Has heatwave changed fundamentals?

Your Bi-weekly update on edible oils & fats by Aveno

Februari 10th 2022.

Palm oil led edible oils and fats rally on demand outgrowing supply.

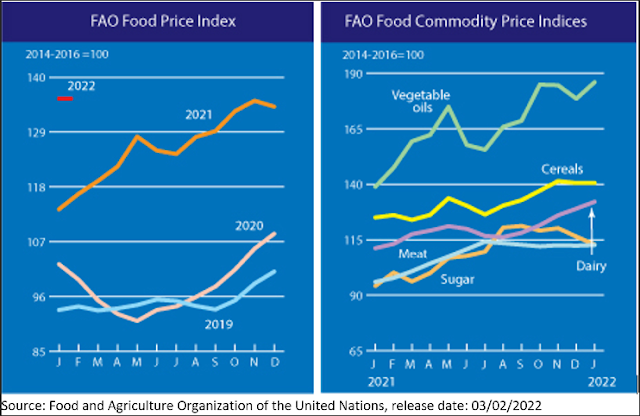

In January the FAO food price index hit an eleven-year high on the back of higher dairy and vegetable oils prices. And many worry more and more that high food prices may lead to social unrest, not to speak of households under torment of higher energy bills.

The Malaysian palm oil futures hit the highest levels ever in history on continuous tight stocks situations and after Indonesia announced plans to limit exports, raising fears for supply disruptions, especially if pandemic restrictions ease.

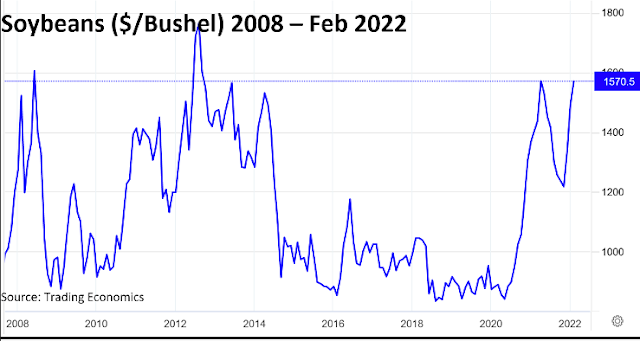

In South America a prolonged period of dryness and excessive heat substantially affected quality and quantity of crops. Extreme dryness first impacted southwest Brazil and Paraguay during December. Parts of Argentina suffered from dryness from late November through early January. Temperatures were between 32 and 43°C and in Argentina even 45°C. Before the heatwave recently broke the damage was done and the market mood turned bullish because the global tight oilseeds and oil stocks situation can’t bear misfortune. Especially with strong demand to replace palm and rape by soy oil…

After some rain, the latest weather forecast for the coming period remains worrying. Argentina in particular continues to suffer from drought and heat.

Diverging variables.

High prices have dampened some demand and invited government interventions to reduce domestic food prices (Russian export tax on sun, India changed import tariffs, Indonesia restricts exports, several countries reduced biodiesel mandates, etc.). All this slows the global consumption growth rate and changes trade flows. Iran is putting a ban on soy oil as of March (500.000 mt/yr.), Bangladesh increased soy oil imports due to shortages of palm oil, China is processing less beans due to low demand for soymeal (low meat prices) and thus produces less soy oil… China also imports less groundnuts and as groundnut production is expected to rise slightly this season, groundnut oil prices may ease a bit.

Weather permitting, this season (oct 21-sept 22) the total global production of 8 major vegetable oils is still expected to be up 3.5% vs. last season (207Mmt) against a consumption increase of about 2% to 205Mmt. But with a supply(chain) crisis for nearly every thinkable commodity “All systems are on overload… and where we are heading with zero visibility behind steamy windows…” we’ll see.

How far can prices rise? In principle as high as biodiesel usage profitability allows them to go. And that is mostly a political thing.

MARKETS

Soybean oil

The Feb. 9th WASDE report was perceived as neutral and as expected with minimal changes vs. last month for beans. Crush in U.S. was up and ending stocks were reduced, South American production trimmed down and Chinese bean buying lowered by 3Mmt to 97Mmt. The USDA also increased the season-average- farmgate-price-forecast for 2021/22 by $0.40 to $13.00 per bushel, partly reflecting the impact of the South American drought.

