Persistent bull market

Your Bi-weekly update on edible oils & fats by Aveno

September 23rd, 2021.

Although in the past season consumption got hit by a double whammy, i.e., lockdowns and high prices, seemingly demand losses were unable to turn around the bullish trend. For this to happen we need higher production and stock levels.

Last season, the only demand growth came from China that increased its oils & fats consumption by 1.5Mmt. And high prices curbed the appetite from the biodiesel industry in several countries.

Today prices fluctuate between pressure from upcoming productions, slower domestic demand in the U.S. and still bigger than expected losses in Canada, delayed sunflower seed harvest in the black sea region plus looming demand from India and others.

To slow down, to stop and to turn around the upward trend in oil prices this season, palm oil production and Brazilian soybeans production (and consequently higher stock levels) will be key.

Last season, the only demand growth came from China that increased its oils & fats consumption by 1.5Mmt. And high prices curbed the appetite from the biodiesel industry in several countries.

Today prices fluctuate between pressure from upcoming productions, slower domestic demand in the U.S. and still bigger than expected losses in Canada, delayed sunflower seed harvest in the black sea region plus looming demand from India and others.

To slow down, to stop and to turn around the upward trend in oil prices this season, palm oil production and Brazilian soybeans production (and consequently higher stock levels) will be key.

MARKETS

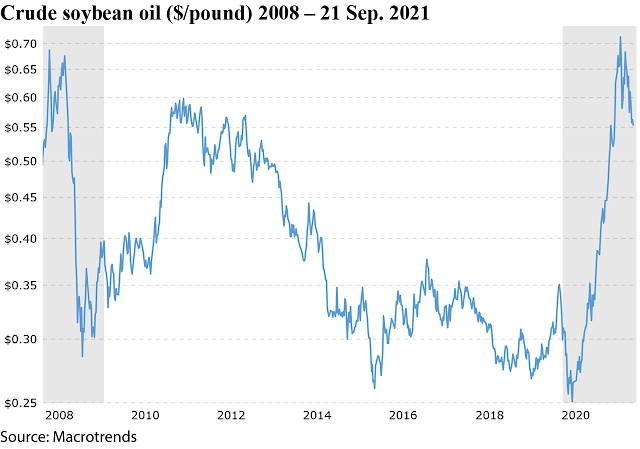

Soybean oil

Soybean prices were pressured by favorable weather that boosted the U.S. crop, subdued exports due to logistic constraints after hurricane Ida, less active Chinese buying and fund selling. So far, in the U.S., soybean oil demand for biodiesel is not yet growing at any price. Harvest started and is about 5% done.

There is much speculation on U.S. biofuel mandates. Though the Biden administration announced doubling the money spent on fighting climate change, they are considering big cuts to biofuel blending requirements. The U.S. Renewable Fuel Standard (policy intended to help farmers and reduce the need for petroleum imports), demands petroleum refiners to blend biofuels in their fuels, or to buy tradeable credits, known as RINs, from those that do. This includes the ethanol made from corn that goes into gasoline. So, this is a very big issue in the U.S. of A.!

Nevertheless, huge investments were and are being made to produce biodiesel and sustainable aviation fuels. Time will tell.

Palm oil

Futures continued to be traded in an historically high-level range. Malaysia's exports during the first 20 days of September rose 38% from the same period in August due to larger shipments to India and China. Demand from India will most probably stay strong.

But OIL WORLD analysts expect that in the current season, global palm oil production will grow from 75.8Mmt last season to 79.8Mmt. We already saw growing supplies from the two largest producers, Indonesia and Malaysia, and the latter confirmed it will allow over 30.000 migrant laborers to enter the country to help harvest fruit bunches. If stocks keep growing in OND this may start weighing on the total oil complex. But we have to remember that February is the lowest production month in the cycle and we are now about over the peak.

Oil buyers face an unpredictable and challenging end of season. The MJJ and ASO positions will become very technical. Price wise old crop will probably make a huge premium over new crop and no one will want to carry expensive old crop seed or oil into the new crop year! If there is anything left to carry...

