The ENSO index

Your Bi-weekly update on edible oils & fats by AvenoNovember 18th 2022.

La Niña and El Niño episodes

After extreme drought and bushfires in Australia a few years ago, the continent is experiencing extreme wetness and this cyclical weather pattern is bound to continue in the future. Much of this year's wetness comes from three La Niña waves producing excessive rain in the east of the continent. The longer it lasts, the bigger the impact. As the ground gets saturated frequent heavy rainfall causes flooding.Meanwhile, dry Argentina got some much-needed rain. The soybean crop forecast was already reduced due to drought and plantings are lagging behind. If things don’t change it will be hard to meet the current increased crop expectations. Neighboring regions of Brazil, China and India, however, had good planting conditions so far, while some of the Russian winter crops may not come up due to too much rain during planting. Malaysia and Indonesia too suffer from excessive rain.

All this erratic weather is not so uncommon: the El Niño/Southern Oscillation (ENSO) is a naturally occurring phenomenon in the Pacific which stems from deviations from normal sea surface temperatures. Since El Niño and La Niña are defined as deviations from "normal", the normal temperature has to be representative of the current climate. The weather disruptions they cause can vary in intensity and length.

A real-time status reporting of ENSO is important to trigger actions for water supply, food security, health, public safety, etc. and there are different ENSO-indexes in use. One of them is the MEI, which combines oceanic and atmospheric variables. It gives real-time indications of ENSO intensity, to follow the evolving conditions.

El Niño and fish oil

El Niño (Spanish for 'the Christ Child') events have been occurring for thousands of years and refer to warming waters in the Pacific Ocean. Normally currents coming from the south pole bring cold water loaded with nutrients for the fish towards Peru. But if the current changes and comes from Indonesia or the Philippines it brings warm water without nutrients and few fish. Usually around Christmas fishermen noticed the warming up. And the fish went looking elsewhere for food. Often El Nino leads to less catches and thus less fish oil production from this major fish oil producer.

El Niño recurs irregularly, from two years to a decade, and no two events are the same. They can disrupt normal weather patterns (change of wind patterns and intensity, drought, rains, etc.) regionally and globally.

When ocean waters cool below normal: La Niña often causes dry conditions in many parts of the world, including Argentina, southern Brazil and the U.S., and it may bring intensified wetness to other regions, such as Australia and parts of Asia. For 3 years we are experiencing an El Niña episode!

It is the length and the intensity (degrees of temperature deviation) of both La Nina and El Nino that influence our markets.

Bullish vs. Bearish

Besides weather uncertainties there has been a lot of speculation that China is to ease its disruptive Covid Zero policy by the end of year for the simple reason that the Chinese economy is receding and the government needs money. Economic recovery in China would lead to a surge in demand for petroleum, gas and other commodities. But the high coronavirus cases in major Chinese cities evaporated hopes for an early reopening of the economy.

Just before expiration of the wartime “Grain corridor deal”, in place since July, it was agreed to extend the deal 120 days which is good news for the supply of oilseeds.

Most fundamentals remain bearish but global consumption of edible oils & fats is seen growing by 9Mmt this season. Lower prices are helping and the fact that inventories need to be replenished (India, China, North Africa), but also policy driven demand (biofuels). Strength in vegetable oil prices in the U.S. is spilling over to other markets, limiting the downside and markets are expected to remain extremely volatile.

MARKETS

Soybean oil

Driven by a strong production growth of soybeans in Brazil, rapeseed in Canada and sunflower seed in Russia the worldwide supply of oilseeds may grow significantly this 2022/23 season. Production in Brazil and Argentina is expected to increase by 16% and 9% respectively. The U.S. soybean harvest is now complete and new crop South American beans will physically come to market as from February.

Argentina and southern Brazil had to cope with dryness but the rest of Brazil are OK and plantings are 75% done with good crop prospects (152-155Mmt? vs. 128MmT last season).

According to a recent USDA GAIN report, China the world's largest soybeans consumer, will use 116Mmt in 2022-23, up from 106Mmt the previous year. Chinese soybean production will near a record 19Mmt this season in a total oil seed production (including groundnuts, rape and cottonseed) estimated at 64.5Mmt. Government incentives for the production of oilseeds, high prices for oilseeds and good growing conditions resulted in an increase in acreage and yield. Meanwhile, Chinese soybean imports hit their lowest level since 2014 in October. Buyers reduced their purchases due to high world prices and low crush margins. There is potential to replenish stocks.

Demand for soybean oil in the U.S. is soaring and the high prices are spilling over to other oils too. In EU crush margins remain worse than crushing soft seeds.

