Balancing act in Panic-land

Your Bi-weekly update on edible oils & fats by Aveno

March 11th 2022.

Everything impacted by a “special military operation”

Not only a wake-up call, Putin’s “special military operation” is a long term global game changer. The conflict is the main driver for soaring commodity prices and it smashed the previously slightly more positive edible oils & fats supply outlook.

Ukrainian exports via Black Sea ports stopped, infrastructure is damaged, there is nearly no willingness or possibility to sell due to great uncertainty about the outcome, banks and insurers are backing off, rising energy, fertilizer, and transport prices, the collapse of the ruble, sanctions and more are all causes for changing trade flows and trade decisions for years to come.

Global grain and edible oils markets were already tight, and now due to the disappearance of Ukraine and Russia from the market, it’s getting even tighter. For the first time wheat went above €400/mt and nearby palm oil above 8000 Malaysian ringgit/mt. Butter is again above € 600/100 kg, sugar hit a 5-year-high, not to mention soaring prices of nickel, gold, aluminum, uranium, petroleum, etc.

The fall out, magnitude and duration of the crisis are unpredictable. There is panic in the market from people covering short positions and others scrambling to replace sunflower seed oil by other oils… we see sellers defaulting on contracts and claiming force majeure.

The edible oils & fats environment is one of tightness:

- Low stocks of palm oil in Malaysia

- Loss of Black Sea sun oil availability

- Insufficient export potential from South America

- Indonesia restricting export of palm oil

- No signals (yet) of reducing biodiesel mandates

- India, China and other countries stepping up purchases

Food autonomy and the farm to fork strategy.

Many countries consider food self-sufficiency as an important strategic concern. In China, at the last annual meeting of the National People's Congress, with prospects for poor harvests and as war rages in Ukraine, Food sovereignty remained a major concern. Central planning said that 117 million hectares of grain will be sown this year and the production of soybeans and other oilseeds will also be increased. All arable land will be used.

In EU, after an emergency meeting on the crisis, agriculture ministers concluded that the Commission needs to rethink the Green Deal, the Farm to Fork strategy and the biodiversity strategy, from the point of view of food security. EU parliament asked to strengthen food autonomy as food production depends heavily on imported fertilizers, natural gas and raw materials for food and animal feed. Besides the price and availability of raw materials, higher energy prices also impact the costs of transport and production (e.g. costs of drying and processing to sugar, starch, oils, etc.).

Food insecurity threatens not only less developed nations. In EU lower income households who are footing a high energy bill can slip into poverty by higher grocery bills, leading to social dissatisfaction.

Climate change and complexity

There was a time when the west was delivering grain to the Soviet Union and drinking “Vodka-Cola”. Then politics, policies, wokeness, globalization, outsourcing and Ricardo’s law of comparative advantage brought us the mess we’re in.

Now, concerns over energy dependence rise as to step up efforts to diversify energy providers and lowering dependency on Russia and several NATO members also announced increased military spending.

The new IPCC report “Climate Change 2022: Impacts, Adaptation and Vulnerability” claims that the world will rapidly be facing devastating consequences if we don’t go fast forward to “net-zero”. Just after Chinese president Xi Jinping in a speech in January said that China’s “ambitious low-carbon goals should not come at the expense of energy and food security or the "normal life" of ordinary people”.

The challenge for political leadership is to balance all issues: the budget, net-zero goals, sustainability, self-sufficiency of affordable food, energy independence, purchasing power, (green)inflation, ESG, social peace, circular economy, national security, etc. and keep everybody happy! With all this in mind, ga er maar aan staan.

MARKETS

Focus is on the unrest in Ukraine and its duration and fall out. In weeks to come we’ll analyze what gets planted or not. How will grain and oilseed supply disruptions evolve? Buyers scrambled to rape, soy and palm olein to replace missing sun. The shortage is boosting demand for other oils!

Soybean oil

Global soybean stocks remain pressured by South American crop losses and renewed Chinese buying. Also soybean oil is being sought to replace missing sunflower seed oil. India, Bangladesh, Venezuela and Mexico have all been buying oil in the U.S.. South American weather improved with rain for most of Brazil and part of Argentina. Brazil’s harvest is reported 50% complete.

