A spoonful of hope in a cup of despair?

Your Bi-weekly update on edible oils & fats by AvenoNovember 26th 2021.

Procurement manager blues

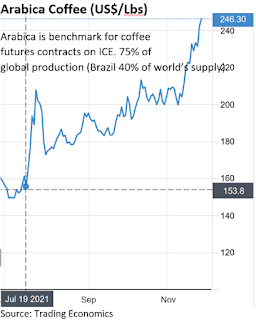

Just like coffee, markets can be bitter. Often a spoon of sugar is enough to swallow it. Likewise, sweet news helps digest high prices and keeps buyers afloat, just as despair sets in.

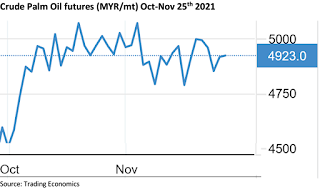

But even a cup of consolation is becoming expensive. So is raw milk, which for the first time passed €0.5/L at farmer’s gate. On MATIF wheat is quoted above €300/mt and FEB rapeseed €685/mt. Dutch butter traded at €544/100 kg and in origins crude palm oil keeps trading around MYR 5000/mt, just under its record of MYR 5220 late October. Baking a cake is not cheap nowadays!

Hope is the last one to die; but where is hope?

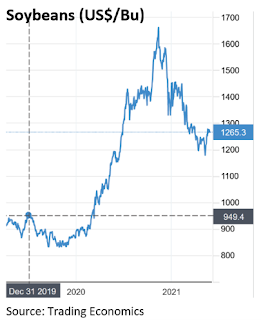

Hope comes from reports like “being neutral to bearish for the soybean complex”. Or from good crop prospects in Australia. Or Oil World reporting increased oilseeds and oils and fats production in the current season. In fact, many markets seem to be moving sideways and have seemingly reached a top. Only, we didn’t really experience a trend reversal yet.

Meanwhile a 4th covid wave is over us and new restrictions across Europe are bringing new uncertainties and doubts as business and consumer morale weakens.

"Hey, whadda ya want?" “One bourbon, one scotch and one beer…”, said the procurement manager.

China

Not always frontpage news but China struggles with a debt and real estate crisis. Since the problems with the highly indebted (China’s second-largest) property developer Evergrande emerged, China set other priorities. The real estate and construction sector account for abt. 25% of GDP and there are more problem cases than just Evergrande. Problems in real estate, uncertainty about new rules for tech companies and “zero-tolerance-corona-measures” lead to fears for slower economic growth. And the Communist Party indicated that debt reduction is now given more priority than growth. Too soon to speculate what that means for commodities, but something to watch.

MARKETS

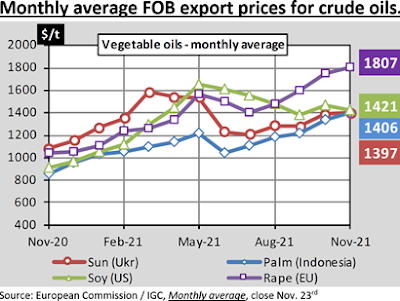

Soybean oil

Unless weather in South-America deteriorates, there is downward potential for soybeans. It remains uncertain what soybean oil will do since many investments have been made in the U.S. for (advanced) biodiesel and SAF (sustainable aviation fuel). California is the main state supporting this through its LCFS (low carbon fuel standard) designed to decrease the carbon intensity of transportation. Also, Washington has a say in the issue, but so far, they are kicking the problem further down the road.

The harvest in the U.S. is about done and farmers already contemplate on spring plantings. The high fertilizer prices (high gas prices) may push them to plant more soybeans because they require less fertilizer than other crops.

In South-America, planting conditions

remained mostly very favorable and in Brazil about 85% is planted. In Rio

Grande do Sul (Bra.) and Argentina only 30% was planted by mid-November. Dry

conditions in southern Brazil and eastern Argentina, (“La Niña” weather pattern)

delayed sowing. So far expectations are for a milder “La Niña” than last year.

Rapeseed oil

Bullish fundamentals for the current season remain. It is still feared that at the end of the season (MJJ) we see less crush in EU because of lack of seeds. The current high prices prompt farmers to sow more winter rape. The EU planting area expanded by abt. 7% and plantings benefitted from good soil moisture and temperatures. Canada and Australia have same price incentives for their 2022 harvests.

Statistics Canada will update crop results, early December which may reduce this year’s crop even further. Meanwhile the west coast province British Columbia suffered very bad weather with floods and landslides which makes exports via Vancouver problematic. Rail and road systems were wiped out. But there is not so much to export to China, Japan, Mexico, U.S. and EU. Japan already shifted partly to Australia for its needs.

In Australia harvest is in full swing, with some rain delays, and optimistic crop analysts keep throwing in new and higher numbers. Now a 6-million-ton crop! Would be great news but far from enough to compensate earlier losses in Canada.

Palm oil

Market stays volatile and many feel the oil is overvalued vs soft oils (e.g., handling of fat vs a liquid oil). In 2022 global production could increase 3.5 Mmt but first we have to live through the low production cycle. Production increases may be seen after March and it is most probable that the market stays strongly inverted till then.

Sunflower seed oil

A record crop not being brought to market may result in unusual high stocks of seed at the beginning of 2022. Furthermore, the South American crop will also come on the market in the second quarter of next year. Prices are supported by the fact that sunflower oil is competitive versus other oils and nearby buying by short squeezed customers helps to keep the market inverted.

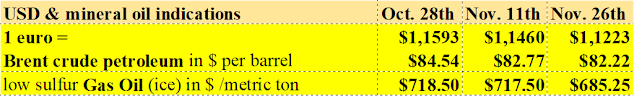

USD and mineral oil.

Euro depreciated further towards $1.12, its weakest since July 2020.

Arm wrestling contest between OPEC+ and importing countries (China, Japan, South Korea, and the UK) who under the lead of the U.S. want to release product out of their Strategic Petroleum Reserves.

OPEC+ ignored calls from the U.S. to pump more oil. Jo Biden’s popularity is inversely decreasing as gasoline prices soared to the highest level in 7 yrs. Difficult to judge how OPEC+ and the market will react, especially now covid restrictions are weighing on economies. OPEC+ may not raise the planned production in December or stick to the plan of a monthly increase of 400,000 bpd.

Always at your service.

Please contact AVENO for further inquiries.

Aveno's Monthly OILS & FATS bulletins:

Don't forget to check out our bi-weekly updates!

There

is some complexity to the business we daily operate in. To help

understand the business of being an edible oil and fat producer we've

launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Disclaimer