What to think about all of this?

Your Bi-weekly update on edible oils & fats by Aveno

October 15th 2021.

Doom and gloom?

Since January 2020 a bit of madness struck the commodity markets. Every day, it seems, new price records are set for grains, natural gas, electricity, oil, fertilizers etc... and there is no shortage of exciting topics such as logistical, sanitary measures, health, monetary, political and geopolitical issues.

Today it’s hard to believe that in 1973 people were not allowed to drive on Sundays because Arab oil producers did not only raise the price, but also curbed the export of oil to Western countries. By mid-march 1974, crude oil had soared to $15.20/barrel. During the second ‘oil crisis’ of 1979 when global oil production fell 4%, prices doubled to about $40. In 1999 oil was back at $10 and steadily rose to $140 by mid-2008. All this time the world kept turning and the sun came up every day.

Today brent is around $85/barrel but, in many countries, for all sorts of excuses, more and more taxes were added to petroleum derivatives. Making it harder for the industry and consumers to swallow energy price increases. Recently oil and natural gas prices rose to multi-year highs, sending electricity prices to record levels as widespread energy shortages strike Asia and Europe.

In China, soybean processors in northern regions were forced to shut down because of power shortages which have spread to 20 provinces now. During peak hours, electricity is rationed and some factories have to suspend production. China even ordered its coal mines to increase production in an effort to ease the crisis.

China needs to ensure enough electricity to cope with a bumper harvest and it will be tough, handling crops from corn to soy to groundnuts (peanuts) and cotton. Electricity is also needed to dry the crops before storage. Corn and groundnuts may deteriorate if not processed in time.

Needless to say, that such disruptions decreased the industrial output and weigh on the outlook for the Chinese economy. But also, in EU we have seen big energy consumers shutting down production lines: from greenhouses (vegetables and flowers) to fertilizer, aluminum and zinc producers. Shutting down productions reduces the demand for raw materials but also creates shortages further down the line.

Lately the International Energy Agency (IEA) warned that the global energy crunch is expected to boost petroleum demand and could increase inflation and slow the world's economic recovery from the pandemic. Also, the IMF, in a rather gloomy report, said that the global economic recovery is losing momentum as a result of the pandemic. Growth forecasts for most developed countries have been lowered as they struggle with supply problems and growth is also disappointing in the poorest countries which are severely affected by the more contagious delta variant.

In recent weeks we witnessed palm oil prices break new records on a pick-up in demand from India and China and benefiting from higher demand for biofuels due to higher energy prices, lower production and transport disruptions. Rapeseed oil prices which have doubled over the past 12 months soared to new highs on nearby positions. But we also saw a little bearishness in soybeans as amongst other reasons the demand for soybean meal for animal feed is dropping.

Today it’s hard to believe that in 1973 people were not allowed to drive on Sundays because Arab oil producers did not only raise the price, but also curbed the export of oil to Western countries. By mid-march 1974, crude oil had soared to $15.20/barrel. During the second ‘oil crisis’ of 1979 when global oil production fell 4%, prices doubled to about $40. In 1999 oil was back at $10 and steadily rose to $140 by mid-2008. All this time the world kept turning and the sun came up every day.

Today brent is around $85/barrel but, in many countries, for all sorts of excuses, more and more taxes were added to petroleum derivatives. Making it harder for the industry and consumers to swallow energy price increases. Recently oil and natural gas prices rose to multi-year highs, sending electricity prices to record levels as widespread energy shortages strike Asia and Europe.

In China, soybean processors in northern regions were forced to shut down because of power shortages which have spread to 20 provinces now. During peak hours, electricity is rationed and some factories have to suspend production. China even ordered its coal mines to increase production in an effort to ease the crisis.

China needs to ensure enough electricity to cope with a bumper harvest and it will be tough, handling crops from corn to soy to groundnuts (peanuts) and cotton. Electricity is also needed to dry the crops before storage. Corn and groundnuts may deteriorate if not processed in time.

Needless to say, that such disruptions decreased the industrial output and weigh on the outlook for the Chinese economy. But also, in EU we have seen big energy consumers shutting down production lines: from greenhouses (vegetables and flowers) to fertilizer, aluminum and zinc producers. Shutting down productions reduces the demand for raw materials but also creates shortages further down the line.

Lately the International Energy Agency (IEA) warned that the global energy crunch is expected to boost petroleum demand and could increase inflation and slow the world's economic recovery from the pandemic. Also, the IMF, in a rather gloomy report, said that the global economic recovery is losing momentum as a result of the pandemic. Growth forecasts for most developed countries have been lowered as they struggle with supply problems and growth is also disappointing in the poorest countries which are severely affected by the more contagious delta variant.

In recent weeks we witnessed palm oil prices break new records on a pick-up in demand from India and China and benefiting from higher demand for biofuels due to higher energy prices, lower production and transport disruptions. Rapeseed oil prices which have doubled over the past 12 months soared to new highs on nearby positions. But we also saw a little bearishness in soybeans as amongst other reasons the demand for soybean meal for animal feed is dropping.

What are we to make of this?

Olivier always says: the jug goes into the water for so long until it bursts. And Isaac Newton said that what goes up must come down some time. It is too soon for utter pessimism, expecting the worst, but one should always hope for the best but prepare for the worst. MARKETS

Soybean oil

High ending stocks pressure soybean prices down.The USDA’s WASDE report on October 12th was ‘mildly bearish’ for soybeans as supplies are outgrowing demand. The report increased the U.S. soybean yields from 50.6 to 51 bushels/acre. Soybean ending stocks were reported above trade expectations, with lower demand for old and new crop beans and the USDA lowered China’s domestic soybean usage by 900,000t, which contributes to higher ending stocks and pressures price. In Chicago soybeans futures traded below $12.25/bushel.

