Two surprises

Your Bi-weekly update on edible oils & fats by Aveno

May 6th 2022.

Indonesia’s surprise move

Be it not on itself, the war in Ukraine greatly impacted global food prices, especially vegetable oils and grains. Expensive basic foodstuffs often lead to social unrest and more recently the International Monetary Fund (IMF), Global Food Crisis Network and the FAO all warned about food insecurity and the rising cost of fuel, particularly for the world’s most depraved.

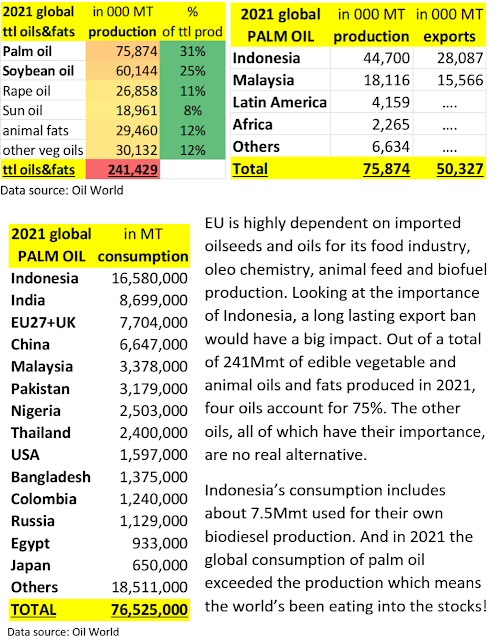

Strangely the world’s biggest palm oil producer has a shortage of affordable cooking oil for its people as export markets and the country’s biodiesel producers can afford to pay more. Therefore, the Indonesian President Widodo announced a temporary surprise ban on exports of palm oil starting on 28th April. This is not only for refined cooking oil but for ALL palm oil products. The goal of the ban is: an abundant availability of cooking oil at affordable prices!

Germany’s Green surprise move

Begin may EURACTIV reported that the Green Agriculture Minister Cem Özdemir and the Green Environment Minister Steffi Lemke are proposing to reduce the production of biofuels made from grain and oilseeds.

Uncertain outcomes

The market got carried away by both announcements and speculated over fundamental changes and side effects.

Indonesia exports nearly 30Mmt of palm oil products per year. Meaning that a total export ban retrieves 550.000 mt per week from the global market. That is huge and prices could soar to unseen highs, but didn’t (yet). Indonesia has no storage capacity and no local market for this volume. It could fill up all available tanks, use more cooking oil and make more biodiesel or even stop producing and leave the fruit bunches to rot in the plantations. But the export ban also cuts the export tax revenue used to subsidize its biodiesel production. The bets are on to how long it will take to guarantee every Indonesian household enough cheap cooking oil.

The German Greens want to use agricultural land for food instead of fuels. They did not comment on organic-cotton, linen from flax, bio-plastics from grain or sugar, environmentally friendly lubricants from rapeseed oil and the like for a sustainable green-economy.

For their proposal they need the support of others and it uncertain the transport minister (liberal FDP) would support this. Biofuels (3Mmt biodiesel and 1.2Mmt bioethanol) are good for about 6.5% of Germany’s annual fuel demand. At a time when Germany and EU want to ban Russian mineral oil imports the proposal would create extra hurdles.

MARKETS

Ongoing concerns about the state of the market.

The palm export ban came at a time when reduced vegetable oil supplies have driven global prices to record levels. Past droughts in South America and Canada decimated soybean and rapeseed crops. And when a big Ukrainian sunflower seed crop could have helped increase supplies, Russia invaded UA. The closure of Black Sea ports limited the supply and underlined the vulnerability of supply chains. All this means more tightness, nervousness and volatile prices at a high level.

For the first time all farmers of the world are simultaneously facing exceptionally high fertilizer and fuel prices and in some cases a lack of fertilizers. This adds an extra layer of uncertainty as no one can judge the ultimate impact on yields/crop development of future harvests.

Some weather scares are also developing. We had dry weather this year in South American, cold delaying plantings in North America, EU had 4 consecutive months of rain deficit and India and Pakistan are experiencing extreme hot weather. Too soon to panic but also too soon to relax.

Soybean oil

In the U.S. cold and wet weather further delayed plantings to the slowest planting rate ever experienced. Corn is just about 15% done vs. 45% in a normal year. If this continues some corn acreage might be switched to soybeans.

Also, soybean plantings had a slow start and even though only 8% is planted, compared to 22% last year around this time, international buyers already bought about 20% of the new U.S. soybean crop (USDA’s export sales forecast) as crushers wanted to lock in the crush margin and secure the physical supply.

Soybean oil got support from Indonesia’s palm oil ban. But soybeans suffered from uncertainty about exports to China due to a contraction of the Chinese pig sector and on concerns over Covid restrictions putting the brakes on the Chinese economy.

China’s production margins for pork remain negative, but pork prices are creeping up which is good news because it could make China buy more beans!

Rapeseed oil

Canadian plantings delayed by cold weather.

As a result of last summer’s drought Canadian rapeseed stocks are very low and farmers’ intentions to cut rapeseed plantings this spring by 7% vs. last year, are not helping to rebuild global stocks. According to the ‘Stats Canada survey’ farmers plan to sow more wheat and oats. In EU new crop prices fell back on Germany’s announcement to potentially drop biofuel mandates.

Palm oil

Markets were closed for most of the week (Malay + Indo) and generally waiting for the outcome of how the Indonesian ban will really impact supply. Malaysian exports for April fell about 15% from March.

Sunflower seed oil

Ukraine’s sunflower oil is finding creative alternative routes via truck and rail to Western Europe. But volumes are limited compared to bulk shipment. Shipments of dry bulk have been set up via Romanian and Bulgarian ports. There’s been one vessel of 70.000 mt of grain loaded in Constanta. Russia continues to bomb infrastructure such as railroads…

There are still positive stories about spring plantings but whether Ukrainian farmers can find enough of all they need remains uncertain. Most fertilizers and 70% of diesel used to come from Russia. On the positive side: if things normalize fast, whatever they can’t export now, they’ll keep, as long as it doesn’t get destroyed or stolen. The problem lays more in the future: are they going to be able to sow their crop and can they harvest and solve logistics problems?

More reports pop up about theft and looting by Russians. In the occupied southern Ukrainian city of Melitopol, 27 agricultural vehicles were stolen from a local John Deere dealership. the GPS trackers on the machines show the tractors and harvesters have been transported to Chechnya. Earlier Ukraine accused Russia of stealing grain on a large scale in occupied territory; some 1.5 Mmt would already have been shipped to Crimea or Russia….

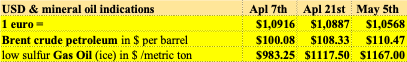

USD, mineral oil and biofuels.

§§§

For questions or queries, please reach out to AVENO

Aveno's Monthly OILS & FATS bulletins:

All our monthly bulletins: https://www.aveno.be/search/label/monthly

Don't forget to check out our bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.