Your Bi-weekly update on edible oils & fats by Aveno

December 19th 2022.

December 19th 2022.

“Alea jacta est!”

...said Julius Caesar when he crossed the Rubicon River with his army in 49 BC. It means “the die is cast”, there is no turning back. On the verge of a new year full of new adventures it’s also applicable to us: we can’t rewind the past and life must be lived forwards. Caesar couldn’t predict if he would win the civil war against Pompeius and we don’t know what hurdles will pop up during our 2023 journey but we’ll all have to manage.

What graphs tell us

Doctor Aveno always says graphs tell us where a market has been, not where it is going. Nevertheless, it may give indications of a developing trend and long term they help us put things in perspective: compared to last week it might be cheap but compared to 3 years ago years it might be bloody expensive. They also show past and present volatility.The past months we’ve seen a lot of volatility, peaks and markets trying to hold on to higher ground. Today, prices for fish oil, groundnut oil, olive oil and animal fat are holding on, if not setting new records! Also, soybean oil prices managed to hold on somewhat. Palm and soft seed oils clearly relaxed.

We see changing trade patterns. Driven by an increasing demand for biodiesel. After India, China and EU, the U.S. is fast becoming the 4th largest net importer of oils and fats. This season (22/23) Oil World forecasts a higher global production (252Mmt) of the 17 most common oils and fats but also a global increase of consumption by 10Mmt to 252Mmt! Not in the least on growing global biodiesel production and on more imports from China.

In EU a preliminary agreement on a new “deforestation-free products law” was reached. The law covers palm oil, cattle, soybeans, coffee, cocoa, timber, rubber, beef, furniture, chocolate, printed paper and certain palm oil derivatives.

Importers are to check and publish a 'due diligence' statement that goods placed on the market didn’t lead to deforestation and forest degradation anywhere in the world after December 2020 and check compliance with the relevant legislation of the producing country including respect of human rights and the rights of indigenous people.

AVEC, representing the European poultry sector, already said the law contains a major flaw with regard to imported poultry meat as soy is being targeted and not chickens fed with it. So, at the detriment of EU producers, consumers will still be able to buy poultry meat that contributed to deforestation. It is still unclear how the law will affect prices and trade flows but traders and importers have a new risk to manage. Sanctions for non-compliance are meant to be dissuasive.

Stimulating economic growth is a top priority again, but it would be wrong to think that China is now letting go all the reins. Some strict measures remain in place and the unpredictable government still lacks a clear exit strategy from the pandemic. It remains to be seen how the health situation evolves when people start travelling and partying. Health experts expect a tsunami of (mutating)virus over the country. This is why observers remain cautious.

Additionally, Chinese New Year, for the Year of the Rabbit, is on January 22nd. Celebrations last up to 16 days of which only the 7 first are public holidays (Jan. 22-29) culminating on February 5th with the Lantern Festival. Xīnnián kuàilè!

New deforestation law

Debatable for some, but it is said that ¾ of deforestation comes from agriculture: beef production is responsible for 41%, palm oil and soybeans for 18% and logging for paper and wood in the tropics for 13%.In EU a preliminary agreement on a new “deforestation-free products law” was reached. The law covers palm oil, cattle, soybeans, coffee, cocoa, timber, rubber, beef, furniture, chocolate, printed paper and certain palm oil derivatives.

Importers are to check and publish a 'due diligence' statement that goods placed on the market didn’t lead to deforestation and forest degradation anywhere in the world after December 2020 and check compliance with the relevant legislation of the producing country including respect of human rights and the rights of indigenous people.

AVEC, representing the European poultry sector, already said the law contains a major flaw with regard to imported poultry meat as soy is being targeted and not chickens fed with it. So, at the detriment of EU producers, consumers will still be able to buy poultry meat that contributed to deforestation. It is still unclear how the law will affect prices and trade flows but traders and importers have a new risk to manage. Sanctions for non-compliance are meant to be dissuasive.

China again. Would you believe it?

In China new measures de facto mean the end of the long-used zero-covid strategy when entire city blocks and neighborhoods were cut off from the outside world. Covid is now being dismissed as a mild flu. This is raising the demand outlook for cooking oil in hotels and restaurants as more people travel and eat out. With 1.4 billion people on the move, just think about the number of Chinese flights which had dropped to 2,800/day from the daily normal of 14,000; that represents a lot of jet fuel!Stimulating economic growth is a top priority again, but it would be wrong to think that China is now letting go all the reins. Some strict measures remain in place and the unpredictable government still lacks a clear exit strategy from the pandemic. It remains to be seen how the health situation evolves when people start travelling and partying. Health experts expect a tsunami of (mutating)virus over the country. This is why observers remain cautious.