It may be that the present harvest brings some price relief on nearby. If crush margins are good, a lot of oil will come on the market. And more uncertainty was added last week when Evonik declared force majeure on deliveries of sodium methylate (key catalyst for biodiesel production). Unexpected technical issues severely affected production which may result in delivery delays and/or in a reduction of delivered methylate volumes. Evonik’s force majeure came after the BASF announcement in August about a fire at its plant in Ludwigshafen. The two companies are the main suppliers in EU and this may lead to lower biodiesel production, unless the supply problems of methylates get solved quickly.

Rapeseed oil

The upward crop revisions in EU, China and Australia vs. the bigger than anticipated Canadian crop loss will result in 4.5 to 5 million ton less rapeseed. This, on top of the low ending stocks, means at least 6.5Mmt less seed supply vs. last season.Oil buyers face an unpredictable and challenging end of season. The MJJ and ASO positions will become very technical. Price wise old crop will probably make a huge premium over new crop and no one will want to carry expensive old crop seed or oil into the new crop year! If there is anything left to carry...

It may be that the present harvest brings some price relief on nearby. If crush margins are good, a lot of oil will come on the market. And more uncertainty was added last week when Evonik declared force majeure on deliveries of sodium methylate (key catalyst for biodiesel production). Unexpected technical issues severely affected production which may result in delivery delays and/or in a reduction of delivered methylate volumes. Evonik’s force majeure came after the BASF announcement in August about a fire at its plant in Ludwigshafen. The two companies are the main suppliers in EU and this may lead to lower biodiesel production, unless the supply problems of methylates get solved quickly.

Sunflower seed oil

The Russian production of sun seeds will be lower than expected but Ukraine’s will be higher. Globally, analysts still see 7Mmt more seed coming from the fields than last season.Low ending stocks, delayed harvesting in the Black Sea region and little selling interest supports sun seed prices. The market has low forward coverage as it is waiting for prices to drop further. All this, delays a significant price drop. As sun oil is to absorb a part of demand of other oils (rape), sellers remain cautious.

USD and mineral oil.

The euro depreciated towards $1.17 on growing risk aversion and fears of slowing global economic growth.Wednesday, brent traded above $75 on global demand recovering and inventories dropping. The shortfall of natural gas also leads to expectations of higher demand for other fuels when gas prices are at record highs this time of the year.

In the U.S. heating oil prices were up as petroleum production did not yet normalize after hurricane Ida. Producers are working to bring back production: about 17% of the Gulf ‘s oil and 25% of natural gas production is still off. Shell, the largest Gulf of Mexico producer, thinks the damages will limit production till early next year.

In the U.S. heating oil prices were up as petroleum production did not yet normalize after hurricane Ida. Producers are working to bring back production: about 17% of the Gulf ‘s oil and 25% of natural gas production is still off. Shell, the largest Gulf of Mexico producer, thinks the damages will limit production till early next year.

Always at your service.

Please contact AVENO for further inquiries.

Please contact AVENO for further inquiries.

Aveno's Monthly OILS & FATS bulletins:

All our monthly bulletins: https://www.aveno.be/search/label/monthly

Don't forget to check out our bi-weekly updates!

There

is some complexity to the business we daily operate in. To help

understand the business of being an edible oil and fat producer we've

launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Disclaimer

Unless

otherwise mentioned the crude oil values quoted in these documents are

prices landed in EU without import duties, handling, storage, financing,

refining, packing, transport or any other cost related to bring the

product to market. They are used as market trend illustration.

Substitution of oils is possible but different oils have different fatty

acid profiles and are not all interchangeable for all applications. One

can make biodiesel from all oils and fats but one cannot make

mayonnaise from coconut oil. This document is exclusively for you and

does not carry any right of publication or disclosure. This document or

any of its contents may not be distributed, reproduced, or used for any

other purpose without the prior written consent of AVENO. The

information reflects prevailing market conditions and our present

judgement, which may be subject to change. It is based on public

information and opinions which come from sources believed to be

reliable; however, AVENO doesn’t guarantee the correctness or

completeness. This document does not constitute an offer, invitation, or

recommendation and may not be understood, as an advice. This document

is one of a series of publications undertaken by AVENO and aims at

informing broadly a targeted audience about the edible oils & fats

market. AVENO’s goal is to keep this information timely and accurate

however AVENO accepts no responsibility or liability whatsoever with

regard to the given information.