The stage is set

Your Bi-weekly update on edible oils & fats by Aveno

July 1th 2022.

July 1th 2022.

Markets increasingly in the grip of recession talks.

As recession and lower consumer confidence talks grip the market commodity buyers are sidelining, wait and see where we go from here. Depending on the oil and the location, our markets lost between 15 and 30% in the past weeks under the lead of palm.

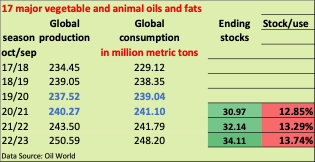

“Oil World” also published its new global forecast for production and consumption of edible oils and fats in season oct 2022- sept 2023, and weather permitting they see a 7 Mmt production increase and 6.4 Mmt more consumption vs. the current season.

The recent downward move may have been exaggerated and like a rollercoaster, what goes up rapidly can go down as fast or faster. But eventually the rollercoaster stops. There is still room for upward corrections in the 3rd quarter because of the tension between old crop scarcity and new crop bearishness: this month global stocks are at a multi-year low, except for palm oil. And prices are still high.

In the summer months we usually see volatile weather markets, especially for the U.S. bean crop. It is very unlikely that we see a straight line down; there still is a lot of buying interest and risk in the market. IF petroleum or more correctly gasoil prices soar above edible oils, it may trigger extra demand for energy uses.

Although higher shipping, trucking and processing costs are spoiling the fun, all in all it seems the stage is set to evolve to lower prices as the new crops come in, get processed and stocks build up!

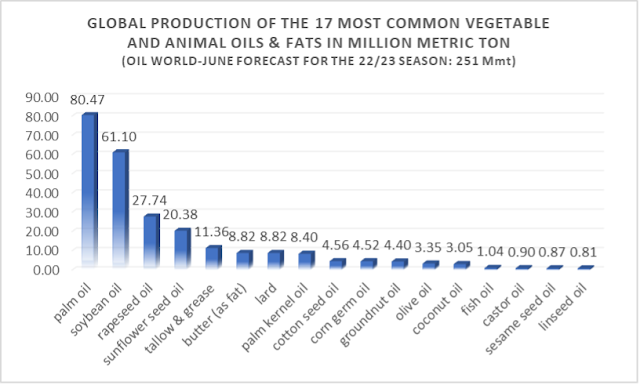

In the total global edible oil production palm accounts for 32% and soybean oil for 24%. The total 30 Mmt of animal fats are good for 12% which is more than rape or sun. Fish oil and the lesser oils are (relatively speaking) peanuts compared to e.g., groundnut oil and groundnut oil is peanuts compared to palm.

MARKETS

Soybean oil

Old crop is bullish and new crop is somewhat bearish but till it is harvested it will stay volatile in possibly stormy weather markets, although in the U.S. weather concerns have faded for the time being. Old crop tightness for oil is because soy oil has been replacing sun and rape earlier this season. Support also came from the Biden administration which is not discouraging the use of biofuels in the U.S. and from China which showed renewed appetite for beans.

Rapeseed oil

Global production of rapeseed is still optimistically seen upwards and in EU France started harvesting as well as Ukraine. After a price drop the seed market rebounded this week on higher palm prices and higher petroleum prices. The reluctance of the G7 to reduce biofuel production also supported the rapeseed oil market. In EU there is debate about biodiesel and any change in policy is directly felt in the market as about 6 Mmt or 60% of all rapeseed oil used in EU went to biodiesel in 2021.

In July at the end of the rape season, crushers usually take their annual maintenance downtime which reduces the volume of products put on the market.

Palm oil

With the seasonal production uptrend stocks are recovering. Stocks in Indonesia became burdensome and weigh on the market. Prices came down and later recovered some of the losses. The POGO (palm oil – gas oil) spread has been narrowing and expensive gasoil could still trigger energy demand for palm oil. Lots of (global) open demand!

Sunflower seed oil

Sun oil prices suffered from spillover weakness in other oils. But seed and oil supplies are still way below normal. However, the market was surprised by the volumes of sun seeds and crude sun oil coming over land to EU; much more than expected. Much business happened off the radar. Of course, vessel exports of seeds and oil to China, India and other countries completely vanished.

High-oleic sunflower seed oil in EU might stay more difficult than classic oil as there is not enough production in EU and it seems short in Ukraine.

USD, mineral oil and biofuels.

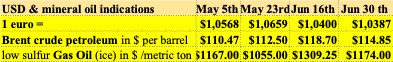

Weak EURO

A weakened euro stayed close to the 5-year low of mid-May and dollar demand grows as the energy crisis threatens the Eurozone economies ahead of winter, not to mention the diverging monetary policies of the ECB and the Fed.

Petroleum to hit $100 or $200?

Difficult to say which way it will go as the volatile market is torn between supply concerns and fears for a global recession driven by interest rate hikes to fight inflation. Some expect a weakening petroleum consumption with high prices killing demand. But supply is tight due to the war in Ukraine, production stops from Libya to Ecuador and (alleged?) production capacity constraints of OPEC’s main producers (Saudi’s and UAE).

During their recent meeting the world’s wealthiest nations, rejected a proposal to temporarily reduce biofuel production as a way to help curb food price inflation, as there are not enough affordable and reliable alternatives for fossil fuels. The G7 even called for more investments in gas/mineral oil production as underinvestment in oil and gas in the past years contributed to the current supply shortage. But to boost investments oil companies need stability and long-term consistency in policies. And high energy prices = recession.

§§§

For questions or queries, please reach out to

AVENO

Aveno's Monthly OILS & FATS bulletins:

All our monthly bulletins: https://www.aveno.be/search/label/monthly

Don't forget to check out our bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Sign-up for Aveno's newsletters:

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.