Harvest progress in the U.S. is about 50% complete compared with the 40% five-year average and in South America, Brazilian plantings are 10% complete and the weather remains good.

Source: UFOP

Palm oil

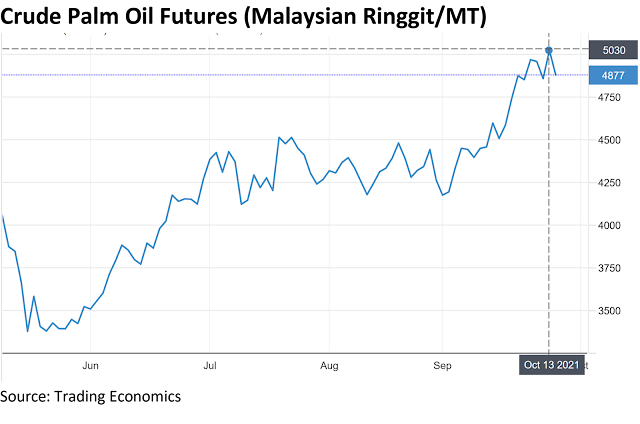

Large purchases from India supported prices. India has low oil stocks and its oilseed harvest is delayed. Harvesting and crushing is picking up in the next weeks but stocks are low and demand grows. Palm oil futures fluctuated with the evolutions of production, stocks and export numbers but remain at record high levels.

On October 13th India slashed its basic import duty on crude palm, soybean and sunflower oil to zero and also other import thresholds were lowered. This is the fifth change in import taxes since February as the world largest edible oil importer fights food price inflation. This is vital in a country where about 209 million, or about 15 per cent of its population, were undernourished between 2018 and 2020. Markets went on fire for a short while but the next day palm gave up nearly all gains on profit-taking, etc.…

Cotton seed oil

Recently cotton got attention in the media when CNN reported that prices hit a ten-year high after droughts and heat waves damaged the U.S. cotton crop. Prices for clothing in the U.S. increased 4.2% and there are worries that they will rise faster next year. In China the government is intervening to stabilize prices as the rapid increase of cotton prices fueled anxiety across China’s cotton industry (spinning mills, ginners, and farmers). To lower the prices the government announced it would sell reserve cotton. High petroleum prices and high recycling rates of PET bottles to new bottles also makes synthetic yarn more expensive. It is not yet clear what the impact on oil production will be as not all cottonseeds are used to extract oil. They can also be fed to cattle.Butter

Milk fat consumption in Europe is good, which means that less butter was exported in the first six months of 2021. Since a few weeks, European butter convincingly trades above € 4,000/mt. The combination of low milk supply and low fat levels in the milk (due to farmers feeding less expensive feed), made cream prices peak which pulls up butter prices. Butter could still gain several hundred euros per ton. Many buyers are still to cover before the end of the year and early 2022.Rapeseed oil

Following reports from Canada Statistics the rapeseed production for Canada is set at only 13 Mmt. Harvest is completed and the lower yields and lower oil content are known. Prices remain volatile.In EU the ban of palm oil and the cap on soy oil for biodiesel, are new drivers in the biodiesel market and consequently the rape seed oil market. Problems at Evonik & BASF catalyst production lines remain a concern for EU biodiesel output as there is no news when production can restart. Biodiesel margins are very good for those that can produce and this supports rapeseed oil prices.

Sunflower seed oil

Sunflower seed production is lowered for Ukraine and Russia on recent harvest results. The harvest is still delayed and farmers are not selling.USD and mineral oil.

Germany's inflation is at a 27-year high, and the economic outlook for EU's largest economy deteriorated. The euro depreciated further to $1.16, its weakest level since July 2020 on concerns over increasing inflation due to rising energy prices and expectations that the U.S. Federal Reserve is to begin scaling back its purchases in November and starts raising interest rates next year; earlier than the European Central Bank.

Brent lost momentum after passing the $85 marker, but remains supported by supply concerns and as shortages of natural gas in Europe and Asia are boosting demand for oil. EIA data showed a larger-than-expected increase in crude stockpiles in the U.S., while gasoline and distillates stocks fell. The data also indicates an unseasonably high demand for petroleum for power plants across a number of countries, including China.

Always at your service.

Please contact AVENO for further inquiries.

Please contact AVENO for further inquiries.

Aveno's Monthly OILS & FATS bulletins:

All our monthly bulletins: https://www.aveno.be/search/label/monthly

Don't forget to check out our bi-weekly updates!

There

is some complexity to the business we daily operate in. To help

understand the business of being an edible oil and fat producer we've

launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Disclaimer

Unless

otherwise mentioned the crude oil values quoted in these documents are

prices landed in EU without import duties, handling, storage, financing,

refining, packing, transport or any other cost related to bring the

product to market. They are used as market trend illustration.

Substitution of oils is possible but different oils have different fatty

acid profiles and are not all interchangeable for all applications. One

can make biodiesel from all oils and fats but one cannot make

mayonnaise from coconut oil. This document is exclusively for you and

does not carry any right of publication or disclosure. This document or

any of its contents may not be distributed, reproduced, or used for any

other purpose without the prior written consent of AVENO. The

information reflects prevailing market conditions and our present

judgement, which may be subject to change. It is based on public

information and opinions which come from sources believed to be

reliable; however, AVENO doesn’t guarantee the correctness or

completeness. This document does not constitute an offer, invitation, or

recommendation and may not be understood, as an advice. This document

is one of a series of publications undertaken by AVENO and aims at

informing broadly a targeted audience about the edible oils & fats

market. AVENO’s goal is to keep this information timely and accurate

however AVENO accepts no responsibility or liability whatsoever with

regard to the given information.