Don’t gamble

Your Bi-weekly update on edible oils & fats by Aveno

June 17th 2022.

June 17th 2022.

Rationing demand.

Edible oils and fats prices got in a downward trend following good harvest projections for seed oils and if all forecasts become reality the global shortages of recent years could be turned around. But weather and geopolitical tensions may still spoil the game. Additional pressure came on Monday when Indonesia announced increasing its export pace of palm oil and lowering export taxes.

Lockdowns in China are often blamed for lower demand but more people are thinking the “lockdown-story” is only an excuse for a more serious economic setback in China. And fears of a global economic recession are much alive. Rising interest rates (decreasing the amount of money) may also pull (speculation)money out of (agri)commodities.

There are more bearish than bullish flags at the moment but the downward price trend is slowing down because of many remaining uncertainties such as weather and policies. Weather and political stupidity are things one shouldn’t gamble on. And although lower, global prices are still at demand-rationing-levels.

Lockdowns in China are often blamed for lower demand but more people are thinking the “lockdown-story” is only an excuse for a more serious economic setback in China. And fears of a global economic recession are much alive. Rising interest rates (decreasing the amount of money) may also pull (speculation)money out of (agri)commodities.

There are more bearish than bullish flags at the moment but the downward price trend is slowing down because of many remaining uncertainties such as weather and policies. Weather and political stupidity are things one shouldn’t gamble on. And although lower, global prices are still at demand-rationing-levels.

MARKETS

Soybean oil

Good prospects for the upcoming U.S. harvest (about 10% up from last year) are pushing soybean oil prices down, especially on deferred. Focus will be on weather developments in the growing months. On Wednesday CNBC reported: “Extreme heat and humidity killed thousands of cattle in Kansas in recent days” and on massive heat waves scorching the eastern and central U.S.A.

There was more talk about both Argentina and Brazil wanting to increase their biofuel mandates, which could support oil prices. And there were reports of China cancelling U.S. purchases. Concerns remain on the state of the Chinese economy.

Rapeseed oil

Projections for the oct22/sept23 season are a global rapeseed production of 73Mmt compared to only 65 in 21/22. But weather concerns remain for Canada where spring crops are one month late. Depending on the pace of an early harvest in EU, the transition from old to new crop may be smoother than anticipated earlier. Prices followed the trend of other oils and deferred positions are cheaper.

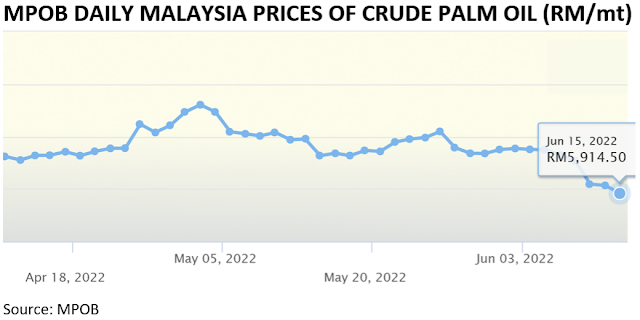

Palm oil

Palm oil prices slipped on increased supplies. Oil World Analysts forecast the oct22/sept23 global production above 80Mmt! Once this was expected to arrive sooner than later but the last two years this turned to be a faraway dream.

The Malaysian production outlook still suffers from a lack of foreign labor but Malaysian palm oil dropped to levels not seen since February, when Indonesia, the world's biggest producer and exporter, announced an export acceleration scheme and a decrease of export taxes to boost exports.

Sunflower seed oil

Uncertainty remains about the cultivated areas in Ukraine, the main exporter and there are concerns over a heat wave in southern EU. Still prices came down, especially on new crop and oil refiners are already well sold on the last quarter of this year.

Global seed production for season oct 22/sept 23 is expected to be about 6Mmt less than the current season but opening stocks of about 6Mmt compensate the production deficit. However, most of the stocks and production are in Ukraine and it still boils down to how much they can get out of the country.

So far, no agreement for an export corridor via the Black Sea has been worked out and large quantities from the last harvest remain in store. Overland transport improved but can only compensate a fraction of ocean transportation.

Ukraine’s railways have a different track gauge than most of the rest of EU, so trains cannot cross to Poland or Romania. They either have to unload and reload on different trains, or have their bogies swapped to fit the local tracks. And since the sea has always been the main route for exports the rail infrastructure to the west is underdeveloped and can’t cope with the sudden volume increase.

Animal fats

The global tallow production this season is also growing, mainly in China, Australia and the U.S., to 11.25 Mmt after two seasons of stagnation. Lard production is picking up in China. But there is a strong demand for animal fats, including lard, from the biodiesel industry. In 2021 about 3.2 Mmt of tallow went to biodiesel production in the U.S., EU and Singapore. The U.S. has been exporting less tallow due to the growing domestic demand. Notwithstanding lower palm prices, tallow prices are on the rise!

Fish oil prices also remain strong at $3300 levels FOB Peru. This is supportive to rapeseed and linseed oil prices as both are a partly substitute for fish oil in aquafeed (salmon industry). The Peruvian fish oil production is down due to imposed fishing bans to protect marine life.

USD, mineral oil and biofuels.

The Federal Reserve raised interest rates 0.75% and hinted that more is coming: another 0.75% in July and maybe 0.50% in September. The $ strengthened on the message that the FED is fighting inflation.

Many say this is far from enough and some claim that when inflation is above 5%, it can only fall back to 2% if interest rates are raised above the inflation level. Meaning that at the current inflation of 8.6%, the FED would have to raise interest rates to 9%.

If at the current rates the market is getting pessimistic such would mean the economy would be heading fast forward towards a recession…. And would inflation come under control? Time will tell.

Mineral oil prices were pressured by concerns over the impact of slower global economic growth on demand. Questions on China remain unanswered.

In their latest report the he U.S. Energy Information Administration (EIA) pointed to lower consumption and increasing global stocks amid a worsening economic outlook. The EIA thinks that petroleum demand will only reach pre-pandemic levels in 2023 and said that U.S. crude production rose to 12 million barrels/day, the highest level since April 2020.

§§§

For questions or queries, please reach out to

AVENO

Aveno's Monthly OILS & FATS bulletins:

All our monthly bulletins: https://www.aveno.be/search/label/monthly

Don't forget to check out our bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Sign-up for Aveno's newsletters:

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.