Lower but still expensive

Your Bi-weekly update on edible oils & fats by Aveno

August 12th 2022.

Slightly cheaper

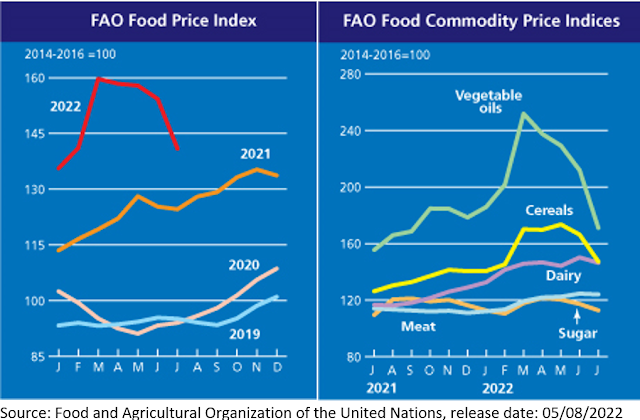

For the fifth month in a row, global food prices fell sharply in July. Particularly grains and edible oils became cheaper. The July FAO food index dropped 8.6% to 140.9 points. Vegetable oils dropped 19.2% and grains on average 11.5% of which wheat -14.5% (thanks to the agreement between Ukraine and Russia on grain exports). But compared to last year, everything is still a lot more expensive.Allegedly hedge funds and other speculators exited the agricultural commodities markets intensifying the price drop and making markets more focused on the basic concept of supply and demand, and less on sentiment. Agricultural productions and food supply

Chains, now and in the future, are still vulnerable to high fertilizer and energy prices, distorted international trade, the rising cost of raw materials and transport, recession or the impact of drought on fruit and vegetables, olive oil, potatoes, sugar beets, oilseed crops, livestock, etc.

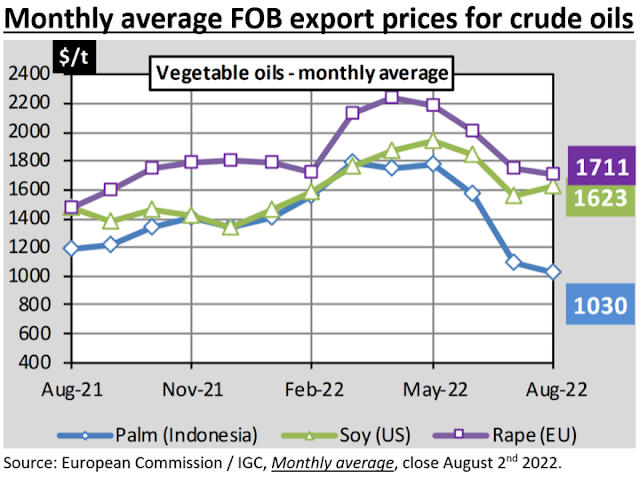

The FAO vegetable oil price index declined on falling world market prices for mainly palm, soybean, rapeseed and sunflower oil. Palm oil prices dropped on growing stocks in producing countries. Prices for soybean oil and rapeseed oil fell on weak demand and expectations of ample new crop supplies. And sunflower oil prices dropped due to weak global import demand, despite Black Sea logistical uncertainties. Lower petroleum prices also contributed to pressure down edible oil prices.

Nobody knows how long this significant price drop will last and what fundamental factors will prevail in the long run. We saw recent support for oils and fats prices on weather concerns and following Biden’s green spending bill, which could draw more edible oil to the U.S. biodiesel market.

In Germany many businesses located along the Rhine, the second longest river in EU, depend on it to ship and/or receive goods. Annually about 200Mmt of coal, chemicals, construction material, agricultural bulk commodities… are transported by Rhine barges. Due to low water levels, businesses are forced to scale back production and/or shutdown if barges can no longer ship the goods. Much oilseeds, oils and ingredients for animal feed are transported by these barges.

