February is for love!

Your Bi-weekly update on edible oils & fats by Aveno

January 16th 2023.

January 16th 2023.

After a turbulent year, with quite some geopolitical tensions, unseen inflation with high prices of raw materials and energy, many speculate on what could be in store for our industry in 2023.

What will edible oils market be like in 2023 and how to cope with challenging market conditions? How will circularity and sustainability goals and legislation develop? What about decarbonation and biodiesel?

No doubt, the reopening of the Chinese economy will be a most important development as it will increase the demand for raw materials. Already soon after the announcement of the end of quarantine measures for travelers from January 8th, we saw a price surge in petroleum and edible oils. But with the number of infections rising, market optimism faded quickly.

Human beings have always been trying to predict the future. The ancient Greeks had their “oracle in Delphi” who, high on plants and toxic fumes, spoke the words of the god Apollo. The Middle Ages had the astronomers as fortunetellers. Later some tried to read the future in Tarot cards or in one’s hand. And today many believe artificial intelligence (self-learning algorithms) will tell us the future.

Humbly we say we don’t know what will happen in 2023 but from the deepest of our heart we wish everyone a prosperous year. If we can’t predict the future, we can try to prepare for it. By becoming aware of the issues, managing the risks and by taking positions that never jeopardize the future of the company if they turn sour! And locking in margins never made anyone poorer, but playing casino did.

Looking back, but especially looking around in the real world and looking forward we might be able to determine where the trends will take us in 2023. And discover what sentiment is driving the market. Today the general sentiment is caution, a bit of a wait and see attitude weighing on the market.

After celebrating Christmas, the whole month of January is for drinks, wishing each other a great, happy, healthy and prosperous year, for looking forward and to venture into predictions. If January is for good intentions and best wishes February is the month for love.

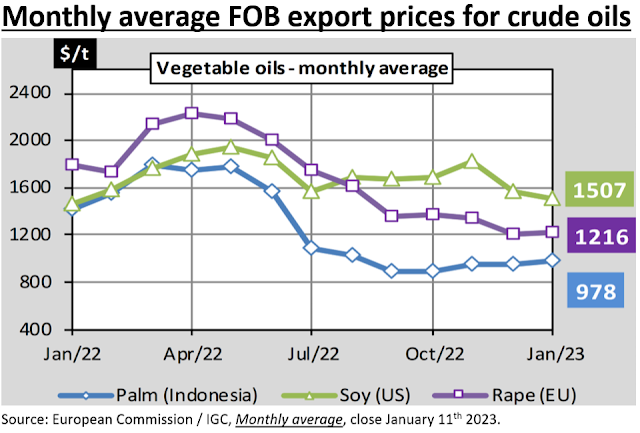

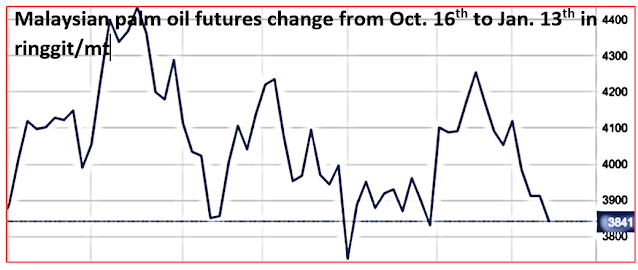

In the U.S. prices of edible tallow FOB Gulf of Mexico dropped to $1840/mt following Canadian and South American imports, and high prices that killed demand in Singapore for biodiesel production. But that’s still at a huge premium over crude palm oil FOB Indonesia ($945).

In Spain extra virgin olive oil prices ex-works went to $5784. Fish oil FOB Peru was contracted above a record high $5000/mt and experts think we’ll hit $6000 before killing demand for human consumption! Any origin fish oil (of lower quality: epa/dha, omega-3 content) c.i.f. EU is being quoted lower.

Generally, price support could still come from soy-beans and -oil due the biodiesel situation in the U.S. and the fear of not having enough oil there… and the U.S. is evolving from being a net exporter to a net importer of oils & fats.

What will edible oils market be like in 2023 and how to cope with challenging market conditions? How will circularity and sustainability goals and legislation develop? What about decarbonation and biodiesel?

No doubt, the reopening of the Chinese economy will be a most important development as it will increase the demand for raw materials. Already soon after the announcement of the end of quarantine measures for travelers from January 8th, we saw a price surge in petroleum and edible oils. But with the number of infections rising, market optimism faded quickly.

Human beings have always been trying to predict the future. The ancient Greeks had their “oracle in Delphi” who, high on plants and toxic fumes, spoke the words of the god Apollo. The Middle Ages had the astronomers as fortunetellers. Later some tried to read the future in Tarot cards or in one’s hand. And today many believe artificial intelligence (self-learning algorithms) will tell us the future.

Humbly we say we don’t know what will happen in 2023 but from the deepest of our heart we wish everyone a prosperous year. If we can’t predict the future, we can try to prepare for it. By becoming aware of the issues, managing the risks and by taking positions that never jeopardize the future of the company if they turn sour! And locking in margins never made anyone poorer, but playing casino did.

Looking back, but especially looking around in the real world and looking forward we might be able to determine where the trends will take us in 2023. And discover what sentiment is driving the market. Today the general sentiment is caution, a bit of a wait and see attitude weighing on the market.

After celebrating Christmas, the whole month of January is for drinks, wishing each other a great, happy, healthy and prosperous year, for looking forward and to venture into predictions. If January is for good intentions and best wishes February is the month for love.

MARKETS

In EU weakness in edible oil prices comes mostly from current poor demand from food and energy markets. Butter prices soared to all-time highs way above €7000/mt last year and now the market is well below €5000/mt and sinking.In the U.S. prices of edible tallow FOB Gulf of Mexico dropped to $1840/mt following Canadian and South American imports, and high prices that killed demand in Singapore for biodiesel production. But that’s still at a huge premium over crude palm oil FOB Indonesia ($945).

