A French saying: “Avec des si, on mettrait Paris en bouteille.” Meaning “if” Paris were small enough it would fit in a bottle.

But, the most consumed edible oil in the world, which was the leading driver for the amazing global oils & fats price rally, is not providing relief. There was no big stock buildup in either Malaysia or Indonesia, during the peak production period.

More and more price sensitive markets lowered their purchases and statistics show many regions and or market segments having bought less since the price hike. Even in Europe. The best cure for high prices is high prices!

But what happens when more than a billion people have a ‘noodle week’? There are mixed signals from China. Will they continue to be hungry for U.S. soybeans or not? How will weather develop? biodiesel mandates around the globe? the economy? will the world see many renewed lockdowns?

There are too much probabilities, “ifs” and “too early to say”, meanwhile we’ll have to sweat it out.

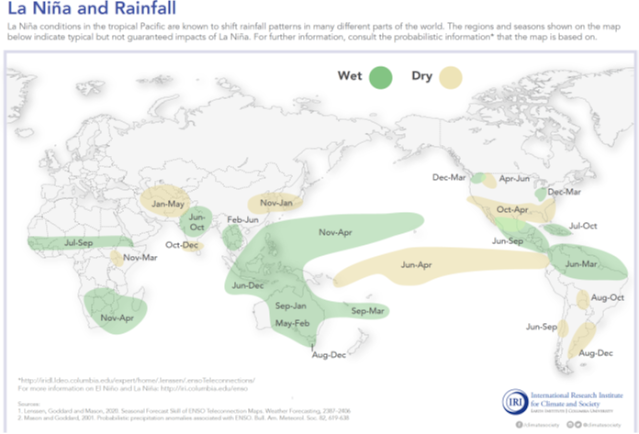

Argentina looks ok but concerns rise due to forecasts indicating “La Niña” weather” in the next months. Generally, this means less rain in Argentina and a poor crop would be bullish for soybeans.

In September China imported its lowest volume of beans in 7 years, because of poor crush margins due to less soybean meal demand from the pork industry. Global soybean stocks are higher than anticipated due to a demand drop for soybean meal. Soybeans traded below $12! Normally soybean prices touch their lowest level just after harvest (Oct/Nov).

Beans lower, oil higher. A lower crush (less meal demand) results in lower oil production. Also, Argentina increased its biodiesel production, which reduces the availability of oil (for export). So, soybean oil prices remained supported.

Chinese buying, news about biodiesel mandates, mainly in U.S., and South American crop developments are the things to watch.

Price boom not broken but high prices not sustainable.

Markets stay unusually high priced. Many buyers have been sidelining, not buying, i.e., not filling their pipeline, hoping for lower prices, in anticipation of a big sunflower seed crop, traditionally increasing palm oil production and soybean harvest pressure.But, the most consumed edible oil in the world, which was the leading driver for the amazing global oils & fats price rally, is not providing relief. There was no big stock buildup in either Malaysia or Indonesia, during the peak production period.

More and more price sensitive markets lowered their purchases and statistics show many regions and or market segments having bought less since the price hike. Even in Europe. The best cure for high prices is high prices!

Hope is despair overcome

For the current season analysts predict a global production surplus and stock recovery (soy/palm/sun) which would lead to lower prices. Counting on rising palm oil stocks after February and a good South American soybean crop in March-April. All this may very well be, with the demand destruction and when big harvests physically hit the market. But it is further down the road.Many uncertainties remain

With good weather, in EU, we often see increased oil offtake by sauce producers. Slaughterhouses then see increased meat demand for the BBQ. And during ‘de week van de frit’ (Belgian French fries promotion week) more frying oil is sold.But what happens when more than a billion people have a ‘noodle week’? There are mixed signals from China. Will they continue to be hungry for U.S. soybeans or not? How will weather develop? biodiesel mandates around the globe? the economy? will the world see many renewed lockdowns?

There are too much probabilities, “ifs” and “too early to say”, meanwhile we’ll have to sweat it out.

MARKETS

Soybean oil

The U.S. harvest is a bit late but 75% is done. Plantings in Brazil are already 40% done under favorable weather and a big crop is expected as acreage has been expanded.Argentina looks ok but concerns rise due to forecasts indicating “La Niña” weather” in the next months. Generally, this means less rain in Argentina and a poor crop would be bullish for soybeans.

In September China imported its lowest volume of beans in 7 years, because of poor crush margins due to less soybean meal demand from the pork industry. Global soybean stocks are higher than anticipated due to a demand drop for soybean meal. Soybeans traded below $12! Normally soybean prices touch their lowest level just after harvest (Oct/Nov).

Beans lower, oil higher. A lower crush (less meal demand) results in lower oil production. Also, Argentina increased its biodiesel production, which reduces the availability of oil (for export). So, soybean oil prices remained supported.

Chinese buying, news about biodiesel mandates, mainly in U.S., and South American crop developments are the things to watch.

A ‘La Niña episode’, may cause areas in green or yellow to have wetter or dryer than normal weather during the indicated months.

The Malaysian Palm Oil Association said that output may fall below 18 million mt in 2021 (1.1 Mmt less than in 2020 and the lowest since 2016) due to labor shortages, floods, and logistical issues.