In EU we start the season with higher stocks of sunflower seed than usual as UA exported seeds to neighboring countries. But this year’s heatwave in EU will have a negative yield effect. In some parts of France, this summer, the sunflowers were partly charred by the heat. Other parts of France might do better. But on August 5th, the ministry of Agriculture said that if it is “too early” to judge on a national scale, the harvested tonnage will be similar to last year, despite a 20.6% increase in acreage. In the driest areas, harvest should start around August 15th, three weeks ahead of schedule. If the French crop is reduced this could impact high-oleic sun oil availability and price!

The EU harvest is done and winter rapeseed needs to be planted after the harvest but the hot and dry weather conditions for next plantings causes concern. It is still early and things can change but something to watch.

At the moment the biggest problem in EU is low water levels on the rivers affecting logistics. And last week there’s been a fire in a German rapeseed mill causing the mill to shut down for repairs.

Because of low water restrictions, especially on the Rhine:

And so, it is always something!

But fundamentals continue to hint bearishness due to rising stocks in both Malaysia and Indonesia. Indonesia the world’s largest exporter is still working to reduce growing stocks by boosting exports.

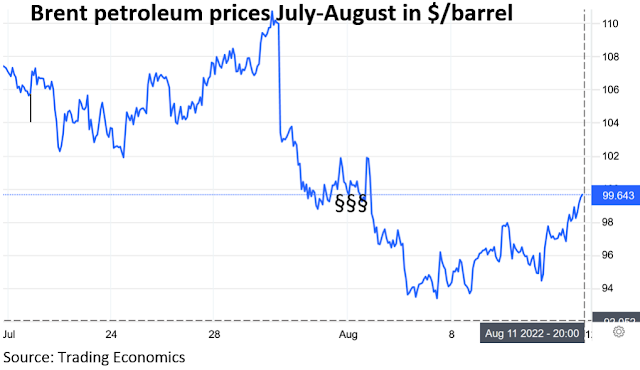

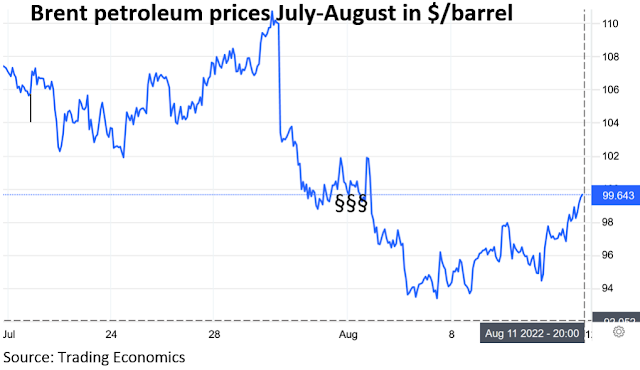

In the past fortnight Brent-petroleum dropped way below $100 on recession fears (resulting in dwindling demand). Also, higher stocks in the U.S. weighed on prices. But then came the International Energy Agency with a rising demand outlook for 2022, following a “gas-to-oil-switch” in some countries. And we are back at $100.

The FAO vegetable oil price index declined on falling world market prices for mainly palm, soybean, rapeseed and sunflower oil. Palm oil prices dropped on growing stocks in producing countries. Prices for soybean oil and rapeseed oil fell on weak demand and expectations of ample new crop supplies. And sunflower oil prices dropped due to weak global import demand, despite Black Sea logistical uncertainties. Lower petroleum prices also contributed to pressure down edible oil prices.

Nobody knows how long this significant price drop will last and what fundamental factors will prevail in the long run. We saw recent support for oils and fats prices on weather concerns and following Biden’s green spending bill, which could draw more edible oil to the U.S. biodiesel market.

Low Rhine level threatens German (edible oil) industry

On top of growing concerns about China's faltering economy and the spreading real estate crisis, markets coped with an added dose of geopolitical uncertainty (Taiwan, Ukraine) and trade tensions. And globally more and more consumers have less to spend due to high prices of food and energy. A situation leading to low economic expectations for businesses which postpone investments.In Germany many businesses located along the Rhine, the second longest river in EU, depend on it to ship and/or receive goods. Annually about 200Mmt of coal, chemicals, construction material, agricultural bulk commodities… are transported by Rhine barges. Due to low water levels, businesses are forced to scale back production and/or shutdown if barges can no longer ship the goods. Much oilseeds, oils and ingredients for animal feed are transported by these barges.