Additionally, Chinese New Year, for the Year of the Rabbit, is on January 22nd. Celebrations last up to 16 days of which only the 7 first are public holidays (Jan. 22-29) culminating on February 5th with the Lantern Festival. Xīnnián kuàilè!

MARKETS

Things to watch: implementation of the biodiesel mandates (including the production of aviation fuel) in the U.S., Brazil, Indonesia, EU…, Covid in China and Chinese vegetable oil imports, Mississippi River water levels, South American soybean crop evolution and La Niña’s wet weather in South East Asia and drought in the America’s.

Soybean oil

Around the globe La Nina is monitored on anticipation of the South American harvest at the end of the first quarter. For Brazil a record crop is in the making. But Argentina, the 3rd bean producer after Brazil and the U.S., is suffering from drought considered to be the worst in at least 20 years if not 50! Only 30-40% has just been sown and speculation on yield losses, ranging from 1 to 6Mmt, has begun. Recent rains in South America dragged the entire oilseed complex down but this won’t save the crop. Much more is needed and there is still a long way to go. Despite forecasted losses, thanks to Brazil the global supply still looks much OK!

Palm oil

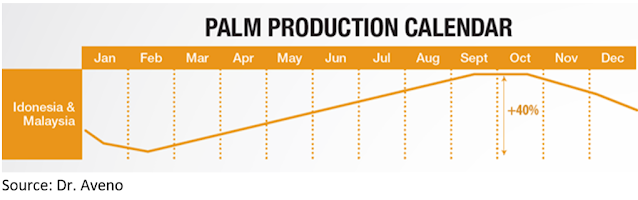

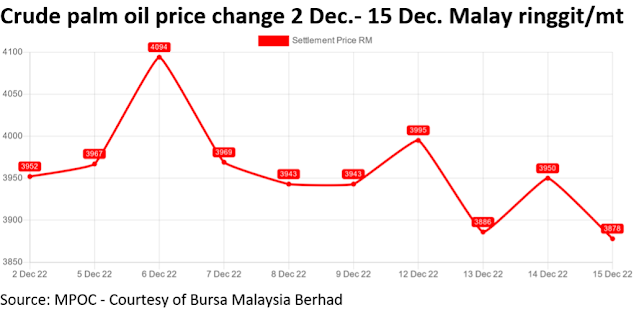

Heavy rains and floods hamper harvesting and logistics in Southeast Asia, emphasizing and enlarging the normal seasonal palm oil production slowdown. Palm oil stayed volatile in a range around 4000 ringgit and may find support at current levels through early 2023, as heavy rains are expected to last through January. Palm is trading at attractive levels vs. soybean and rapeseed oil but supply issues will continue as heavy monsoon rains are expected to hit the region in the coming weeks.

Support may also come from a potential recovery of other vegetable oils and the energy markets. And from a drop in production plus plans in Indonesia, the world's largest palm oil producer, to increase biodiesel blending from B30 to B35, starting January. The industry also estimates that Indonesia's palm oil stock declined from its recent peak to more comfortable levels.

Rapeseed oil

The market is stuck between reluctant sellers and well covered buyers and is struggling with a lack of news to revive trade. With ample supplies on the nearby positions and poor demand, stocks weigh on the market which turned into a carry! One swing factor though could be China. China has been taking a lot of rapeseed oil from Russia and may be keen to buy European oil!Sunflower seed oil

