Omicron vs. Fundamentals

Your Bi-weekly update on edible oils & fats by AvenoNovember 13th 2021.

Looking back

End November, covid came back strongly on the agenda for global commodities which slipped lower on reports abt. the new Omicron. Petroleum which is a good indicator of how the economy is doing dropped sharply on concerns over the potential rolling out of new lockdowns, travel restrictions and less consumption.

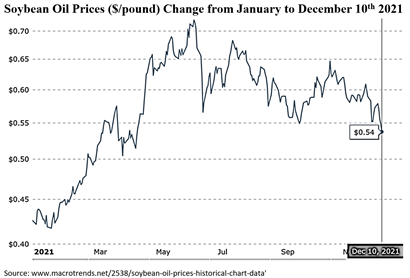

After a panic sell off and profit taking most markets recovered some lost ground but overall, cautiousness rules. The pandemic is far from over and Omicron could hamper global economic recovery. Also, in the past two weeks soybean oil has been leading our oil complex down with an impressive price dive in the U.S. domestic market; attracting buying interest.

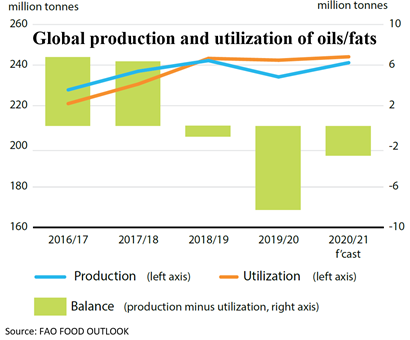

If this year was difficult, it won’t last long now. It was all about covid and food inflation. Fundamentally prices go higher when there are more buyers than sellers and when looking at end stocks (a result of supply and demand) we saw low stocks of everything everywhere. Since 2018 global consumption of oils & fats has been above production and eating into stocks.

Not only a growing population and higher incomes were the drivers: from less than 2 % of global demand in 2000, biodiesel demand is now good for about 20 %. Other traditional non food uses represent about 10%.

On the supply side the weather has not been good enough in the past years. And as (end)stocks stay low, so far, no real supply pressure developed in the sun, soy, palm and certainly not in the rape market.

Looking forward

Market expectations remain that in 2022 global production, (helped by high prices to curb demand and boost production), will exceed consumption: global production of oilseeds is set to increase by 26Mmt (oil 8.4Mmt). This will allow stocks to grow, under condition that weather remains favorable and that politics (biodiesel) do not surprise, that covid doesn’t disrupt supply chains and that the input cost (e.g., fertilizer and energy) stay under control.

Long term (looking at worldwide investments) it is believed that the global expansion of biofuels for road transport and SAF (sustainable aviation fuel) may eat up all growth in edible oil production, and more, and lead to still higher prices. But we also saw political decisions to halt biofuels expansion.

Still, if Omicron knocks us down and pins us at home for a longer period of time, all bullish fundamentals could be wiped off the face of the earth.

MARKETS

Interesting how FOB export prices for the usually cheapest palm and the usually most expensive sun converged with soy (unrefined oils, without duties and transport). Meaning substitutions are working out. The high premium for rape is expected to stay till the new crop.

Soybean oil

The Brazilian government announced to limit biodiesel admixture, in 2022, to 10% instead of the planned 13-14%. They want to slow down inflation and cut transport costs. This decision had a bearish impact on soybean oil and helped the downslide in the U.S. However, it is still possible for Brazilians to produce and export the biodiesel…

Last Tuesday the EPA (U.S. Environmental Protection Agency) proposed scaling back the volume of biofuels that American petroleum refiners are required to blend (retroactively reducing the 2020 biofuel blending obligation by nearly 15%, 2021, about 10%, 2022 was increased). The market perceived this proposal as bearish.

The last USDA WASDE report was neutral and the global soybean crop expectations remain excellent.

Rapeseed oil

In EU-27, winter crop plantings are up 6% which could result in a 5-year high crop of 18.4Mmt in 2022, if the crop survives winter kill (frost), moisture deficits in spring, cold, heat waves, etc. Seed prices remain sky high and Friday MATIF February quoted 75% higher than a year ago, around €720, reflecting the tightness of the market. At the earliest the new crop comes in AUGUST onwards and there will be plenty space in the sheds to store it! Biodiesel margins are good.

The Canadian production will probably also recover but the 2022-harvest is still months away. If their spring plantings inspire any confidence this could be a start of some market pressure.

Palm Oil

Prices came under pressure by the lower soybean oil prices but we are entering the seasonally low production months so we mustn’t expect much stocks buildup unless something goes terribly wrong. In the next half year, prices will be supported by tight stocks and relief may come when productions go up again.

But already a red flag is raised: an extended period of labor shortage may hold back the recovery in 2022. Today fruit bunches are still rotting on the plantations which encounter further delays in getting migrant workers back due to the emergence of Omicron.

Indonesia had postponed its plan to implement B40 in 2022 and all diesel fuel in the country contain at least 30% biodiesel (B30). The intention is to increase this to 50% by 2025. That being the case, it would require a lot of expensive palm oil. As coffee has no leaves, we leave it to tea drinkers to read the tea-leaves in the bottom of the cup.

Sunflower seed oil

Fundamentally little changed. Some farmer selling was seen but also some reluctance from buyers to step in. Stocks are there and expectations are that early next year more will move to the market. Usually after the Christmas holidays and New Year celebrations, bellies are full and wallets empty. Bottling business for retail slows down as people still have lots of oil in stock at home.

USD and mineral oil.

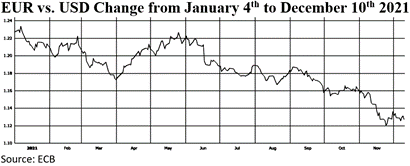

EU is fighting a new wave of infections and surging energy prices, slowing down economic growth.

Petroleum follows the ups and downs of the economy. While waiting for enough cheap CO2-free energy from solar and wind, economies remain dependent on petroleum. Not only for fuels but also for plastics, fertilizers, clothing, etc.

Today, most are not inclined to invest in an energy source that is “doomed to disappear” and banks only invest in “sustainable companies”. Declining investments, with oil consumption expected to increase for another decade and gas consumption another twenty years, could be very price supportive in coming years. In this respect a new UN report says nuclear power generates less CO2 over its lifecycle than any other electricity source, including wind, solar, gas and coal…. Old rockers never die.

AVENO thanks you for the interactions we had throughout the year and whishes you a happy holiday season and a safe, healthy and prosperous 2022!

Aveno's Monthly OILS & FATS bulletins:

Don't forget to check out our bi-weekly updates!

There

is some complexity to the business we daily operate in. To help

understand the business of being an edible oil and fat producer we've

launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Disclaimer