An exciting new year but less wine!

Your Bi-weekly update on edible oils & fats by Aveno

Januari 14th 2022

Then recent adverse weather gave new support to prices: dryness in South America, floods in Malaysia, super typhoon Rai in the Philippines. But also, earlier weather events still worked out on prices of rape, linseed and grapeseed oil (fondu olie).

Januari 14th 2022

Looking at the facts

As companies closed the books at year end, many saw a lower cash position and increased debt level caused by ever higher input prices. Purchasers had to deal with possible shortages and longer delivery times, which often forced them to increase inventories. Omicron may also lead to more lockdowns, to more supply chain disruptions and disturb the normal consumer demand pattern.

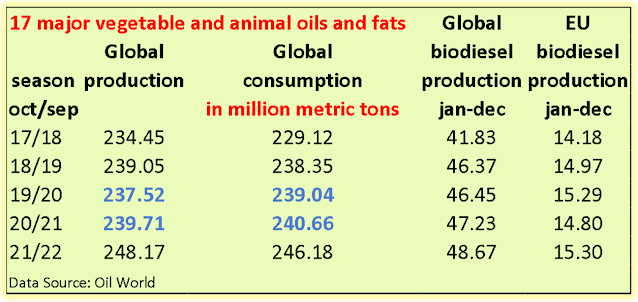

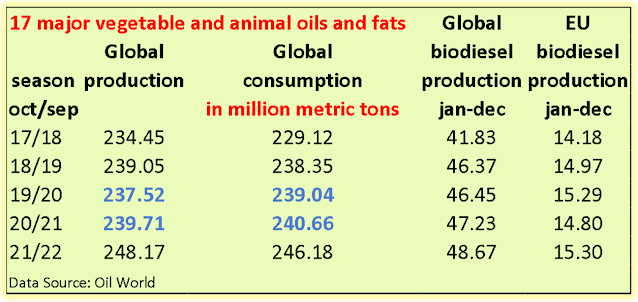

Since mid-December global prices eased in an overall mildly bearish trend. Prices of edible oils and fats weakened on anticipation of a (not yet realized) boost in production, stock recovery, Chinese imports declining 6 months in a row, high prices curbing demand in several countries and the spread between gasoil and edible oils making biodiesel a less attractive choice.

Then recent adverse weather gave new support to prices: dryness in South America, floods in Malaysia, super typhoon Rai in the Philippines. But also, earlier weather events still worked out on prices of rape, linseed and grapeseed oil (fondu olie).

In 2021 EU’s wine producing regions faced unfavorable conditions during most of the growing season: frost, hail, storms, and humidity in the summer (diseases). The world’s three biggest wine-producing countries, which account for 78% of all wine in EU and for about 50% of global production (Italy -9%, Spain -14% and France -27%) collectively produced 17% less wine. Therefore, it is expected that EU grapeseed oil production will drop by about 25%. The good news, is that despite weather problems, the wine quality is good.

Since last year we also saw butter prices move above €600/100 kg and supported olive oil prices due to good demand. Olive oil harvest is in full swing in the Mediterranean area but was slowed down by rains. For a second consecutive year, global ending stocks of olive oil are set to decline.

An uncertain year

Volatility, high prices, inflationary pressure and supply chain disruptions will remain themes in 2022. Investors are concerned over rising interest rates and the unknown impact of Omicron which has already disrupted supply chains like in China which orders lockdowns of factories and ports in response to even small numbers of infections.

Geopolitical challenges in Eastern EU (Ukraine, Belarus, Kazakhstan) are a concern. Norwegian Yara, a global company in agricultural products announced last Monday it will end the sourcing of a key ingredient for the production of mineral fertilizers used in food production, from Belarus (effects on the supply chain from current sanctions on Belarus). High energy prices and supply chain issues contribute to the high cost of fertilizers which are needed for crops!

So far, companies coped with the many challenges but more and more the question arises to what extent companies can pass on the many price increases, when this year we’ll experience the strongest inflation since the 1980’s. Whatever will be, will be. The future's not ours to see. Que sera, sera