MARKETS

Olive oil

The situation did not improve since last report! On the contrary.Soybean oil

In the U.S., soybean products for nearby positions continued to support the whole complex as old-crop supplies dwindled ahead of next harvest and on estimations that 30% of the soybean acreage suffered some kind of drought stress. The yield impact remains to be seen but many turn cautiously bullish. In South America everyone is fighting to predict the biggest number for a record crop in 2023 but the future ‘s not ours to tell, que sera, sera.

Sunflower seed oil

The war in Ukraine blocked seaports and left at least 25Mmt of grain and oil seeds waiting to be shipped. Added to this is this year's harvest. The agreement of July 22nd allows ships to call on these ports again and sail with mainly grain. Storage space will then be available for the new harvests but UA will continue to rely on rail, inland shipping and road transport because to get rid of 25Mmt of the previous harvest, 1000 ships of 25,000 tons are needed!In EU we start the season with higher stocks of sunflower seed than usual as UA exported seeds to neighboring countries. But this year’s heatwave in EU will have a negative yield effect. In some parts of France, this summer, the sunflowers were partly charred by the heat. Other parts of France might do better. But on August 5th, the ministry of Agriculture said that if it is “too early” to judge on a national scale, the harvested tonnage will be similar to last year, despite a 20.6% increase in acreage. In the driest areas, harvest should start around August 15th, three weeks ahead of schedule. If the French crop is reduced this could impact high-oleic sun oil availability and price!

Butter

Butter prices eased in the past few weeks, but tend to firm somewhat again in Germany, Poland, and France. We are still way above last year’s price of €400 on august 22nd and there are concerns about milk shortages due to the drought and expensive animal feed concentrates, which often force farmers to reduce their livestock. Cows are mostly peaceful gras/roughage eating animals minding their own business but when weed and gras is gone, they may start eating rocks which is not good for them.

Rapeseed oil

So far rapeseed benefitted from favorable conditions in the key growing regions. Overall yields are surprisingly good. But old crop tightness spilled over in the new season in EU. And concerns over soybeans led to a rebound in the oilseed market. Rapeseed remained very volatile, fluctuating between €633 and €660/mt but without returning to its peak of €689.75 end July.The EU harvest is done and winter rapeseed needs to be planted after the harvest but the hot and dry weather conditions for next plantings causes concern. It is still early and things can change but something to watch.

At the moment the biggest problem in EU is low water levels on the rivers affecting logistics. And last week there’s been a fire in a German rapeseed mill causing the mill to shut down for repairs.

Because of low water restrictions, especially on the Rhine:

- The supply of oilseeds to some crushers is problematic

- The supply of rape meal to animal feed producers is also problematic and (if available) prices went through the roof

- But also, oil is not available and if available it can’t be shipped out

- Nobody knows when the mills will be able to run at capacity again, shipping out meal and oil

And so, it is always something!

Palm oil

Palm oil remains the most competitive oil. Some buyers (Iran, India, Nigeria and others) stepped in to replenish stocks. So, palm futures rose above the MYR 4,000/mt mark, not only supported by a more robust export demand but also by the firmness in soybean oil.But fundamentals continue to hint bearishness due to rising stocks in both Malaysia and Indonesia. Indonesia the world’s largest exporter is still working to reduce growing stocks by boosting exports.

USD, mineral oil and biofuels.

§§§

For questions or queries, please reach out to

AVENO

Aveno's Monthly OILS & FATS bulletins:

All our monthly bulletins: https://www.aveno.be/search/label/monthly

Don't forget to check out our bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats. You can find all previous updates on: https://www.aveno.be/search/label/bi-weekly

Sign-up for Aveno's newsletters:

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.