Bouncing bulls or diving bears?

Your Bi-weekly update on edible oils & fats by AvenoJuly 15th 2022.

Coming off the highs.

Recession fears which caused petroleum, stocks and currencies to tumble on financial markets spread to agricultural markets where in recent weeks prices went on an irregular but downward trend.Generally speaking, market themes remain unchanged: lockdowns in China that increase the probability of demand destruction, pushing prices lower; inflation and higher interest rates; the war in Ukraine, unpredictable Russian gas supplies to EU… all combined often leading to a sell off.

Before covid edible oils & fats prices were on an uptrend and we’ve seen two consecutive seasons with a higher global consumption than production. The past year markets were tight because of low overall inventory at the start, a poor Canadian rapeseed crop, more soybean oil use in the U.S., the war in Ukraine killing near 30% of global sunflower seed oil supply, labor shortages in Malaysia, drought related losses in South America and strong biodiesel production in some countries. So, we saw change in trade flows, shifts in usage, higher prices and ultimately price driven demand destruction.

It took a while for demand destruction to seep in the market. Countries like Iran, India, Middle East and northern African countries and even China consumed less oils and fats. This resulted in depleted stocks and pent-up demand and sustained prices.

In an uncertain economic environment and anticipating a growing production, even exceeding the projected consumption, prices trended lower -although still at historically high levels. Was the recent drop overdone? As always, probably yes! Is the downward trend broken? Maybe not. Prices may bounce back before diving or prices may bounce and stay up. A weather market may also spoil it.

China and biodiesel

Mixed signals came from China as the “mortgage boycott” problem surfaced: house buyers default on their loans because during the housing boom residential dwellings were sold long before completion and now many real estate developers don’t have the cash to complete the projects and banks already had problems with developers defaulting or asking their debtholders longer credit. This may jeopardize the stability of Chinese banks.A rise in Covid cases also caused more lockdown concerns. Some businesses are unable to reopen and port congestions keep building. The USDA reported on lower soybean imports this and next season and also oil imports were down. On the other hand, we hear of better margins for pork production and of a higher projected animal feed production (more soybean meal). China has depleted stocks, so need to watch closely what they do.

In some countries it is more rewarding to use edible oils & fats for energy purposes than for food: e.g., in Argentina there is a shortage of mineral diesel. And then there is the rapidly rising biodiesel production (soy, tallow, corn, palm...) in the U.S. where large mineral oil refiners have made supply deals with so called agro-giants. This season the U.S. uses 25.5Mmt of oils, 1 million more than last season on account of biodiesel production. Imports are 5.9Mmt vs. exports of 2.3Mmt. Exports will eventually drop to zero and imports may rise further; the capacity to produce is built.

MARKETS

Soybean oil

The last USDA report showed less production, less demand and higher ending stocks. Current hot weather in parts of the U.S. is cause for concern… weather market.Rapeseed oil

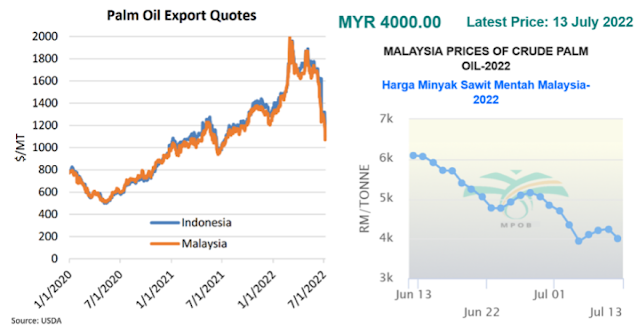

Crushers are in maintenance downtime or running other raw materials as the supply of rapeseed is bad. In 2-3 weeks, the market hopes for a maximum crush of the new crop of rapeseed.Palm oil

Ironically, since Indonesia set an export ban in order to lower domestic cooking oil prices, tanks are flowing over and authorities want to shortly increase the biodiesel blending mandate from B30 to B35 in order to reduce stocks… or adapt export taxes.Since the historical high of Malaysian Ringgit 8000/mt was hit begin march the Malaysian market lost 50% of its value to reach MYR 4000/mt mid-July, a level not seen since July last year.

Notwithstanding the recent price drop palm may not rebound until…? Buyers keep sidelining, dancing the Limbo, to see how low they can go before satisfying pent-up demand: price go unda limbo stick, all around the limbo clock. Hey, let's do the limbo rock!

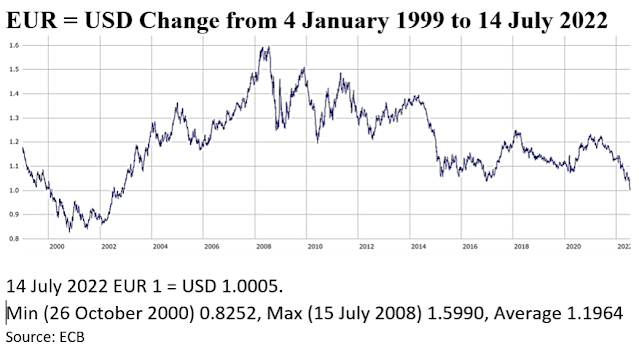

€ dropped to parity with the $ for the first time in 20 years. War in Ukraine, unpredictable gas supplies to EU and U.S. interest rates offering a higher return, make the $ a good safe haven. Basically, the Euro is pulled down by poor economic prospects in EU. Energy issues weigh on the economy making it harder for the ECB to tighten the money supply.

€ dropped to parity with the $ for the first time in 20 years. War in Ukraine, unpredictable gas supplies to EU and U.S. interest rates offering a higher return, make the $ a good safe haven. Basically, the Euro is pulled down by poor economic prospects in EU. Energy issues weigh on the economy making it harder for the ECB to tighten the money supply.

USD, mineral oil and biofuels.

Are the bears back?

§§§

For questions or queries, please reach out to

AVENO

Aveno's Monthly OILS & FATS bulletins:

All our monthly bulletins: https://www.aveno.be/search/label/monthly

Don't forget to check out our bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Sign-up for Aveno's newsletters:

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.