Cooking costs money

Your Bi-weekly update on edible oils & fats by Aveno

November 12th 2021.

Procurement managers challenged

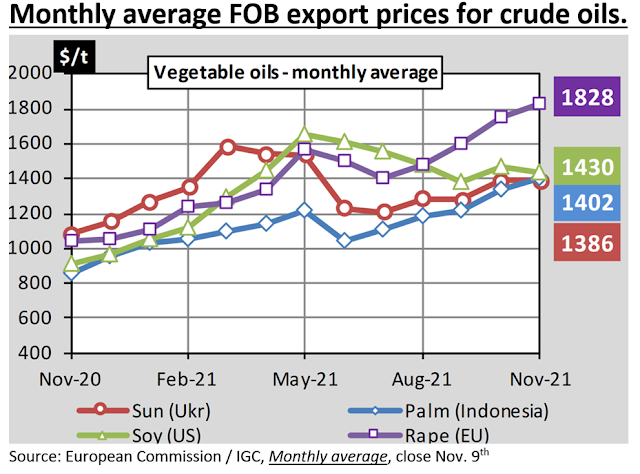

My Bomma always said “koken kost geld” and even if you tried, you couldn’t miss that global food prices continued to rise. The October FAO Food Price Index jumped 3% to its highest level since July 2011. The latest month-on-month increase was mainly due to strength in global prices of vegetable oils (up 9.6%) and grain (up 3.2%).

In the U.S., October year-on- year inflation rose to 6.2% as businesses passed on their cost increases in their sales price. The highest increase in three decades was higher than anticipated. Core inflation (without food and energy) rose to 4.6%.

Like in EU a wide range of goods and services became more expensive: energy, food, transportation, housing... Many businesses struggle with considerable cost increases stemming from supply problems and higher prices of packaging, raw materials, energy, replacement parts, logistics, etc. Also, a shortage of suitable staff drives up wages in order to be able to recruit or retain employees.

In EU, reports about transport price increases from 10 to 20% or transport companies abandoning loyal customers are no exception. Some supermarkets were reported not coming to terms (on price) with suppliers and leaving shelves empty after delisting (temporarily?) some branded food products.

Covid is still around and adds uncertainty.

In EU, reports about transport price increases from 10 to 20% or transport companies abandoning loyal customers are no exception. Some supermarkets were reported not coming to terms (on price) with suppliers and leaving shelves empty after delisting (temporarily?) some branded food products.

Covid is still around and adds uncertainty.

Margin squeeze in the agro-food-complex.

The agro-food-complex includes all agricultural and food related businesses in the supply chain from the field to the plate on the table. Many foods segments struggle.

There is an unprecedented price rally in the dairy market with prices of cheese and butter skyrocketing. But producers' margins remain under pressure. This stems from the low milk supply in Northwest Europe (covid, weather, high feed prices). The scarcity confronts retailers and industry with higher costs. Large companies such as Danone and Nestlé lament about price hikes that will be passed on to consumers. Cheese cake, butter, pizza and yogurt will cost more. So will festive and Christmas ice-cream.

The collapse of China’s import demand for pork is a severe blow to the (not yet fully recovered from Covid) EU pig sector which is facing higher feed and lower meat prices. A bloodbath.

For most food producers, energy is a big cost (machines, pumps, warming, cooling, freezing, transport etc.). Likewise, in the edible oils & fats industry. Also, with high raw material prices, handling and processing shrink, weigh on profitability. Losing a percentage of an oil of €800 or €1600/t makes a big difference for the bottom line. Not to mention the need for more working capital. Dangerous conditions, especially in a sector where margins are razor thin.

There is an unprecedented price rally in the dairy market with prices of cheese and butter skyrocketing. But producers' margins remain under pressure. This stems from the low milk supply in Northwest Europe (covid, weather, high feed prices). The scarcity confronts retailers and industry with higher costs. Large companies such as Danone and Nestlé lament about price hikes that will be passed on to consumers. Cheese cake, butter, pizza and yogurt will cost more. So will festive and Christmas ice-cream.

The collapse of China’s import demand for pork is a severe blow to the (not yet fully recovered from Covid) EU pig sector which is facing higher feed and lower meat prices. A bloodbath.

For most food producers, energy is a big cost (machines, pumps, warming, cooling, freezing, transport etc.). Likewise, in the edible oils & fats industry. Also, with high raw material prices, handling and processing shrink, weigh on profitability. Losing a percentage of an oil of €800 or €1600/t makes a big difference for the bottom line. Not to mention the need for more working capital. Dangerous conditions, especially in a sector where margins are razor thin.

MARKETS

Are edible oils and fats at a ceiling and erratically moving sideways? Globally there’s been quite a lot of demand destruction by the high prices. Some oil prices seem to be converging at a high level because of substitutions. And amazingly sun oil is flirting with palm while rape is kissing the usually most expensive lauric oils. Very unusual.