An American researcher recently commented: “…/…we need another 20 million tons of vegetable oil just to support existing investments in renewable fuels…/…”. The number is debatable but American biodiesel demand increased with the rise in soybean oil prices. So far, this increase had little effect on domestic use for food, feed and other industrial uses. The reason being that the additional demand from biofuels is being met by scaling back soybean oil exports. Meaning less oil for the rest of the world where there remains a strong demand to replace palm and rape… (e.g., in EU biodiesel).

The crush in China has been under pressure due to less soymeal demand from the feed industry due to low pork prices. A crush reduction in China would in principle force them to buy oil on the global market to satisfy domestic oil needs.

Rapeseed oil

Probably all shortages have been discounted in the price by now but rape seed and rape oil remain volatile. Strength or weakness for rape oil will spill over from the seed market and from other oils. Global consumption is down in most price sensitive markets and also China is expected to buy less oil.

This season (oct 21-sept 22) global production of oil is forecast at 25.5Mmt, down 1.6Mmt vs last season. Global disappearance is projected at 25.97Mmt, so eating into ending stocks with no room for any setback. This looks like raising pigs on paper: manageable. But the production this season includes partly the processing of the new EU crop! There is still a huge supply gap between old and new crop in which buyers mustn’t get trapped.

Palm oil

Indonesia, the world’s largest palm oil producer (+45Mmt) and the world’s largest exporter of edible oil (+27 Mmt) always had a challenging and unpredictable regulatory environment. But decisions are taken in good faith to protect the country’s interest and in response to rising domestic cooking oil prices, they rolled out new policies:

- Implementation of a temporary cooking oil subsidy from the Crude Palm Oil Fund (same subsidizing the biodiesel mandate program).

- A Domestic Market Obligation requiring exporters of palm oil products to sell 20 percent of their total export volume domestically (restricting export to boost domestic supply).

- Until recently no export approval was required for palm oil products but Indonesia expanded its export permit requirement for all palm oil products (+ derivatives, PKO, margarines, etc.), per February 15th.

- The retail price for cooking oil is now capped.

Indonesia’s restrictions and the delays in solving foreign worker shortages in Malaysia and the low production season in the first quarter of 2022 continues to keep palm supply very tight, which in turn generates continuous price support as any output gains will struggle to keep up with good demand for vegetable oils in general.

Laurics (coconut and palm kernel oils)

Global demand remains strong and mostly inelastic. Production is capped and stagnant because global CNO production has been fluctuating around 3 Mmt for decades. PKO, a byproduct of palm oil production, has grown over the years but has suffered same production setbacks as palm oil.

The severe typhoon in the Philippines damaged 3% of trees and 40% of that fatally. It will take 6 months to recover. And stocks are already too low to compensate any shortage of PKO.

PKO suffered big production losses in Malaysia (floods, labor, etc.). There is a big demand in Indonesia from the oleochemical industry and export controls. Large premium over CNO. Supportive fundamentals.

Sunflower seed oil

Farmer selling of seeds is catching up the historical selling levels. Oil competes with soybean oil in export markets so the market is very reactive to any fundamental changes on the soy side. Sunflower seed oil remains supported by strength in soy, palm and rape.

This season the hi-oleic premium over classic remains strong because of limited supplies.

USD and mineral oil.

Currency speculators are betting on rate hikes in EU, following the ‘hawkish’ tone in the latest ECB press conference. Others think the first move will only be end 2022 or early 2023.

Petroleum touched new highs on demand recovery, falling stockpiles and supply disruptions. Production problems of some OPEC members and geopolitical tensions in Eastern EU also supported prices. Shale oil drillers are making a lot of money with $90 oil and a nuclear agreement with Iran (which could add 1.5 million barrels/day) is within reach. It can freeze and it can thaw.

§§§

Should you have any questions or queries, please call your regular AVENO contact.

Aveno's Monthly OILS & FATS bulletins:

All our monthly bulletins: https://www.aveno.be/search/label/monthly

Don't forget to check out our bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.