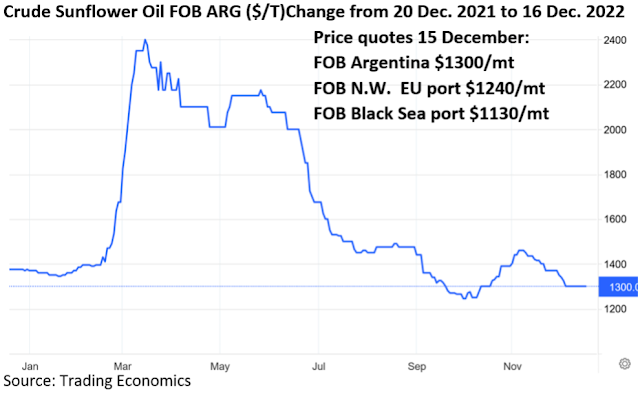

Sunflower oil prices dropped, following a period of higher prices in October. Ukraine continued to surprise with good exports of sun oil in November and also stepped-up exports of oilseeds (sun, rape, soy) on top of old crop (sun)stocks in EU. Ukraine also developed more alternative export routes, outside seaports, for oilseeds and moved part of the crush of sun seeds to Bulgaria and Romania.The market is unusually well covered as in response to the Russian invasion the market panicked and in order to secure their pipeline procurement managers covered long term at high prices sun oil or alternatives. This still needs to be sweated out of the market and is just a matter of time. Of course, cheap palm oil will keep pressuring sun oil prices too.

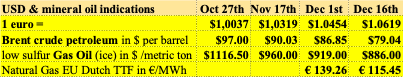

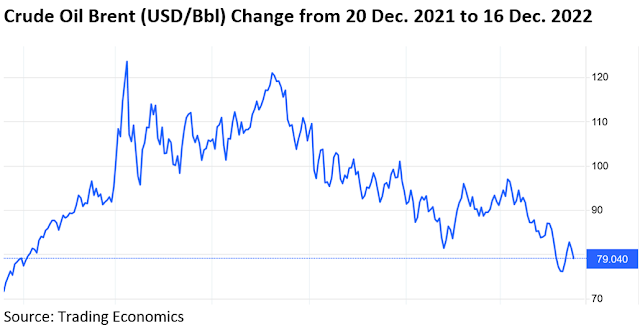

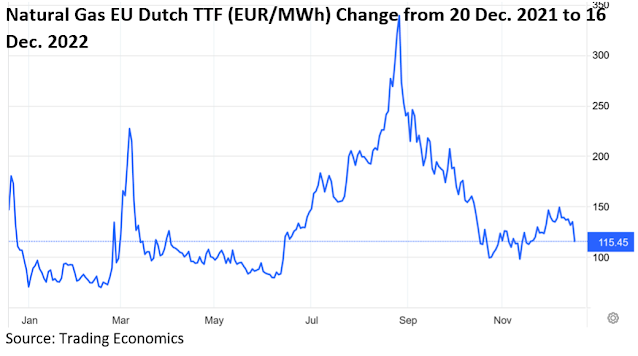

USD, mineral oil and biofuels.

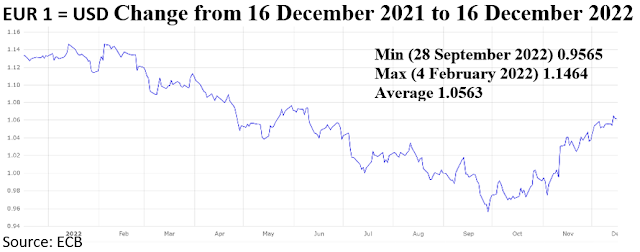

Will higher interest rates or a recession tame inflation? Or both? Central Banks are balancing between lowering inflation and avoiding recession. The € regained strength on higher interest rates.

Where will it all come from?

The U.S., EU, Brazil and Indonesia are driving most of the growth in biodiesel/renewable diesel production and consumption.In the U.S. the Renewable Fuel Standard, National Low Carbon Fuel Standards and IRA tax credits are driving demand for renewable diesel and Sustainable Aviation Fuel (SAF). In EU, consumption is increasing, but the Union is phasing out the use of palm oil and imposed limits on other raw materials, which stimulates the use waste, residues and rapeseed oil.

Fuels made from “waste and residues” are in high demand as they are of low Carbon Intensity (CI) and meet GHG and feedstock policy goals in the U.S. and EU but demand reached the supply limits of most used wastes and residues like UCO (used cooking oil) and animal fats. Additional requirements must come from domestic production of e.g., soybean, rapeseed and corn oil.

Recently the International Energy Agency voiced concerns over a feedstock shortage between 2022 and 2027 if current trends stay unchanged. The demand for vegetable oils, “waste and residual oils and fats” is forecast to increase 56% to 80Mmt.

Ho, HO, HO! And a very merry Christmas to you too!

§§§

For questions or queries, please reach out to

AVENO

Don't forget to check out our previous bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats.

You can find all previous updates here

Newsletter sign-up

Sign-up here to receive our Biweekly directly into your inbox.

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.