In Spain extra virgin olive oil prices ex-works went to $5784. Fish oil FOB Peru was contracted above a record high $5000/mt and experts think we’ll hit $6000 before killing demand for human consumption! Any origin fish oil (of lower quality: epa/dha, omega-3 content) c.i.f. EU is being quoted lower.

Generally, price support could still come from soy-beans and -oil due the biodiesel situation in the U.S. and the fear of not having enough oil there… and the U.S. is evolving from being a net exporter to a net importer of oils & fats.

Soybean oil

The soybean complex copes with persistent dry weather conditions in Argentina and southern Brazil. Precipitations weren’t near enough to save the crop. More rain is needed. From an initial production estimate of 48Mmt, Argentina’s crop could fall to 35Mmt which would then be the smallest crop since 2009.The last USDA WASDE-report of January 12th was not a real shocker. Some productions were revised down, others up and ending stocks were revised upwards. Losses are still expected to be offset by a record Brazilian crop of well over 150Mmt vs. last year’s 130Mmt. Some nervousness persists in the U.S. where since October soybean futures have been on an uptrend from $13.75 to $15.265/bushel last Friday.

Palm oil

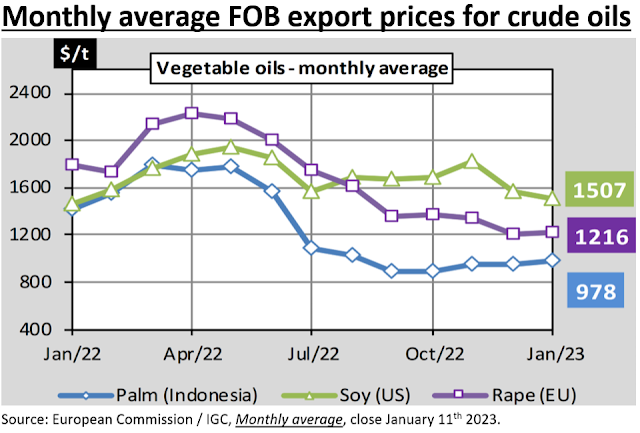

Ending 2022 Southeast Asia suffered from very hard rain and floods. Malaysia had an exceptionally dense monsoon followed by heavy showers which limited the production potential of palm oil. In the last three months palm moved sideways in a range between 3800-4200 ringgit/mt. Futures dropped below MYR 3,900 end last week, from the high of MYR 4,250 on January 3rd on worries of weak demand with shipments to India and China slowing down. India also has rebuilt sizeable stocks.

Just last week Malaysia announced it may stop palm oil exports to EU in retaliation for new EU regulation around deforestation which Malaysia finds discriminatory. Such might weigh on prices in origin but push prices up in EU. To be followed up.

Rapeseed oil

Although there is more demand developing from EU biodiesel producers (also to replace demonized palm oil and lower Argentine SME imports) stocks of rapeseed oil remain high. Nearby heaviness got tackled with demand for biodiesel picking up, exports to China and bargain buying. With lower energy prices some crushers may switch to soybeans. All this will bring more balance in the market. The rapeseed oil market is close to full carry. On the supply side Australia nearly finished a record harvest, but demand did not increase.

All else being equal, many expect that going forward, prices will continue to trend lower. But, there always comes a time when stocks draw down especially at the end of the rape season in July. And it is often said that a man forewarned is worth two! Keep watching soy oil price evolution too.

Sunflower seed oil

Unexpected a couple of months ago, today there are ample supplies of seed and oil in EU. The front months feel heavy with oil and there is more selling than buying interest since the start of the year; but the uncertain situation in Ukraine is keeping prices from weakening further, so some caution is needed. We started this season with high opening stocks (partly blocked in UA) and it’s hard to judge how ending stocks will evolve this season!On deferred (MJJ onwards), 6 ports crude sun has been trading below soy and rape; meaning sun is relatively cheap.

USD, mineral oil and biofuels.

A stronger euro is making dollar commodity imports into EU cheaper and is helping to combat inflation.To fight climate change, decarbonization stays a priority of most governments. Renewable fuels are part of the plan and, with their own ambitions, major fuel producers entered the market for renewable fuels, such as biodiesel and sustainable aviation fuel. So-called ‘advanced feedstocks’ such as used cooking oil and animal fats are preferred due to their low ‘carbon intensity’, but availability of those feedstocks is finite and can’t match demand; the gap will most likely be filled by vegetable oils. Hence the stressful situation in the U.S.

The reopening of the Chinese economy will support petroleum prices in the coming months but from when and how much is uncertain. The depth of (a) potential global or regional economic recession is, so far, also unpredictable and uncertain.

Due to an unusually warm winter in EU with lower EU consumption and weak demand in Asia, gas prices dropped to pre-Ukraine-war levels. Spot interest in LNG cargoes is weak despite lower prices but Asian demand could rise when China overcomes the current Covid wave and fully re-opens. Also, any prolonged cold spell in EU could quickly change things. A gas deficit in EU this winter seems unlikely but the outlook for 2023 remains challenging. EU needs to increase LNG import capacity and continue to attract gas deliveries i.e., compete with Asia for gas.

The average EU consumption of natural gas dropped 20% during August-November 2022, compared to the 5-year average of the same months in 2017-21. So, stocks remain unseasonably high and weigh on price!

§§§

For questions or queries, please reach out to your regular AVENO contact

Don't forget to check out our previous bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats.

You can find all previous updates here

Newsletter sign-up

Sign-up here to receive our Biweekly directly into your inbox.

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.