Indecisive bearish fundamentals

Your Bi-weekly update on edible oils & fats by Aveno

August 31st 2022.

Not yet able to choose a definite direction, most prices roughly and mostly moved sideways in recent weeks. Preliminary harvest figures and economic developments sent conflicting signals which need to be balanced.

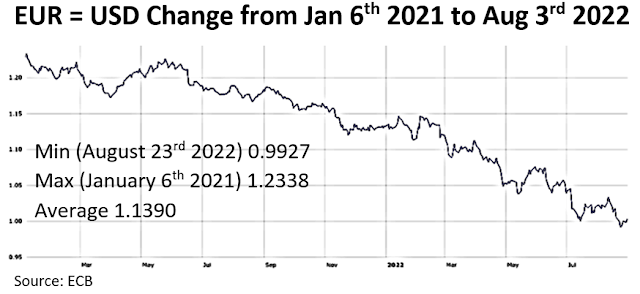

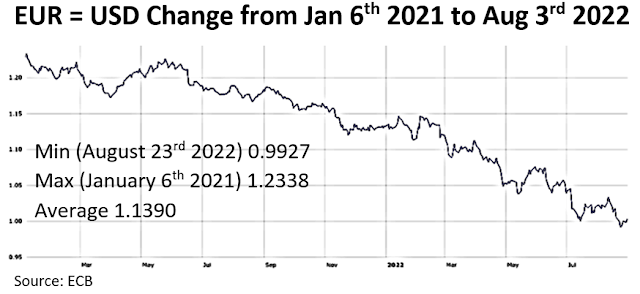

The market tries to adapt to bearish fundamentals of ample supplies in palm, rape, sun and soybean oil but so far, the floor hasn’t collapsed for several reasons. Some crops are yet to be made; weather scares; difficult logistics; uncertain global and regional economic outlook; unpredictable future evolution of EU energy prices; the € lost 20% of its value vs. the $ since January 2021; inflation; geo-political risks; availability and cost of fertilizers for future food production, etc.

To mitigate these risks, buyers, worldwide, are buying the dips and the cheaper oils to replenish empty stocks and build some buffer stocks. And yet still cautious not to overdo it as we are still on high ground.

During September the North American soybean harvest will start and go on till about November. The Canadian rapeseed harvest follows, palm oil production is about to peak, the EU sunflower seed harvest is just around the corner and the upward revised EU rapeseed crop should start reaching all processing plants. All of this will result in a lot of oilseeds/oil on the market.

In EU, a weak euro and high energy prices drive up the local prices of crude and refined edible oils as energy is a major cost factor in oilseed and oil processing.

Not only clothing will be more expensive. In the U.S. the crushing of cottonseed is expected to drop 10% next season and this supports prices of cottonseed oil. Hard to say how the global trade flows of cotton seed and oil will develop in the future. Later in the season countries like Turkey, Argentina and Australia might bring some relief by bringing extra oil to the market but that remains to be seen and a partial switch to other oils is probable.

China has been on the buying side and it is unclear how much damage was done to their oilseed crops by the floods in spring and the more recent drought. China imported less oil and stocks are low. They might be forced to import or consume less….

Lower prices attracted some buyers and in September, all eyes will be on production and stock growth since palm oil output is expected to rise further as plantations move into the peak production months. Top producer and exporter Indonesia extended a palm oil export levy waiver until Oct. 31st which was in place since mid-July. This indicates the need to export as production grows. The government also believes more palm oil biodiesel will be used this year following higher than expected domestic gasoil consumption in Q4.

The ECB has been reluctant to go along with the interest rate hikes announced by the U.S. last year, to curb inflation. This and the fact that the American economy is better off, caused capital flight and devalued the euro by roughly 20% vs. the dollar. As a result, EU imports from 3rd countries also turned about 20% more expensive.

A weak euro is good for exports but boosts imported inflation. Inflation was also helped by the huge amount of money printed by central banks.

For EU petroleum is 20% more expensive than for the U.S. due to our weak currency. Since EU decided to fill up the gas storage before winter “at any price” gas prices exploded. So did electricity prices which are based on gas prices regardless of the source and cost of production. Our gas prices are about 20 times higher than before the pandemic and 10 times more expensive than in the U.S.! The origin of the problem is that the EU infrastructure is not suited to import enough liquified gas by ships which amuses Mr. Putin very much.

Not yet able to choose a definite direction, most prices roughly and mostly moved sideways in recent weeks. Preliminary harvest figures and economic developments sent conflicting signals which need to be balanced.

