Apocalypse now?

Your Bi-weekly update on edible oils & fats by AvenoMay 23th 2022.

The Ying.

In the final book of the Christian bible, the book of “Revelation”, the four horsemen of the apocalypse symbolize four disasters taking place before the end of times: deceit, war, famine and death.

The media often warn that war in Ukraine, global warming and logistic problems threaten the world with food insecurity. That the global food system is about to collapse and that rising food prices add to poverty, hunger, and political instability. Up to 20 million people could starve in the Horn of Africa which currently faces the worst drought in four decades. And much more.

Last week in an address to the Treasury Committee the Governor of the Bank of England, Andrew Bailey, talked of "apocalyptic consequences" as food inflation is a 'major worry' for the central bank, with particular concerns about wheat and cooking oil. And Andrew Crook, president of the National Federation of Fish Friers (NFFF) claimed that high frying oil prices may push 33% of UK’s +-10.000 fish and chip shops out of business in the next months. Besides the higher priced oil most of the fish comes from Russia…

Not only the BoE is alarmed. Iran had recent food riots and imports of oils and fats are down 1Mmt. Indonesia set an export ban on palm oil to lower domestic cooking oil prices. And there are other hidden cases bubbling under the surface such as Sri Lanka experiencing violent riots over unaffordable food and fuel. Moreover, rice farmers can’t afford fertilizers nor fuel for the field equipment, yields collapse and harvest will be so low that it won’t even cover the increasing labor cost. There, YoY food inflation is 50% and rising due to increasing logistical costs.

Also linked to food production are the UN’s World Meteorological Organization (WMO) findings that, in 2021, four key indicators for climate change were all higher than ever before: sea level rise, ocean temperatures, greenhouse gas emissions, and ocean acidification (due to absorption of +- 25% of human-emitted CO2 from the atmosphere).

And the Yang.

The Russians have weaponized food in their attempts to divide the rest of the world. Getting control over food and blocking Black Sea ports is an element in the battle and of geo-politics. They are even stealing UA grain and exporting it as their own.

Still, Ukraine is trying to produce all they can notwithstanding the war and the fact that they could face a massive shortage of storage because at the end of this season, oilseeds stocks might be at an all-time high of 21 Mmt and the FAO thinks that 25 Mmt of grain are still stuck in the country. It is there but not accessible! As UA ports are blocked, land routes through neighboring countries remain the only option. The G7 group of countries and EU are working to help UA maintain their exports. Expanding railroad capacity and more barging via the Donau are being explored.

And finally, some countries are expanding biodiesel production while others want to scale back. And in its “European Regional Obesity Report 2022” the World Health Organization said obesity rates reached an ‘epidemic level’ in EU after finding that 59% of the region’s adults are overweight.

All be it expensive, it seems there is still plenty of food around.

Would be wise to show more respect and give more support to all actors (from field to fork and also close to home) in the agri-food-supply-chain, those who help fill our bellies on a daily basis!

MARKETS

In 3 years, prices of soy, sun, rape and palm oil about tripled to all-time highs due to a combination of supply-limiting events and ongoing strong demand. Markets continue to be supported by tight balance sheets, serious adverse weather (delayed planting, drought, etc.), Black Sea export problems, export taxes/bans, etc.

In recent weeks prices eased, moving sideways and lower, due to a global price driven demand destruction. But values remain historically high. Apart from Indonesia lifting its palm oil export ban, (in place since April 28th) on the 23rd of May, there is little fundamental news.

The negative impact, from high prices, on consumption is mainly in food use markets in lower income countries. But consumption kept growing in Indonesia, Argentina, U.S. and EU following an increase in biodiesel production. In this uncertain supply and demand environment the near-term outlook for edible oils prices remains strong and volatile on the delusion of the day.

Soybean oil

The May 12th WASDE report revised world soybean ending stocks this year down 4.34 Mmt to 85.2 MMT, the lowest since the 2015/16 season. As the global supply of soybeans for this season remains tight, buyers are anxious for a record new U.S. soy crop.