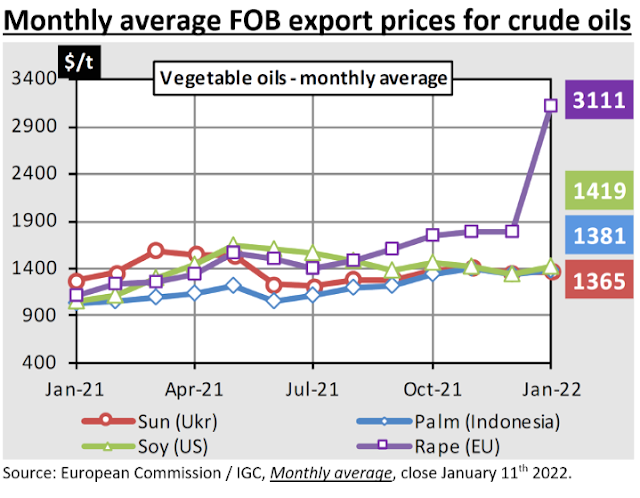

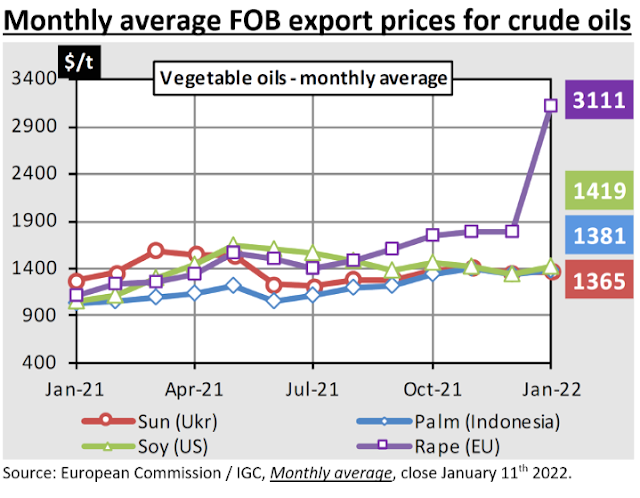

MARKETS

In past months the discount for palm oil vs other major oils evaporated. The unusual minimal discount reflects the strong demand and reduced availability of palm. Relatively speaking, palm oil prices gained more than soy, sun and rape. Palm oil traditionally trades at a discount and is often the choice of lower income countries. With price increases of all vegetable oils, buyers moved away from more expensive oils, adding demand for palm. Also, slow-to negative growth of palm oil production in Malaysia and Indonesia tightened supply and contributed to the rise in palm oil prices. For 2022 we may expect a continuation of this situation with the major oils converging in price.

Soybean oil

This week’s USDA report was ‘Cautiously bullish’ on the Agri-commodities front. Markets reacted mixed, initially falling after the publication to quickly recover. The South American bean production was reduced by 9Mmt: Brazil put at 139 vs 144 Mmt last month, and Argentina at 46.5 vs 49.5Mmt last month. Dryness in Southern Brazil, Argentina and Paraguay raises concerns.

Before the report soybean oil prices weakened on rumors that the Biden administrations was contemplating cuts to the 2022 biofuel blending mandate, which if realized may have a negative impact on demand for biodiesel production. Still, some analysts expect that U.S. biodiesel production will grow 1.5Mmt this year. Biodiesel is a driver for growth in demand and the expansion of biodiesel (incl SAF – sustainable aviation fuel) production capacity in the U.S. and elsewhere is huge. On the other side we’ve seen Brazil dropping its aspirations this year.

Rapeseed oil

Currently supply is reasonable, although there are concerns for the coming months due to the very tight supply in rapeseed. Prices on new crop are lower although in absolute numbers still high. In EU a significantly larger area has been sown in than last year. Crush and biodiesel margins have been under some pressure. On the MATIF nearby rapeseed futures reached new records to correct down afterwards. Fact is that seed is scarce!

Palm oil

Malaysian palm oil traded higher following a bullish Malaysian Palm Oil Board report: stocks were 12.9% down and production down 11.26% vs November.

Shortage of foreign workers amid the floods in parts of Malaysia, the high cost of fertilizers and the impact of Omicron threaten the production recovery of crude palm oil according to the Council of Palm Oil Producing Countries (CPOPC).

Less fertilizer application will result in lower yields at a later stage putting a lid on output growth. A double whammy could come from the weather. After La Nina comes El Nino: after heavy rainfall, El Nino drought could emerge in the following years. It is of course too soon to predict the end-start-intensity of a weather phenomenon but all this adds to cautiousness.

USD and mineral oil.

The euro rose to near $1.15, its strongest level since mid-November. Inflation and tightening monetary policy in the U.S. and EU are carefully watched.

Petroleum prices climbed as inventories dwindled and demand recovers despite Omicron. With Brent above $84, its highest level in two months, it seems the bullish sentiment returned. Global demand is more resilient to the effects of the Omicron spread than analysts expected. And some even started questioning if there is enough crude to go around? At these prices U.S. shale oil production might kick in big, sooner than expected.

Please place orders in time so that you can be delivered at the right time and before shortages surprise you.

AVENO is here for you. Take care of yourself and each other.

Aveno's Monthly OILS & FATS bulletins:

All our monthly bulletins: https://www.aveno.be/search/label/monthly

Don't forget to check out our bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Sign-up for Aveno's newsletters:

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.