The market tries to adapt to bearish fundamentals of ample supplies in palm, rape, sun and soybean oil but so far, the floor hasn’t collapsed for several reasons. Some crops are yet to be made; weather scares; difficult logistics; uncertain global and regional economic outlook; unpredictable future evolution of EU energy prices; the € lost 20% of its value vs. the $ since January 2021; inflation; geo-political risks; availability and cost of fertilizers for future food production, etc.

To mitigate these risks, buyers, worldwide, are buying the dips and the cheaper oils to replenish empty stocks and build some buffer stocks. And yet still cautious not to overdo it as we are still on high ground.

During September the North American soybean harvest will start and go on till about November. The Canadian rapeseed harvest follows, palm oil production is about to peak, the EU sunflower seed harvest is just around the corner and the upward revised EU rapeseed crop should start reaching all processing plants. All of this will result in a lot of oilseeds/oil on the market.

In EU, a weak euro and high energy prices drive up the local prices of crude and refined edible oils as energy is a major cost factor in oilseed and oil processing.

MARKETS

Olive oil

Global production is now forecast to drop 700.000 mt or about 20% vs. the oct 21- sept 22 season. European production is expected down 25% or 565.000 mt and already prices are on the rise. Higher prices might kill some demand and make consumers switch to e.g., sunflower seed oil. Or high prices might simply kill demand from households struggling to pay rising cost of living.Cottonseed oil

The price of cotton is expected to rise in the coming months due to extreme weather in growing regions. Worldwide prices rose 30%. Pakistan and India face declining harvests due to heavy rainfall, flooding and pests. In China, extreme heat is cause for concern for cotton growers and Brazil too has 30% lower yields as a result of drought, while in the US, drought is responsible for the smallest crop in more than a decade. The USDA says 43% of the acreage will go unharvested.Not only clothing will be more expensive. In the U.S. the crushing of cottonseed is expected to drop 10% next season and this supports prices of cottonseed oil. Hard to say how the global trade flows of cotton seed and oil will develop in the future. Later in the season countries like Turkey, Argentina and Australia might bring some relief by bringing extra oil to the market but that remains to be seen and a partial switch to other oils is probable.

Soybean oil

Monday, in Chicago soybean futures fell in anticipation of a large U.S. crop and favorable weather ahead of the harvest. The market’s attention will shift to South American plantings in September. The expected large South American crop could significantly pressure soybean prices further down.China has been on the buying side and it is unclear how much damage was done to their oilseed crops by the floods in spring and the more recent drought. China imported less oil and stocks are low. They might be forced to import or consume less….

Sunflower seed oil

EU-27 sunflowers were negatively impacted by heat and drought, causing probably a 600,000 mt drop in production to 9.5Mmt (main decreases in Romania, Hungary, Bulgaria). Ukrainian and Russian crops are much better off. Most still needs to be harvested. So far crush plants seem to have enough seed. But there is little buying interest for sun oil. Although bottlers are keen to replenish stocks.Rapeseed oil

Rapeseed production in EU is revised up by 0.9Mmt (main increases in Poland and France while Hungary declined by 200,000 mt). So, the rape complex trended lower on the better crop and seed availability in EU and the good crop and export prospects from Canada and Australia. With nearby tightness diminishing, the market inverse will fade out and prices on nearby will drop gradually.Palm oil

Lower prices attracted some buyers and in September, all eyes will be on production and stock growth since palm oil output is expected to rise further as plantations move into the peak production months. Top producer and exporter Indonesia extended a palm oil export levy waiver until Oct. 31st which was in place since mid-July. This indicates the need to export as production grows. The government also believes more palm oil biodiesel will be used this year following higher than expected domestic gasoil consumption in Q4.

USD, mineral oil and biofuels.

A weak euro is good for exports but boosts imported inflation. Inflation was also helped by the huge amount of money printed by central banks.

The European problem.

There’s a balancing act going on between short term tight petroleum supply and anticipation of a global long term looming recession. Fundamentally petroleum prices must fall on the darkened outlook for the global economy, on an eventual deal with Iran, lockdowns in China… but every time OPEC succeeds to talk the market up by announcing production cuts or by political turmoil somewhere like in Libya, Iraq… through it all, on average, Brent sticks around $100.For EU petroleum is 20% more expensive than for the U.S. due to our weak currency. Since EU decided to fill up the gas storage before winter “at any price” gas prices exploded. So did electricity prices which are based on gas prices regardless of the source and cost of production. Our gas prices are about 20 times higher than before the pandemic and 10 times more expensive than in the U.S.! The origin of the problem is that the EU infrastructure is not suited to import enough liquified gas by ships which amuses Mr. Putin very much.

§§§

For questions or queries, please reach out to

AVENO

Aveno's Monthly OILS & FATS bulletins:

All our monthly bulletins: https://www.aveno.be/search/label/monthly

Don't forget to check out our bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Sign-up for Aveno's newsletters:

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.