Back to work.

Your Bi-weekly update on edible oils & fats by AvenoBi weekly dd January 30th 2023.

Except maybe for biodiesel speculations, the market is lacking fresh fundamental news to trade on. After the Chinese New Year celebrations, culminating on February 5th with the Lantern Festival, the global economy is expected to pick up. Until a decade ago, Chinese economy grew about 10% per year, but slowed down considerably. Economic activity is bound to pick up when everyone returns to the workplace and as China is a planned economy, where the government decides, it is expected that the central bank will help the economy by expanding the money supply. This is possible as Chinese inflation remains below the official target of 3%. Boosting exports, with a weakening currency, is also a way to revive the economy.

During January, at many New Year parties, stories and hopes were shared like the drop in energy prices which is bound to cut the costs crushing and refining. Or the story over the sale of bottled oils in EU supermarkets being poor because households, at the time when the war broke out and the shelves were almost empty and the prices high, bought more than they needed and they still have stocks. And there’s been speculation on global economic growth or a further downgrade contradicting a widespread optimism this year.

Prices of food ingredients, transport and energy are down, but remain higher than before the pandemic. The food industry faces double-digit rising input costs compared to last year. Commodities contributed to inflation but it was more a lot of money chasing too few goods. As such, agricultural commodities do not cause inflation. Prices respond to supply and demand. Higher prices may occur in a low inflation environment and vice versa. Let’s hope we get low inflation with lower commodity prices, because of a good supply.

MARKETS

Rains or lack of rain in South America has been the main factor impacting our markets. And we saw odd things recently like crude palm kernel oil having the same price as crude palm oil c.i.f. Rotterdam (without import duties). We saw EU IP soybean oil being quoted lower than GMO soybean oil. Soybean oil in the U.S. and rapeseed oil in Canada continue to be supported at high levels by North American biodiesel/HVO demand forecasts. And in EU we saw rapeseed oil pressured down by the German plan to phase out crop-based biofuels. Ample stocks of sunflower seed oil weigh on prices of classic and high-oleic sun oil. So, the sentiment remains a bit negative but it is normal that at the beginning of the year in EU food offtake is slow till end Feb. The 14th is Saint Valentine celebration, let the sunshine in your heart.

Soybean oil

According to the “Bolsa de Cereales de Buenos Aires” sowing was 98.8% done on the 16.2MHa planned for sowing in Argentina. Heavy rainfall over the past two weeks has partially reduced the impact of drought. And more is expected. Markets reacted with lower soybean prices although some analysts think the rains will stabilize the state of the crop, but will not be able to make it much better.The ultimate impact of the weather will be seen in February and March, when Brazil completes its harvest andArgentina starts harvesting its beans. The market is also awaiting what the policy for biofuels will be in Brazil April onwards; if the blending will go to 15% or not. The low crushing volumes in EU and Argentina have been supportive to oil prices. Last week’s crude soybean oil prices:

- $ 1450 FOB Gulf of Mexico

- $ 1307 FOB Dutch mill

- $ 1142 FOB Arg + Braz.

Palm oil

The Indonesian government had postponed the start of the B35 obligation till February but the plan is still on. Exports from producing countries were disappointing because of big stocks in India and no buying interest from China. But, at one point in time, when global demand picks up, palm will capture more market share as it is abundant and the cheapest choice. Stocks in origins have normalized at a lower level but with poor exports and poor buying interest. The downside is however limited and futures are expected to continue trending sideways in a range around 4000MYR but last 2 weeks stayed south of 4000.

Rapeseed oil

The market is still trying to sort out the real impact of the proposal in Germany to phase out, in stages, the use of edible oils as feedstock in German biodiesel by 2030. Cuts would start next year. But in an environment with ample supplies, it’s been more a psychological blow than anything else as it is still being debated. Without additional demand and with a record harvest in Australia this puts additional pressure on prices in the short term.The ample supplies with steady seed imports from Australia and Canada led to a general weakness in the seed market, resulting in an increased net short position of Euronext participants. FDM rapeseed oil market feels weakish as well with little biodiesel interests, poor food order flow, rival oils under pressure and many EU food customers running behind on contractual obligations.

