Driving in the dark

Your Bi-weekly update on edible oils & fats by Aveno

April 22th 2022.

Trading

For centuries traders have brought commodities from places of abundance to places with shortages. Knowledge, insights and speed give traders a hedge and expanding populations with increased disposable incomes assure them that markets keep growing.

Although we still have some black boxes in our globalized economies (e.g., Chinese, animal fat, tall oil or used cooking oil statistics) it is fairly easy to identify the supply side of things. Of course, unpredictables like weather and politics can be a bummer. No artificial intelligence predicted the war in Ukraine nor the cold spell in the U.S. currently delaying corn plantings and the snow delaying spring rapeseed plantings in Canada.

More difficult to judge is the (evolution of the) demand side. We know high prices kill demand in price sensitive markets and today countries like Ethiopia, Egypt and India buy less sunflower seed oil. And it took a while to realize that the Hindi per capita consumption of 8 major vegetable oils (excluding butter, animal fat, fish oil, rice oil, sesame…) dropped from 16 kg in 18/19 to 14,8 kg in 21/22. And the population kept growing. We saw Malaysian crude palm oil exports drop due to high prices, and supermarkets in EU accepting formerly banned palm oil in their products to replace unavailable sun oil.

Supply and demand results in “ending stocks” at the end of the marketing year. Anticipating these end stocks is a major factor in price formation. Today it is difficult to assess the ending stocks amidst many uncertainties. For a couple of years our markets have been very tight and we may be balancing on the brink of a global recession or the feast may go on.

Many sellers don’t dare take a position nor do they want to give prices for sun, rape, palm… as they are not sure if they can perform. But in EU demand for food uses is still very good. Some are still convinced we are going to see lower prices in the second half of this year. Others will only believe when seeing.

It feels like driving in the dark to a bright future in the sun.

MARKETS

Soybean oil

Crushing of soybeans was recently more driven by increased oil demand to e.g., replace sun oil. Now demand for soybean meal picked up to replace the less available and more expensive lower-protein meals (rape/sun) and grain in animal feed formulations. This helps keeping a healthy margin for crushers.

In Brazil the current by drought reduced harvest is not yet completed but estimates range between 122 and 125Mmt vs. 139 last year. Argentina just started and there, estimates were revised upwards by 1Mmt.

Worldwide demand for soy products is expected to remain very good. Soybean prices stayed supported.

Rapeseed oil

Tightness on old crop is perfectly illustrated by MATIF futures pricing: on April 21st the May 22 ctr for SEED was at €1064.5/mt and new crop Aug 22 at € 855.25. May 23 at €811.50.

For next season 22/23 the global production of rapeseed is forecast at 71Mmt vs. 65 in 21/22.

But already trouble is in sight. After the drought last year, Canadian farmers can’t start spring field work due to a severe late winter offensive. Snow may take longer to melt after a storm left 20 cm on the Prairie last week and the weather forecast is for more of the same. Canada is the biggest rapeseed producer in the world!

Australia had good rains which are beneficial for their plantings but it is expected that the crop will be smaller than in 2021. India had a very good harvest.

Palm oil

Prices went down, then up and down again. Malaysian palm oil exports were reported down (-15%) in April compared to the same period in March.

Sunflower seed oil

Same story since weeks. Six-ports-market is not trading and with the war in Ukraine, shortages of sunflower oil are real. Panic prices came down because of demand destruction. Stocks and flows out of UA are managed by trains and trucks but limited due to unavailable or damaged logistic infrastructure.

Planting season is on and many wonder what farmers are able to get in the ground. Analysts estimate that next harvest can be between 50 and 60% of a normal year. If it can be harvested and stored, etc. is a question mark so for next year, given the context, nobody knows. Reports of workers on tractors with a bulletproof vest and helmet came our way but difficult to judge how widespread this is.

In France the federation of oilseed growers counts on 780,000 ha of sunflower in 2022, compared to 699,000 ha in 2021. The first sowings took place 2-3 weeks ago and farmers are right in the middle of the second wave. They also aim for 900,000 ha in 2023. But that increase cannot replace the losses in UA.

