Beyond the battlefield and price…

Your Bi-weekly update on edible oils & fats by Aveno

March 28th 2022.

The war shakes up global agri-food supply chains.

The Russian-Ukrainian conflict pushed commodity prices, which were already on the rise, higher. Both countries are major suppliers of raw materials, ranging from seeds and fertilizers to animal feed and energy sources. Shipments from Black Sea ports stopped, which reduces the global availability of grain, sunflower- and rapeseed, hence the explosion of prices for the entire oilseed complex (oilseeds, oils and meal).

There are reports of deliberate attacks on Ukraine's agricultural infrastructure in order to create famine. For instance, the largest chicken farms are purposely targeted as well as Ukrainian food supplies and warehouses. This also means longer term global disruptions of food chains.

Due to a combination of bird flu in EU, the dissipation of the large Ukrainian chicken industry supply, and high chicken feed prices we now face a chronic lack of eggs for the food industry. COFCO, China’s largest food and agriculture state-owned company, invested millions in Mariupol, including in a sun seed processing plant, and all that got bombed. Russia mostly occupies the Eastern and Southern bordering zones of Ukraine, with many sun crushing facilities and bulk oil terminals.

Some try to use the (rail)road system to export grain, oilseeds and oil, to cash the high prices, but it remains a marginal and difficult exercise. Max capacity is estimated at 600.000 mt/month vs. a need of 5 million!

In Ukraine, outside the war zone where possible, spring fieldwork started and about 50% of the agricultural area is expected to be sown. Crops like summer wheat and corn should be sown in the coming weeks, as should soybeans and sunflowers. Seemingly there are stocks of seeds but fertilizers and diesel could be a problem in many locations. Also, suppliers grant no credit and want full payment in advance. If this succeeds, uncertainty remains on yields, harvesting and export logistics.

To help reduce the global food security risk EU came with a support package including derogations on “EU rules on set-aside land”, making it possible to cultivate about 4 million additional hectares. Temporarily food security is prioritized over e.g., “the objectives for nature restoration”.

After the first shock, the extent of disruptions is still unknown but repercussions from the war are being felt far beyond the battlefield and, as the war drags on, most probably for a long time.

Beyond price.

After the first panic buying wave, dust settled. Globally, high prices scared away the poorest. Many sellers withdrew from the market and gave no more quotes as, now, beyond price, sellers and purchasers worry more about availability.

It has become a sellers’ market where it seems that one can ask any price. Of course, asking is free and sellers must also be able to replace the sold goods and it’s better expensive and available than not for sale. However, this only works till expensive inputs leave no margin for the producers and consumers stop buying which is a starting point for stagflation and recession.

Some agro-food businesses already reduced production due to negative margins and buyers are more often not getting delivered because of products not being available. For years, society took for granted that supermarket shelves are always full of affordable foodstuffs. But reflecting on the supply chain it is “not obvious” that there is always a pack of flour, sugar, milk or a bottle of oil. Let alone bakery products, sauces, butter, frozen pizza, etc. Going forward we must all adapt to this new reality and work together on solutions.

MARKETS

Two weeks ago, butter was quoted at €6700/mt. Even though olive oil can only partially alleviate the shortage of sun oil, in Spain spill over strength made prices rally to a 10-month high. In aquafeed for salmon farms fish oil is often partially replaced by cheaper omega-3 rich rape and linseed oil but now poor availability and high prices of both plus lower fish oil production and stocks are supporting fish oil prices. Globally high prices have already led to demand destruction and this is likely to continue. Several countries see a declining per capita consumption of edible oils & fats.

In EU roughly 50% of meal used, as protein source, in compound feed is soybean meal, 25% is sun and 25% rape. Poor- and/or non-availability of non-genetically modified rapeseed and sunflower seed meals create a huge problem for the animal feed industry who can no longer produce ad libitum non-gm animal feed (and thus milk and meat…). It can be replaced by GMO-soybean meal. This situation helps support the soybean complex.