In its first “official look at next season (oct 22-sept 23) “the USDA projected a 45 Mmt bean production increase from the current season to 395 Mmt. Some 39 Mmt of this increase will come from South America coming back from a drought year and with Brazil expanding its acreage. But this is months away in 2023! Global demand is forecast up 14 Mmt to 377 MMT, and global ending stocks are expected to grow by more than 14 Mmt.

This year the U.S. crop is expected to grow from 120.7 last year to 126.3 Mmt. But that crop is barely in the ground! Soybean oil demand from biodiesel producers is expected to be strong and Chinese demand for beans remains uncertain due to the uncertain state of the Chinese economy.

Rapeseed oil

New crop values of rapeseed and rape oil weakened on doubts about the EU biodiesel demand with Germany’s intention to lower the share of crop-based biodiesel from 2023 onwards and on Indonesia’s announcement of lifting its palm oil export ban.

In EU crop yields may have suffered from dry weather but rains now in most parts of EU might bring relief. In Canada weather related planting delays still cause concern. Cold and wet in some areas and dry in others. Wet weather is forecast for next weeks.

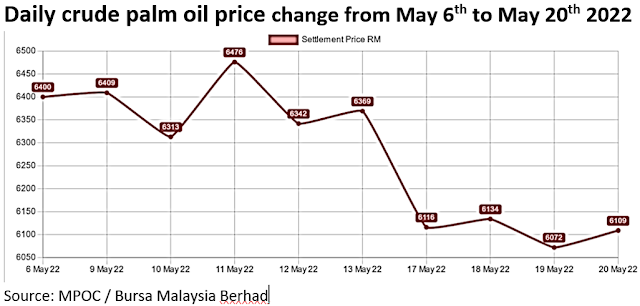

Palm oil

Indonesia lifted its export ban but still keeps a “domestic market obligation policy” in place to secure that enough affordable cooking oil stays in the country. During the period of the ban from April 28th to May 23rd Malaysia exported more and stocks went up in Indonesia. Stocks are now expected to grow faster as we are in the seasonal higher production months. But stocks at imports destinations are low which can lead to a nearby local supply squeeze. Lifting the ban is bearish and the DMO restrictions are bullish. And so shall it always well be something….

Sunflower seed oil

The shortage of sunflower seeds and sunflower seed oil will stay as long as UA production and exports stay disrupted by the war. The transition from old crop to new crop will be very challenging. Ukraine may be sitting on high stocks and elsewhere more acreage has been sown in but dry weather has been complicating things and logistics out of UA remain uncertain.

Laurics

Coconut oil prices have been under pressure by better supplies. ‘Oil World’ analysts revised this season’s global production up to 3.03Mmt. Palm kernel oil demand was down mainly in China but also in EU and U.S. Demand from oleochem industry is down with a slower Chinese economy and on weaker demand for “sanitary products”. Buyers show cautious buying behavior, staying nearby with more spot business than deferred.

USD, mineral oil and biofuels.

The depreciation of the euro is not helping EU purchasing managers. Since March, the euro lost about 5% against the USD and compared with a year ago, the € depreciated by more than 13%!

A weakening euro is favorable for eurozone exports and although the weak euro may not be the reason for high inflation, it is at least reinforcing it by making imported commodities and energy more expensive.

Higher interest rates will not bring commodity prices down but might strengthen the euro; a quick and efficient fix to ease inflation. The question then arises if central banks will succeed in bringing down inflation without causing a recession.

Or, in case of a recession, how hard will the fall be and how hard will global petroleum demand be hit? Bullish and bearish market forces pull mineral oil prices in both directions.

Concerns about a global economic slowdown, and even recession make market participants step out of risky assets (e.g., the massive sell-off in equities on Wall Street), including crude oil futures. On the bullish side, China announced a tentative reopening of Shanghai from June 1st. But confidence got shaken when a new Covid variant was found that might stop the easing of lockdowns.

§§§

For questions or queries, please reach out to

AVENO

Aveno's Monthly OILS & FATS bulletins:

All our monthly bulletins: https://www.aveno.be/search/label/monthly

Don't forget to check out our bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.