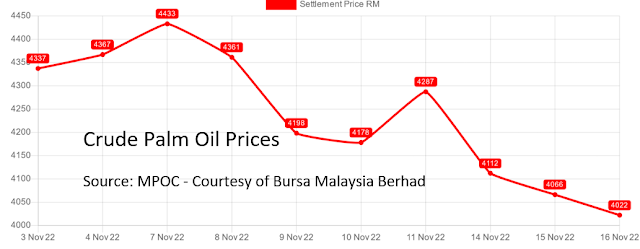

Palm oil

Indonesia and Malaysia experienced more rain than usual, and flooding in the major production areas. This already had a negative impact on the production and quality of the oil. Analyst think supply disruptions may continue into the first quarter of 2023, supporting prices on the short-term, because of tropical storms. The situation remains uncertain because of a chronic labor shortage in Malaysia, geopolitical tensions, etc. Weather models forecast La Niña will end after February and production will enter a new upward cycle after March. Positive is that all that rain may lead to higher palm oil production in the second and third quarters of 2023. Exports to China could rise as China is expected to gradually relax its zero-Covid policy (?), which has inhibited palm oil consumption. But also, India and other countries with low stocks are expected to replenish them. Palm oil prices are likely to trade in a range around 4,000 ringgit/mt till the end of the year.

Prices got support from higher priced other oils: a week ago U.S. tallow FOB Gulf (of Mexico) quoted at $1905/mt vs. RBD palm FOB Malaysia at $945/mt; crude soybean oil at $1788 FOB Gulf and $1406 FOB Argentina.

There are ample supplies of palm oil, stocks being reported at a three-year high, and one should be aware that when countries replenish stocks, this may merely lead to shifting stocks from producing countries to consuming countries (at least for a while). It is not for nothing that Indonesian authorities extended “export help” (zero xpt levy) till the end of the year.

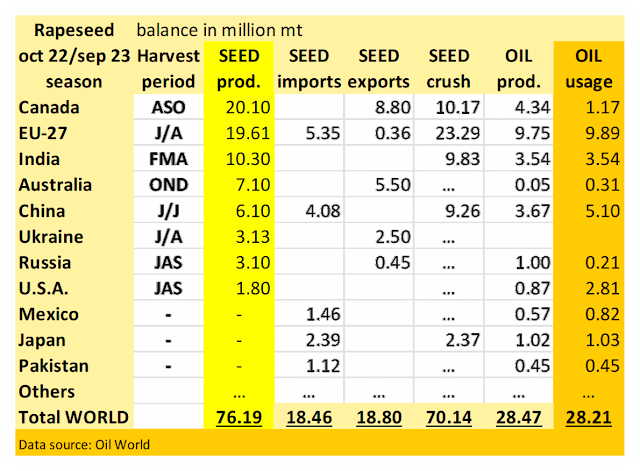

Rapeseed oil

Australia’s 2022/23 rapeseed crop might hit a record 6.75Mmt or 7 and some even see 8Mmt, despite recent floodings in the eastern growing regions. It seems the crop “withstood the wet conditions fairly well" and crop conditions in South and Western Australia are considered to be “very good” according to the Australian Oilseeds Federation (AOF) in their latest crop report.

Global rapeseed production this season is expected up 14% vs the 21/22 season so there should be ample supplies.

Sunflower seed oil

Russia and Ukraine are two of the world's largest producers and exporters of sunflower seeds and oil. The export of oilseeds after the grain corridor opened up eased the markets. When the deal was signed, the price of sunflower oil decreased from $1.590/mt to $1.250. However, the recent escalation in the war led to uncertainty as to whether the maritime corridor agreement would continue and the prices of all vegetable oils strengthened. Now the extension of the deal for 120 days will bring some relief.

But as the Russians are bombing the energy infrastructure the question arises if there will be enough electricity to run the export machinery. And if the Ukrainian crushers can function. This will depend on the degree of damage and if alternatives can be put in place. Many plants have their own electricity production or plan to install generators. Needless to say, this is a new challenge and time will show if more seed and less oil were exported or not.

USD, mineral oil and biofuels.

Fundamentals vs. money supply

The greenback lost some strength and the euro kept trading slightly above parity, but that is still 20% or so less than months ago. Food for thought: too much money chasing too few goods equals inflation. The central banks are tightening the money supply and as liquidity is contracting the price of commodities may drop even in a tight situation. Although, there is still a lot of money around….

As global petroleum production is under pressure, we could see petroleum prices go up sharply in the coming months. Investors were anticipating a world of declining petroleum demand, in line with climate change goals. The reality is that since the IEA laid out its roadmap for net-zero 2050, global consumption has only increased. Earlier, petroleum prices skyrocketed on rumors that China wanted to relax strict Covid rules. Then Brent crude futures drifted lower as rising COVID-19 cases in China weighed on sentiment. In the U.S. lower inventories of diesel drove prices to a record premium over gasoline and crude petroleum.

Aveno's Monthly OILS & FATS bulletins:

Don't forget to check out our bi-weekly updates!

Sign-up for Aveno's newsletters:

Sign up formDisclaimer