Inflation and Geopolitics

Your Bi-weekly update on edible oils & fats by Aveno

Januari 28th 2022.

Januari 28th 2022.

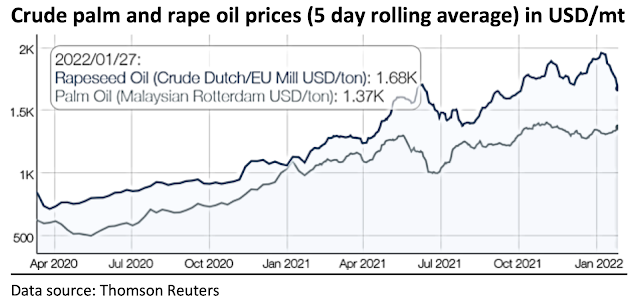

As the global economy is recovering from and adapting to changing pandemic challenges, inflation continues to worry. Also, weather conditions on several continents, the conflict between Russia and Ukraine and global demand continue to impact prices. So far, everywhere, governments have been unable to stop skyrocketing (food)prices.

Greenflation

Many have warned against "greenflation". Even ECB Director Schnabel admitted the shift to green energy carries the risk of higher inflation. "Investments in the energy transition and the rising CO2 tax contribute to the price increase." Demand for copper for electrification and demand for biodiesel to decarbonize transport are just two examples contributing to higher prices.

The main cause for rising prices is the central banks’ ultra-loose monetary policy, on top of which came higher energy prices, which cause more inflation like higher production prices for paper, cardboard and plastics. Most analysts expect this upward spiral to last throughout 2022.

In EU the fourfold increase in fertilizer prices over the year will hit farmers badly. This is also true on palm plantations, in the U.S. Midwest, the Canadian prairies, etc. Now, some fear that due to too high input costs (energy, fertilizer, transport…), the needed increase in global agricultural production may not materialize.

Food, petroleum and gas can be used as weapons

Geopolitical tensions and speculation about gas supply cuts in the event of sanctions on Russia cause concerns. Grain prices rose again last week as Ukraine and Russia are amongst the world's biggest grain exporters. Escalation could have a global impact. So far, it had little impact in the edible oil markets but Ukraine is the world’s biggest sunflower seed producer. And both Russia and Ukraine are important suppliers of sun and rape.

Amidst the many uncertainties the market is looking for direction and prices remain as volatile as the weather. The general expectation is that palm and soybean oil will remain firmly priced. The much hoped for stocks increase and lower prices is again pushed forward till…. The end of the year?

It’s been reported that Vlad Putin will attend the opening ceremony of the Chinese Winter Olympics early Feb so an attack is not for direct. A smoke screen or will he delegate?

MARKETS

Soybean oil

In Chicago, the last few sessions soybeans were on an upward trend due to the South American weather. Sowing began optimistically, with most soybeans planted on time. But extreme weather, with drought in some regions and excessive rain in others, dampened prospects for a record crop. Moisture deficits stressed the crop development like in Paraguay, a relatively small soybean producer, which has hardly got any rain but extreme heat, there is talk of losing 50% of the crop. In Argentina and Brazil, the crop was revised downwards and there is now a wide array of crop estimates circulating. “Oil World” thinks we may lose 7.5 Mmt of beans which is 1.3Mmt of oil.

On the demand side China imported less in the past months and prices for pork remain low as supply recovered. This also impacts pork producers elsewhere who can’t export to China (less soybean meal demand). We are now just before Chinese New Year for the year of the tiger and the Winter Olympics. Covid restrictions (lockdowns) in China also affected consumption negatively.

Rapeseed oil

We saw much volatility in seed and oil markets. Oil struggled for demand and high seed prices killed crush margins. Bigger Australian and Indian crops may bring temporary relief and support may come from the South American weather market, so prices are likely to remain very volatile. The recent price drop prompted buyers and sellers to action, leaving the market with a more neutral feeling. Many buyers are short on nearby and continue needing spot material. Biodiesel producers covered some demand on deferred.

Palm oil

The flow of bad news continued. In 2021 the average Malaysian oil yield/ha dropped to a 23 year low at 3.48t/ha vs. the past 10-year average of 4.03t/ha. Plantation management, weather, labor, older trees…

Indonesia announced restrictions on palm oil exports in order to curb domestic food prices. At the same moment they said to launch B40 road tests to eventually roll out the higher blend. Currently 30% biodiesel in blended with fossil diesel but they want 40%, 50% and eventually 100% biodiesel to support the local palm oil industry while reducing foreign exchange expenditures on fossil fuel imports.

Malaysian palm oil futures climbed above MYR 5,450 per mt for the first time. But at current prices palm has lost and is losing demand. India shifts to cheaper substitutes, such as soy and sunflower oils.

Sunflower seed oil

Sellers and buyers have been doing business. Ukrainian farmers were motivated by falling prices and tensions with Russia. As military actions may make it more difficult to export from the Black Sea region. As we move forward the high stocks of sun seeds may weigh on the market but on the other hand missing millions of tons of rapeseed and soybeans could inspire owners of sun seed to remain omicronly cautious and prefer seed over inflated money.

USD and mineral oil.

The Euro was pressured by the economic slowdown in the Eurozone, in January, and by concerns over the conflict in Ukraine as investors sheltered in the dollar safe haven. The currency depreciated further to below $1.12, as others rushed for the dollar after Jerome Powell indicated there was "quite a bit of room to raise interest rates".

Last year global investment in new oil fields were the lowest since 1946. Many countries are shutting down coal and nuclear power plants and replacing them by gas power plants, but the gas inventories are low and so is production. As the global economy grows the need for energy grows. And love grows where my Rosemary goes. Even if OPEC agreed to increase production, Russia and other OPEC countries are unable of producing more. Then there was a drone attack on a petroleum operation in the middle east and the conflict in Ukraine. That while the pandemic is just about over, and that economies open up soon. The price of petroleum may rise further, which is bad news for inflation, and therefore for the economy.

§§§

Always at your service.

Please contact AVENO for further inquiries.

Aveno's Monthly OILS & FATS bulletins:

All our monthly bulletins: https://www.aveno.be/search/label/monthly

Don't forget to check out our bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.