Yields in Malaysia and Indonesia will now decline and likely remain weak into the first quarter of next year. Production may improve in the second quarter. (For Malaysia, IF workers can enter the country. The Prime Minister gave some hope when saying that the country will allow fully-vaccinated migrant workers).

The good crop is not reflected in the prices because farmer selling remains slow. They are not in need of money and sell other crops instead of sunflower seed. Crushers face limited supply of raw material and for nearby, oil remains scarce.

The high oleic sunflower oil premium is back and there are very few offers. In EU the acreage dropped 10-15%. Worse is that the low premiums offered to farmers resulted in less segregation of classic and high oleic sun seeds, mainly in Black Sea origins. This may decrease the linoleic content of classic sun oil and dilute the oleic content of HOSO!

Palm oil

The high production months that usually run from August to October, are now behind us. Palm oil prices repeatedly peaked and a new high of 5,220 ringgit was reached last week as Malaysia faces a combination of lower output, supply chain issues, and growing demand. During September, Malaysian palm oil stocks dropped 7%. In Indonesia during August the drop was 25%, as a result of the strong exports.The Malaysian Palm Oil Association said that output may fall below 18 million mt in 2021 (1.1 Mmt less than in 2020 and the lowest since 2016) due to labor shortages, floods, and logistical issues.

Yields in Malaysia and Indonesia will now decline and likely remain weak into the first quarter of next year. Production may improve in the second quarter. (For Malaysia, IF workers can enter the country. The Prime Minister gave some hope when saying that the country will allow fully-vaccinated migrant workers).

Lauric oils

The price of laurics increased to its highest in 5 years, caused by a reduced supply and higher demand. Mainly less supply of Malaysian palm kernel oil as the kernels are a by-product of palm oil production. There is good demand from the oleochemical sector which needs the C12 and C14 fatty acid chain length to produce fatty alcohols. There is a core demand for coconut and palm kernel oil for food and oleochemicals. So, these buyers are very sensitive to any supply changes.Butter

The last reported EU average butter price was 475 €/100 kg, up 10% over the last 4 weeks. In the Netherlands price quotations went above €500/100kg! Higher feed costs (+4%) and energy costs (+15.9%) in week 42 compared to the previous 4 weeks, contributed to the price increase. An increase in cheese production and lower milk supply had already declined EU butter production in the first 7 months (-1.3%). On the demand side, as the HORECA opened up, the dairy sector saw a good flow. Cheese and butter consumption in EU grows about 0.6%.

Rapeseed oil

The Matif (Marché à Terme International de France) rapeseed futures surprised again by trading at new highs, as markets anticipate a supply squeeze in the Jan-Jun period. This situation forces many to switch to other oils, if they can and if affordable and available e.g., sunflower oil. Depending on EU biodiesel demand, to ensure physical supply of rapeseed oil this season, may prove pretty challenging and there is little downside potential for rapeseed oil.Sunflower seed oil

A very good - if somewhat delayed – harvest but poor availability.The good crop is not reflected in the prices because farmer selling remains slow. They are not in need of money and sell other crops instead of sunflower seed. Crushers face limited supply of raw material and for nearby, oil remains scarce.

The high oleic sunflower oil premium is back and there are very few offers. In EU the acreage dropped 10-15%. Worse is that the low premiums offered to farmers resulted in less segregation of classic and high oleic sun seeds, mainly in Black Sea origins. This may decrease the linoleic content of classic sun oil and dilute the oleic content of HOSO!

USD and mineral oil.

In Asia there’s been a big switch from natural gas to fuel and diesel. It looked like mineral oil supply couldn’t meet the rebounding oil demand. Although trading at the highest since mid-June 2014 ($115), Brent could not convincingly break the $85 resistance level. Market slipped back with all energy markets retracting. Thursday petroleum fell to its lowest in two weeks after Iran said talks on its nuclear programme would resume and on increased crude oil inventories in Cushing Oklahoma, U.S. of A.

Always at your service.

Please contact AVENO for further inquiries.

Please contact AVENO for further inquiries.

Aveno's Monthly OILS & FATS bulletins:

All our monthly bulletins: https://www.aveno.be/search/label/monthly

Don't forget to check out our bi-weekly updates!

There

is some complexity to the business we daily operate in. To help

understand the business of being an edible oil and fat producer we've

launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Disclaimer

Unless

otherwise mentioned the crude oil values quoted in these documents are

prices landed in EU without import duties, handling, storage, financing,

refining, packing, transport or any other cost related to bring the

product to market. They are used as market trend illustration.

Substitution of oils is possible but different oils have different fatty

acid profiles and are not all interchangeable for all applications. One

can make biodiesel from all oils and fats but one cannot make

mayonnaise from coconut oil. This document is exclusively for you and

does not carry any right of publication or disclosure. This document or

any of its contents may not be distributed, reproduced, or used for any

other purpose without the prior written consent of AVENO. The

information reflects prevailing market conditions and our present

judgement, which may be subject to change. It is based on public

information and opinions which come from sources believed to be

reliable; however, AVENO doesn’t guarantee the correctness or

completeness. This document does not constitute an offer, invitation, or

recommendation and may not be understood, as an advice. This document

is one of a series of publications undertaken by AVENO and aims at

informing broadly a targeted audience about the edible oils & fats

market. AVENO’s goal is to keep this information timely and accurate

however AVENO accepts no responsibility or liability whatsoever with

regard to the given information.