodities might drop. Chinese restrictions could cause a drop in demand for meat, soybean meal, grains and edible oils & fats. In many developing countries the pre-pandemic oils & fats consumption uptrend was reversed due to high prices and covid. In 5 north African countries per capita consumption fell 0.6kg in the last two years. So, if global demand for oils & fats would have been ‘normal’, supplies would be even tighter still than they are today!

Besides disrupting demand, covid also disrupts productions and supply chains. After alarming weather-related losses of rapeseed in Canada the situation in Malaysia is also getting very alarming. The August 11th report of the Malaysian Palm Oil Board (MPOB) turned out to be very bullish for the whole vegetable oils market.

Eventually prices may drop. Meanwhile, it seems, we’ll still be kicking the can of tight stocks, uncertainties and volatile but firm prices, down the road, way into 2022.

MARKETS

Soybean oil

In the U.S., production confidence is growing. The weather is forecast to turn cooler and rainy in the last half of August. And although the World Agricultural Supply and Demand (WASDE) report of August 12th announced lower yields/production, this downward revision was counterbalanced by a higher carry-in from the old crop and downward revisions of domestic use and exports. So, the projected carry-out for the new crop was left unchanged at 155 million bushels. August will continue to be critical but if good rains arrive timely, they could further pressure prices. Hopes are on lower prices for global edible oil markets as the harvest nears.

Palm oil

Palm oil grew to become the dominant source of edible oils & fats in the world. And production is not growing anymore, on the contrary severe production losses in Malaysia are keeping global vegetable stocks tight.

The MPOB-report turned out to be very bullish and caused a sudden steep increase in palm oil prices. End-July stocks at the world's second largest producer fell 7.3% from June to 1.5Mmt.

Production dropped 5.17% from June to 1.52Mmt (lowest since April) as a covid-related-labor shortage continues to hamper harvesting in the high production season, when production and stocks should be growing! Fruit bunches are left on the trees. Production grows from February and usually peaks in September.

Malaysia's palm oil production is in trouble not only because of the labor crunch but also yields are seen declining to the lowest in 20 years because trees were not replanted and aging trees produce less. The Malaysian Palm Oil Association (MPOA) said the 2021 production could drop below 18Mmt vs 19.1Mmt in 2020. Indonesia’s production and stocks are still growing. Later palm oil prices fell back due to the weaker vegetable-oil market (Chicago beans) and a fall in palm oil export demand.

Rapeseed oil

The delayed EU rapeseed harvest is ongoing but some farmers first harvest wheat before rape, further delaying rape. The continuing drought in Canada led to a further significant reduction in crop expectations. Some estimate a harvest down by more than 4Mmt vs. last year. As the market is digesting the ongoing declines in production estimates, many believe it could fall further. The expected better harvests in Australia and Ukraine are not enough to meet a normal global demand. As all oils compete for market share rapeseed followed soybeans downwards.

Sunflower seed oil

What is left of the old crop remains in store at farmers and dealers, who are still very reluctant sellers of old and new crop. Hot weather concerns over Russian’s sunflower crop added to the reluctance.

This may change as soon as the new crop hits the market as farmers might have to sell if there is not enough place to store all the crops (wheat, corn, rape… etc.), if they need cash and if they want to cash high prices.

Overall, the market expects a good crop and also consumers remain cautious in anticipation of a large harvest. Only hand to mouth purchases are done. Meaning the market is short!

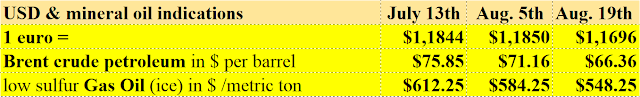

USD and mineral oil.

€ remained below $1.18 on slower global economic growth, mainly in Asia, and expectations of higher interest rates in the U.S., while the European Central Bank is not expected to move. The weaker € makes our imports more expensive!

Several countries re-introduced travel restrictions and air traffic slowed in recent weeks. Lockdowns are slowing economic growth in some regions, and thus demand for mineral oil. OPEC+ might have to scale back production to avoid an oversupply in 2022. While petroleum demand in the U.S. and EU followed increased mobility, demand is falling in Southeast Asia. The IEA still doesn’t see global demand recovering to pre-pandemic levels before 2023.

Always at your service. Please reach out to your regular AVENO contact for further inquiries.

Aveno's Monthly OILS & FATS bulletins:

All our monthly bulletins: https://www.aveno.be/search/label/monthly

Don't forget to check out our bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.