In EU oil demand is set to increase when PME (palm methyl esters) is further phased out in several member-states and with SME (soy methyl esters) being too expensive. We can still get a late winter cold spell but spring is just around the corner and when the sun begins to shine and the BBQ season begins… sales of sauces rise!

Sunflower seed oil

Black Sea oil has been trading much lower than 6 ports because of the cost and risk to get the oil to EU refiners but the spread is becoming smaller. The trade flow is settling in new patterns like more crush in Romania and Bulgaria (of Ukraine seed) but also Turkey has become a more important place for handling and trading sunflower seed and oil.Sentiment remains weakish in EU with a limited food order flow, running behind on contracts and competition from other oils that are also looking for spot demand. The market structure is in a carry indicating stocks are weighing on the market on nearby, pushing prices down.

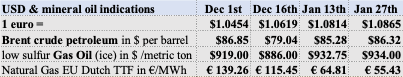

USD, mineral oil and biofuels.

The € sems to be heading for $1.10 as the ECB is expected to continue its more aggressive monetary policy tightening and raise interest rates by 50bps in both February and March while the FED is expected to slow down the pace of tightening.

With high gas inventories for this time of year (storage 75% full) in EU, natural gas prices continued trending lower but are still 12 times higher than in mid-2020. The world LNG market is 400Mmt and if EU wants to replace 100Mmt of Russian pipeline-gas by liquified natural gas, 25% of the world market, which normally went elsewhere, must be diverted to EU. Till now EU sourced only half or 50Mmt of its LNG needs. The market is to remain tight as supply is limited and new production in the U.S. and Qatar will only hit the market in 2025-26. With equal supplies and increasing demand, prices go up!

The EU embargo on Russian crude petroleum came into effect Dec 5th and the embargo on petroleum products goes into effect on Feb. 5th. The IEA sees rough competition ahead for non-Russian diesel but net importer EU starts the post-Russian diesel period with high stocks. Diesel supply issues may develop April onwards.

The EU embargo on Russian crude petroleum came into effect Dec 5th and the embargo on petroleum products goes into effect on Feb. 5th. The IEA sees rough competition ahead for non-Russian diesel but net importer EU starts the post-Russian diesel period with high stocks. Diesel supply issues may develop April onwards.

Biodiesel

A recent study voices Argentina’s concern over the growing consumption of HVO in the U.S. which is expected to grow significantly in the years to come. An expansion of crushing capacities and the construction of new plants in North America to produce the soybean oil for the production of HVO, will result in more soybean meal production. This additional supply competes with Argentina's meal exports and weighs on global meal prices.

The German Environment Minister Steffi Lemke proposed to end the production of plant-based biofuels in stages by 2030 and to grow the use of biofuels produced from waste and used edible oil. In addition to oilseed crops, also corn, wheat and sugar used for ethanol are targeted. Germany's greenhouse gas reduction program includes the blending of fossil diesel and gasoline with biodiesel and bioethanol, made respectively from edible vegetable and animal oils or waste oils and grain or sugar(beets). The greenhouse gas reduction obligation of fuel providers can be partly fulfilled by blending biofuels. A ban would reduce EU oilseed import needs and probably lead to a reduction in the German production of rapeseed. But, it’s not possible to replace biofuels of vegetable origin because there is not enough waste available and the rapeseed meal for animal feed coming from the crushing of rapeseeds would have to be replaced by imported soybean meal.

For questions or queries, please reach out to your regular AVENO contact

Don't forget to check out our previous bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats.

You can find all previous updates here

Newsletter sign-up

Sign-up here to receive our Biweekly directly into your inbox.

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.