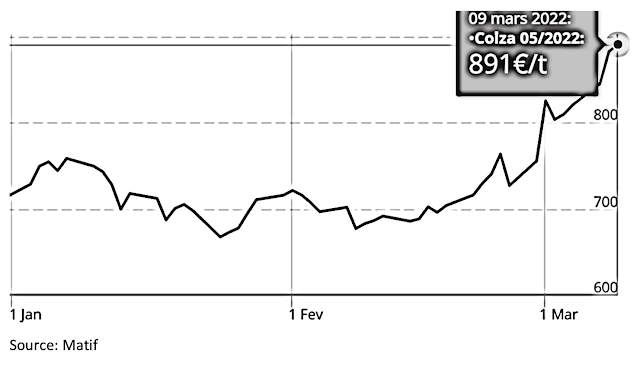

Rapeseed oil

Rapeseed traded at record highs because of the unpredictable rapeseed supply from the Black Sea region for this and next year. Also Russia placed an export ban on multiple goods…. The MJJ position might prove even more difficult than anticipated and some are replacing unavailable sun by very expensive rape. Rapeseed on the May position rose to nearly €900!

Palm oil

Begin March crude palm oil prices topped RM8000/mt for the first time as buyers rushed for palm on the shortfall in sunflower seed oil. Later Malaysian palm corrected on profit taking, but following the announcement of further restricting exports out of Indonesia, the market keeps trading way above 7000 (depending on the position). At the moment Indonesia is probably sitting on the largest vegetable oil stock in the world and it reduced availability for the outside world.

Sunflower seed oil

Sunflower seed oil supplies have been disrupted on both old and new crop. New crop supplies out of Ukraine and Russia look doubtful, with farmers unable to work and plant new crops.

Seed and oil supplies are slowly drying up and everyone concerned is working on replacement. Sellers are defaulting on contracts/claiming force majeure. With uncertain availability it is mostly not quoted. Argentina is harvesting now but most is already sold.

In Spain the most used vegetable oil is sunflower seed oil which is widely used in restaurants and food production as it is cheaper than the local olive oil. Spanish supermarkets are already rationing oil and limiting sales to customers.

This situation is pushing up olive oil prices….

USD and mineral oil.

In both the U.S. and EU inflation is running at record highs and is likely to be more persistent on the back of higher commodity prices. Reducing the quantity of money is highly desired but not always economically feasible.

Energy markets traded at new highs above $130 on turmoil in UA and calls to limit use of Russian petroleum, but dropped on UAE calling on OPEC to increase production to cool the market.

Biofuels: two sides to a coin.

The Renewable Fuel Standard (RFS), requires U.S. petroleum refiners to mix corn-based ethanol, soy-based diesel, and other biofuels in their fuel or to purchase credits from those that do.

In a recent letter Biofuel & Ag leaders asked the White House to provide relief at the pump by allowing the year-round sale of petrol mixed with up to 15 percent ethanol (E15): “Expanding the volume of American-made ethanol in the U.S. fuel supply can help alleviate these issues, as ethanol is currently priced 70-80 cents per gallon lower than gasoline.”

A bipartisan group of Senators called to ‘unleash clean American-made renewable fuels that are available right now’to replace Russian oil. “As gas prices hit record highs for Americans across the country, it’s never been clearer that energy security is national security” they said.

And Reuters reported that the Biden administration is studying whether lowering biofuel blending mandates could help lower prices of corn and soybean oil. Inflation, e.g. for food and energy, is a major political vulnerability for Jo Biden. Should he make more corn and soybeans (oil) available for food and meat production or for biofuels?

EU is importing considerable amounts of mineral diesel from Russia. If the supply stops it might be good to have some biodiesel on hand to compensate the shortage. Be careful with what you wish for.

India asked Indonesia to lower their biodiesel production and release more palm for food. The food for fuel discussion is back on the table.

§§§

Should you have any questions or queries, please reach out to AVENO

Always at your service.

Please contact AVENO for further inquiries.

Aveno's Monthly OILS & FATS bulletins:

All our monthly bulletins: https://www.aveno.be/search/label/monthly

Don't forget to check out our bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.