When the pan catches fire!

Your Bi-weekly update on edible oils & fats by Aveno

Februari 25th 2022.

Palm and Soy on Olympic Highs!

Conflict in Ukraine pours oil on the inflation fire.

In the last week of February palm oil futures broke through 6000 Malaysian Ringgit/mt for the first time in history, as demand outstrips production. When crop reports estimated 27 to 28 Mmt of South American soybean production being lost market watchers believed that soybeans had the potential of surpassing the all-time high of nearly $18.00/bushel from 2012.

With the lowest stocks (relative to use) in years, grain and oilseeds markets remain tight and tensions in Ukraine continued to fuel uncertainty and price volatility for all commodities. Uncertainty over sunflower oil supplies due to the conflict spurred demand for other oils, further fueling an already red-hot edible oil market.

Unexpected logistic hassle.

Military analysts say Russia built the ideal army for their “active defense strategy” highly capable of fighting on home soil or near its border and striking deep with long-range fire. But for most everything Russian forces are highly reliant on trains and so have limited capabilities for a long ground offensive far from Russian railroads. To resupply troops beyond the Russian rail system is quite challenging. The largest country in the world, extends across eleven time zones and its most western part on the Baltic Sea is 9,000 km from its most eastern part. Their railroad is also wider than in EU meaning their army rail sustainment capability ends at the borders of the former Soviet Union.

With the current troop deployment there seems to be a shortage of railroad material because the army needs it. So, all grains and oilseeds moving over Russian territory (also from surrounding countries) are experiencing delays. This could lead to ‘out of time situations’ on (shipment)contracts. Also, Ukrainian ports like Mariopol and Oddessa were bombed, making exports impossible at the moment. Russia and Ukraine account for 25% of global grain exports and both account for 50% of sunflower seed and oil exports and some 20% of rapeseed exports (not productions).

Difficult to say how the invasion and sanctions will disrupt grain and oilseed supplies from the Black Sea region. Also, how trade flows will shift from one region to the other. But already we know that ingredients for animal feed prices are up, which will drive up meat prices (not profits) etc.

Hold your horses

Short term uncertainty is high and this encourages sheltering. Though unlikely, a halt of the economy and sudden fall in demand could be beneficial if all commodities collapse and so solve inflation and logistic bottlenecks...

MARKETS

Soybean oil

We really see crops only once they’re harvested. There is much speculation and debate on how big the area and yield losses are in South America due to problematic weather conditions brought about by the La Niña phenomenon. A lot of people are throwing numbers and raising questions. Fact is nobody really knows and there is a danger of exaggeration.

Still, high prices are doing their job and in China due to negative crush margins, some soybean crushing plants were idled, waiting for the government to put on the market 5 Mmt of beans from its reserves. There were reports about 10 to 12 cargoes of soybeans canceled from South America due to high soybean prices and low Chinese soymeal prices (low meat prices). Of course, less crush also means less oil production which can in turn fuel the oil leg of the soy complex. Thursday bean futures jumped to $17.5/ bushel, the highest since 2012; later the market eased a bit.

Rapeseed oil

The spread with other oils had narrowed. High prices led to less demand and there were poor biodiesel margins. But in sympathy with other oils, on worries for tight world oilseed supplies, and on rallying energy markets the whole rape complex jumped higher.

Palm oil

Although still the most produced oil in the world, palm oil is losing global market share because it is no longer the cheapest and the expected production growth is also down. Expansion is likely to come from Latin America and Africa. There is (conditional) optimism on higher production and lower prices in the second quarter of the year but seeing is believing and we ain’t seen nothing yet!

Sunflower seed oil

Very strong demand because of being competitively priced. Sun oil traded below FOB Argentina soy oil and below FOB palm olein. Demand from destinations with low stocks picked up and larger supplies moved into the market. In EU some sun oil replaced rape in biodiesel production. But now uncertainties around Black Sea origins will support prices…. Or completely dry up the market?

USD and mineral oil.

Markets moved to safe-haven assets such as the U.S. dollar and gold.

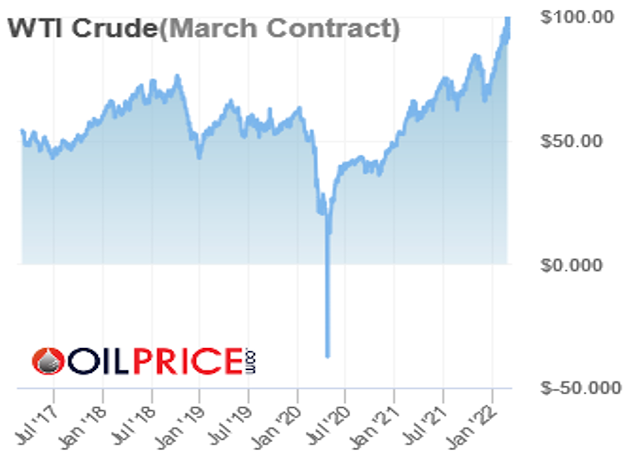

Petroleum prices rose on falling inventory, higher demand and an added geopolitical risk premium. Then they soared past $100 on Russia invading Ukraine, to ease later in the session below $100.

After seeing WTI crude at $0.00 and less in 2020, shale oil producers remained disciplined and focus on return and shareholders’ reward. They want to earn back years of burning cash before investing in growth/more production. It will take a while for extra productions to kick in and meanwhile high energy prices may lead to consumption decreases and slow down economic growth.

§§§

Should you have any questions or queries, please call your regular AVENO contact.

Aveno's Monthly OILS & FATS bulletins:

All our monthly bulletins: https://www.aveno.be/search/label/monthly

Don't forget to check out our bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.