Soybean oil

The soybean market stays well supported by lower production estimates due to unfavorable weather conditions in South America. In Northern Brazil persisting wet weather is slowing down harvesting and affects negatively the quality of beans which need to be dried. All this contributes to delayed vessel loadings.

Iran dropped the ban on imported soybean oil as sun oil supplies dried up. Extra demand for soy oil and meal to replace lost supply in sun and rape support the complex.

Rapeseed oil

Fundamentally, prices remain supported by exhausted local seed supplies and unusually low seed imports. According to the EU Commission, cumulative imports since July 1st amount to abt. 3.8 Mmt, against 5 Mmt in the same period last year.

The run up of the entire edible oil markets in response to the war (which is also threatening the 2022 production), the shortages in sun oil and sun meal boosting demand for rape products and the fight between food and biodiesel producers for oil are causing a staggering and dangerous volatility.

In EU for the first time in its history, on March 23rd rapeseed futures passed the € 1,000/mt bar on the May contract. To drop later in the session and settle at € 969.25 last Friday. Crude rapeseed oil prices for April loading passed the €2,000/mt marker and the old/new crop inverse continues to widen, reflecting nearby tightness.

Palm oil

After touching historic highs beginning of March the market scared away buyers. The following price decline reflects hope for an increased supply through higher production later in the year and the fact that Indonesia cancelled the DMO (domestic market obligation) and so eased export restrictions. Nevertheless, concerns remain over tight global supplies, soybean crop losses, persistent labor shortages in Malaysia and the current low palm oil production season. During the upcoming Ramadan period production may as usually come under pressure but also buying activity may slow down.

Sunflower seed oil

There are no or few sellers and markets try to adapt to the sudden loss of sunflower oil supplies from UA, the largest producer of sun flower seeds and the leading exporter of sun oil. Exports via ports became impossible and about 20% of Ukraine's sun seed crushing capacity and 50% of Ukraine’s bulk oil shipping capacity is under Russian control. If Odessa falls in Russian hands that would mean 60% of the country's crushing capacity and 100% of the shipping capacity under Russian control.

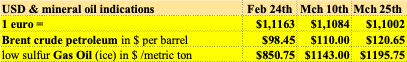

USD, mineral oil and biofuels.

The USD strengthens on interest rate hike announcements but raising the interest rate in small steps to 2%, while having 8% inflation, is hardly enough to fight inflation. But it can be enough to stop economic growth.

There was a report last week on the “FT Commodities Global Summit” where the world’s largest independent oil traders voiced concern over EU risking a ““systemic” deficit of diesel supply that could worsen and even lead to rationing of fuel”. EU mineral diesel stocks were already low before the start of the war and some 30% of EU diesel consumption is imported of which about half comes from Russia where petroleum refining has been scaled down.

With a barbaric invasion and a humanitarian crisis on our doorstep boycotting energy is no longer unthinkable. The U.S. and EU are discussing escalation options and a boycott of Russian petroleum and gas could further support energy prices and spark a recession in EU and/or a Russian regime change.

China, the biggest petroleum importer in the world, is still struggling with covid lockdowns that weigh on economic growth and thus their energy consumption.

On march 23rd, in a communication about “Safeguarding food security and reinforcing the resilience of food systems” the EU Commission wrote it “supports Member States in using possibilities to reduce the blending proportion of biofuels which could lead to a reduction of EU agricultural land used for production of biofuel feedstocks, thus easing pressure on the markets for food and feed commodities.”

The day after “the green lobby” called for a complete stop to the use of wheat, corn and vegetable oils for biofuels production. They said that rapeseed, palm, soy, and sunflower seed oils account for 78% of feedstocks used for EU biodiesel production.

In Malaysia the Ministry of Energy and Mineral Resources continues pushing for biodiesel production despite rising palm oil prices. And there are no signs that Indonesia is scaling back its biodiesel production.

§§§

For questions or queries, please reach out to AVENO

Aveno's Monthly OILS & FATS bulletins:

All our monthly bulletins: https://www.aveno.be/search/label/monthly

Don't forget to check out our bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.