There are mixed prospects for oils and fats with lots of uncertainties in the analysis and expectations of higher productions and lower prices. Although the timing is always pushed forward. Some think the price drop is delayed till 2023. Game changers: mineral oil, biodiesel mandates, Chinese demand. Despite many challenges and the “real estate debt crisis” in China, they may hold up their pants till after the Winter Olympic games in February, just before spring.

There are mixed prospects for oils and fats with lots of uncertainties in the analysis and expectations of higher productions and lower prices. Although the timing is always pushed forward. Some think the price drop is delayed till 2023. Game changers: mineral oil, biodiesel mandates, Chinese demand. Despite many challenges and the “real estate debt crisis” in China, they may hold up their pants till after the Winter Olympic games in February, just before spring.

Soybean oil

On Nov. 9th the USDA, in its WASDE report, lowered the U.S. soybean crop due to lower yields in some states. This supported the market. But at the same time demand was lowered and ending stocks were estimated higher. Production estimate for Argentina was also lowered to 49.5Mmt. Overall, a slightly bullish report. The market still faces a large Brazilian crop later this season. Fast planting progress in favorable conditions (70% done) may push an early crop to market next year. Even Argentina received some rain.

Rapeseed oil

The supply remains unchanged tight and biodiesel demand in EU is the most important price factor. The market presently requires “winter-biodiesel” with rape methyl esters to protect diesel from frost (melting point). The supply shortage is perfectly illustrated by the price rally above $1800/t and the premium over soybean oil. On Matif the Feb ctr for rapeseed costs €704.25. Once upon a time you had refined oil for that price.

Palm oil

Low production in origins and short covered consumers support palm oil prices. Demand from China and India stays strong but it is most probable that EU will import less. Also, the direction of the soybean oil market will influence prices.

Lauric oils

Palm kernel oil is expected to stay supported by good demand. Better copra arrivals could pressure coconut oil but it seems that palm kernel levels have a bigger influence so far.

Sunflower seed oil

Reluctant farmer selling stays a problem but harvest is abundant.

USD and mineral oil.

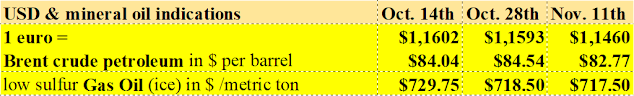

The USD climbed on interest rate hike (FED) speculation to curb inflation. The Euro dropped to its lowest since July against the USD when ECB’s Lagarde said it was "very unlikely" that a rate hike would take place in 2022. A weaker euro fuels EU’s “import-inflation.” While central banks want the public to believe that the current inflation surge is temporarily, most investors think it's here to stay. “J’y suis j’y reste.”

The inflation boost prompts both the Biden administration and the Federal Reserve to take action. Biden is considering releases from the Strategic Petroleum Reserve and called repeatedly on OPEC+ to raise production.

Brent and WTI futures dropped as speculators, expecting central bankers to take steps, sold off of risky assets, including stocks and commodities. This suppo rts the USD, which often trades inversely to mineral oil. A higher USD undermines the price of dollar traded commodities as it raises the cost in importing countries. Brent seems to be consolidating below $85.

Always at your service.

Please contact AVENO for further inquiries.

Please contact AVENO for further inquiries.

Aveno's Monthly OILS & FATS bulletins:

All our monthly bulletins: https://www.aveno.be/search/label/monthly

Don't forget to check out our bi-weekly updates!

There

is some complexity to the business we daily operate in. To help

understand the business of being an edible oil and fat producer we've

launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Disclaimer

Unless

otherwise mentioned the crude oil values quoted in these documents are

prices landed in EU without import duties, handling, storage, financing,

refining, packing, transport or any other cost related to bring the

product to market. They are used as market trend illustration.

Substitution of oils is possible but different oils have different fatty

acid profiles and are not all interchangeable for all applications. One

can make biodiesel from all oils and fats but one cannot make

mayonnaise from coconut oil. This document is exclusively for you and

does not carry any right of publication or disclosure. This document or

any of its contents may not be distributed, reproduced, or used for any

other purpose without the prior written consent of AVENO. The

information reflects prevailing market conditions and our present

judgement, which may be subject to change. It is based on public

information and opinions which come from sources believed to be

reliable; however, AVENO doesn’t guarantee the correctness or

completeness. This document does not constitute an offer, invitation, or

recommendation and may not be understood, as an advice. This document

is one of a series of publications undertaken by AVENO and aims at

informing broadly a targeted audience about the edible oils & fats

market. AVENO’s goal is to keep this information timely and accurate

however AVENO accepts no responsibility or liability whatsoever with

regard to the given information.