Weather, politics, high input prices.

Your Bi-weekly update on edible oils & fats by Aveno

April 8th 2022.

Have prices peaked?

The war in Ukraine, disturbing our markets, continues to dominate the news. It adds uncertainty to the availability of grain and oilseeds in already tight markets and points to fundamental food security problems, not to mention concerns regarding affordability of food, and points to our dependency on food, feed and fertilizer imports (Russia, China, the U.S. and Canada are the big fertilizer exporters).

As usual a problem never comes alone. Already in 2020, we had increased global food demand, led by China. Then followed several droughts. Higher energy prices increased the costs of fertilizer, transportation, and agricultural production. Over the past one-and-a-half-year vegetable oil prices rose 140% and in March palm and soy oil prices hit record levels. But it seems we may have peaked as high prices killed demand. Also, in Europe we see food businesses reduce or stop production due to high energy and raw material costs they can’t pass on to retailers/consumers. High prices killed biodiesel margins. China’s economic slowdown may decrease their food imports. So, under the lead op palm oil prices started to drop.

Assumption is the mother of all f*ups

Yet, the situation is far from normal and it is very unlikely that the situation normalizes soon. But there is nothing so optimistic as a human being in trouble.

There are many optimistic reports on spring plantings in Ukraine. Even the increased planting intentions of soybeans in the U.S. were perceived as a bit bearish. In EU expectations are for a major growth in oilseeds acreage (for next crops, after the current ones are harvested).

Very few question the global availability and affordability and application of the required fertilizers and its effect on yields. And all forecasts are made assuming average weather around the globe. Normalizing might take a while… and we might have to kick the anticipated price drop further down the road as we did before.

MARKETS

Soybean oil

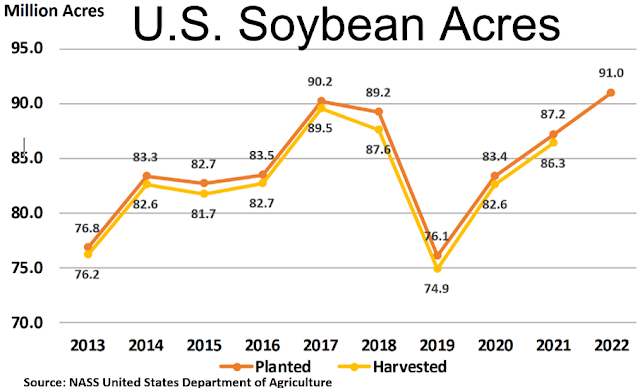

In the U.S. farmers are expected to plant more soybeans and less corn this season according to the USDA survey of March 31st. Intentions are to plant a record high 91.0 million acres of soybeans up 4% from last year.

The market perceived this as mildly bearish forgetting the huge losses in South America. It must be observed that in practice farmers don’t change much from year to year as they are bound by crop rotation. Cropping soybeans 2 years in a row on the same land differs little in yield but the third time yields may drop by as much as 7%. Weather can also influence plantings intentions till the last moment.

There is still discussion in the U.S. and Brazil about the use of soybean oil in biodiesel and demand in China is weakening. Around the world lots of sunflower seed oil has been replaced by soybean oil. In EU availability of refined oil remains poor.

Rapeseed oil

Old crop is sold out. Bad biodiesel margins may have released some quantities for the food markets but demand remains bigger than supply. EU still expects a larger crop than last year, but this won’t compensate the loss of rape and sun from Russia-Ukraine. Winter rapeseed acreage is at a 4-year high of 5.5 million ha and the mild winter has been good for the crop. This season seed production is expected to increase by over 1 Mmt to 18.1 Mmt. But EU new crop is available at the earliest in August, weather permitting.

Hopes are also on larger acreage for the spring sowings and good weather for the upcoming Canadian crop later this year.

Palm oil

High prices have reduced demand noticeably in the first quarter in India and China and other importing countries. Prices dropped from the record highs a few weeks ago and we are slowly nearing the seasonal production growth. Availability in EU remains challenging.

Sunflower seed oil

Easy to say that high prices killed demand when there are no offers and there is no real possibility to replace the imports from Ukraine.

There are reports of Russian oil shipped at discounts to “friendly nations” (India, China) and oil coming overland from Ukraine. Whatever volumes go into a market will alleviate the needs elsewhere as it changes trade flows.

In EU acreage for sunflower seeds is expected to increase given the high prices and the authorization to plant on set-aside land. But that is for next year’s harvest!

The upcoming crop in Ukraine, for harvest this autumn is uncertain despite all good news; something will be harvested and we hope a lot will be. But frankly speaking nobody knows.

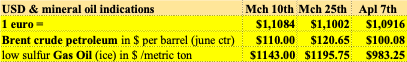

USD, mineral oil and biofuels.

COVID-19 outbreaks led to lockdowns in China’s (like Shanghai the most populous city of 26 million people!) and petroleum prices eased on fears that this will slow down economic growth and oil demand. Also, elsewhere high prices are killing demand and International Energy Agency members agreed to release 60 million barrels on top of an earlier 180-million-barrel release from strategic reserves announced by the U.S. to help cool prices.

High prices of edible oils discourage the further expansion of biodiesel production and global production estimates for this year have been revised downwards. Though Indonesia is seen stagnating at 7.5Mmt other countries are seen reducing their production. The food for fuel discussion is high on the agenda and it is a complex debate whereby all concerned parties throw in valuable arguments beside CO2 reductions: in some regions biofuels are cheaper than fossil fuels (taxations), biofuels generate valuable byproducts e.g. replacing grain in animal feed, biofuels replace imported fossil fuels, not to forget that all the investments in biofuels created a “fallback position” i.e. the huge stocks that can be brought back to food markets in case of need. If it were not for biofuels they would not have been produced. It is important to remember that the debate concerns not only all edible vegetable oils but also animal fats, used cooking oil, wheat, corn, sugar (very big for ethanol in Brazil), glycerin (e.g., for biogas in the grid), etc.

§§§

For questions or queries, please reach out to

AVENO

Aveno's Monthly OILS & FATS bulletins:

All our monthly bulletins: https://www.aveno.be/search/label/monthly

Don't forget to check out our bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.