USD, mineral oil and biofuels.

Euro weakened on expectations of further widening interest difference between € and $!

Brent went over $108/barrel, driven by fewer supplies from Libya (losing more than 550,000 barrels/day due to protests), from Russia and a possible European ban on Russian oil.

On the other hand, the IMF and the World Bank lowered their forecasts for global economic growth. A recession risk in U.S. and subdued Chinese demand continue to worry the market as the world’s largest petroleum importer’s coronavirus-induced lockdowns hit manufacturing and global supply chains.

This week Germany announced phasing out Russian oil imports before end of the year. It is the first time a deadline on fully stopping Russian imports is given. Gas imports were projected to stop by 2024.

Mid-April the International Energy Agency (IEA) said that reductions in biofuels blending mandates could increase demand for petroleum products. This in a reaction to some EU countries considering a cut following price hikes for biofuels due to higher priced feedstock and fertilizers. (Finland cut its biofuels blending mandate from 19.5 to 12%! Croatia stopped penalties for not blending, Sweden…)

In Argentina, trucking is the main transport bringing crops from farms to river and sea ports. The shortage and rationing of fuel are seriously affecting logistics as well as field work. Truck owners went on strike for higher freight rates to offset rising fuel prices. The number of trucks arriving at ports then fell to nearly zero just in the middle of the soybean and corn harvest. After an agreement to increase freight prices the flow of trucks normalized and according to a logistics firm 4,295 trucks arrived at port terminals on Easter Monday!

Following the shortage of diesel in the country, the Camara Argentina de Biocombustibles, (CARBIO), proposed to expand the current mandatory 5% biodiesel blending to 20%, arguing they can supply the entire diesel deficit as there is enough soybean oil and production capacity to replace more than 1 Mmt of mineral diesel imports by a 100% ‘nationally made vegan diesel’. Only about 40% of the 4 Mmt biodiesel production capacity is actually being used.

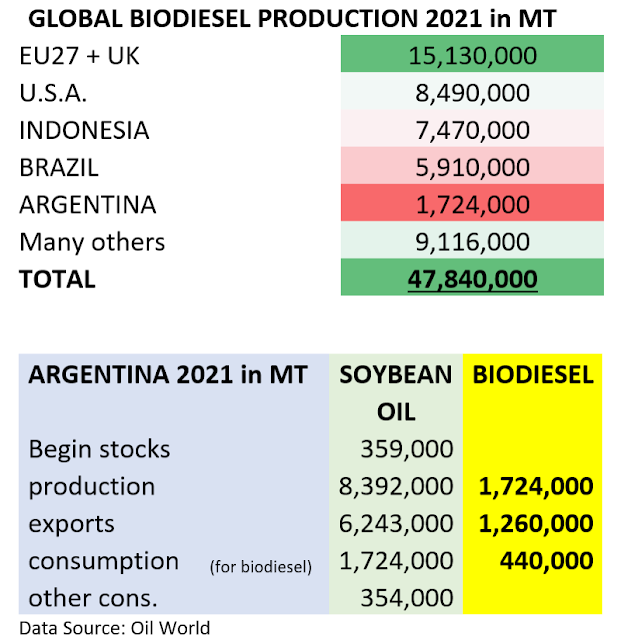

Out of 12.2Mmt of soybean oil globally used for biodiesel production in 2021, Argentina only accounted for 1.7Mmt of which only 440.000 mt were used locally. Argentina has a duty-free quota of 1.36 billion liters with a minimum set price (formula) to EU which they still try to fill.

The proposal probably won’t fly because the government controls prices and it is fighting inflation. It had already decreased mandatory blending from 10 to 5%. But all this shows the vulnerability of logistics, that biofuels can be a solution, but expensive and that the energy crisis and inflation are everywhere.

§§§

For questions or queries, please reach out to AVENO

Aveno's Monthly OILS & FATS bulletins:

All our monthly bulletins: https://www.aveno.be/search/label/monthly

Don't forget to check out our bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.