Let the music play.

Your Bi-weekly update on edible oils & fats by AvenoBi weekly February 27th 2023.

Wishful thinking, a pie in the sky, a fool’s paradise?

Everything seems uncertain and contradictory. Some oils & fats stay or become more expensive; others less expensive and others keep their price. We see a diminishing projected production of soy and increasing rape and sun oil production. Inflation shows little sign of slowing and the economy is doing better than expected. Promotion sales have been a bit disappointing and private label is gaining more market share at the expense of brands. Forecasts of more interest rate hikes cooled optimism for an economic revival but there is no big recession causing impact of interest rate hikes yet although some think it only kicks in 12 to 18 months after the fact.Last year, we saw historic cost increases across the agrifood chain, longer shipping times, increased energy and interest costs resulting in higher working capital requirements. Yet today is seems increasingly difficult for to believe that within 2 years we are heading for a strong economic recession. The worst price panic in energy markets is gone and alternatives appear to be able to substitute Russian energy. Trucking companies have less shortage of drivers and there are layoffs here and there, ‘Big Tech’ and in Germany, the largest industrial company in the EU announced layoffs too. The cost of wage growth itself facilitates broader consumption and therefore economic growth with commodity markets cooling off. And central bankers have a weaker spine due to politicization so they may even lower interest rates and increase the money supply.

The oleochemical industry, a good gauge of the economy, has seen sharply reduced sales volumes over the past 4 months and this is expected to continue for another 2 months although customers have low stocks and too thin coverage.

Commodity trade is looking at China trying to re-emerge from the covid-19 crisis, so a lot hinges on China with growing hopes though for a better-than-expected global economy. It is believed that the music will replay from the 2nd quarter. But more moderately than just after the post corona renaissance.

Not everyone is singing in the rain.

The South American weather and the final harvest outcome remains worrying. Heavy rains in palm growing areas hampered harvesting, production and plantation logistics. And then there is a growing risk of El Niño developing in the second half of 2023. El Niño could bring drought to Brazil and the U.S. and, with a delayed effect of 1 to 2 years depending on the intensity of El Niño, also negatively impact palm oil yields.The alarming drought in Italy and other parts of southern EU is causing serious concern. Normally floods are the biggest threat in Venice, but now dried up rivers make the town inaccessible by boat. Lake Garda and the Po River are plagued by historically low water levels. In addition to a lack of precipitation in recent weeks, the lack of snow too plays a role (- 53% below normal in the Italian Alps). In the Po basin, where 33% of Italy’s agricultural production is grown, rainfall decreased 60% and it would take 50 days of rain to bring the water levels to normal.

In southern France, the situation is worrying too and worries about water reserves grow. Elsewhere in France, according to Météo France, the country experiences the longest winter period without significant rain thus leaving the soil exceptionally dry for the time of year. In Spain, government measures to save water have already been announced. Water reserves are well below the 10-year average at this time of year.

Some experts say it's too early to panic because lots of rain may still fall in spring, allowing water levels to recover and although the situation could still improve with heavy spring rains, it is wise to take into account the potential impact on future production of EU olive oil, sunflower seeds and rapeseed.

MARKETS

Following the drought in Spain, olive oil prices continued to rise, pushing more customers to cheaper (high oleic acid) sunflower oil and corn oil. Due to much lower meat production in some parts of the world, e.g., Germany, and higher demand for HVO (hydro-processed vegetable oil as biofuel) tallow and lard prices remain high despite a downward correction due to lower palm oil prices making it more attractive in some countries for the production of HVO.

Cautiousness also comes from uncertainties surrounding the extension of the Ukrainian grain corridor after March, which could affect the availability of rape and sun seed.

Soybean oil

Oil remains unusually expensive versus rival oils but sunflower oil in Argentina was priced $100 below soybean oil which added some downward pressure and generally speaking bean oil ‘s been under pressure due to lower palm oil prices and competitive EU rape oil prices. But a smaller bean crush, combined with increased demand for biodiesel (HVO) in the U.S. and Brazil, may further support bean oil prices in the months ahead.

In Chicago, soybeans stayed above the $15.00 mark, on continued news of Argentine crop cuts and despite a slowdown in U.S. crush and slower exports. U.S. stocks are tight, but export demand always drops when the Brazilian crop arrives. Argentinian bean production is expected to fall to its lowest level since long due to the prolonged drought and could be lower than in 2009, when 32Mmt were harvested. Some observers are already talking about only 30Mmt. If weather conditions remain favourable, Brazil is bound for another record crop of around 153Mmt. Rains have delayed the Brazilian harvest, abt. 25% done, and the usual port congestion as well as internal logistical problems are not yet helping to flood the market with beans.

Palm oil

Just like Morocco limiting tomato exports to ensure there is enough supply for the local market and to ensure affordable prices as the Islamic fasting month of Ramadan approaches, Indonesia announced early February that it would suspend two-thirds of palm oil exports to lower prices and bolster local cooking oil supplies ahead of Ramadan festivities and of Eid. In response to local rising cooking oil prices and insufficient local supply, authorities aim to increase local cooking oil supply by suspending 66% of cooking oil export immediately until May 1st. Ramadan 2023 begins on the evening of Wednesday March 22nd and ends with Eid on April 21st. The impact on global supply is that between 400 and 800Kmt would not come on the market from February 6th to May 1st.

Having said that, neither Indonesia nor Malaysia is happy with EU legislation limiting imports of deforestation-related goods, arguing that the measures will mainly hit small-scale farmers. Compared to 2020, EU palm oil imports fell 22% to 6.4Mmt in 2022. By 2030 production of biodiesel with palm oil will be banned too. However, in the U.S., Brazil and South East Asia, demand for biodiesel is increasing, which will undoubtedly compensate for any loss of EU demand.

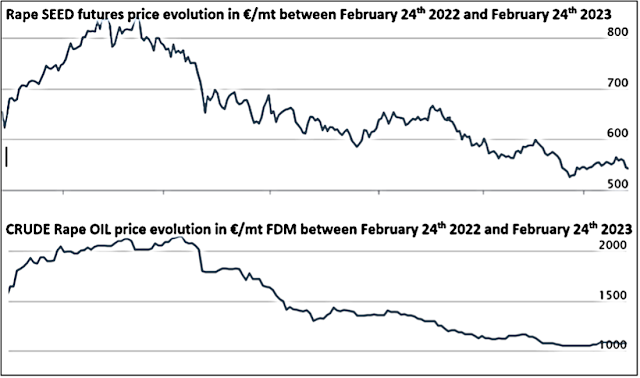

Rapeseed oil

A shortage of soybean meal and less sunflower meal deliveries created a shortage in the EU protein market. As a result, rapeseed crush for meal in EU continued strong, pressuring the oil market downwards. The market needs additional oil demand to reduce stocks. Biodiesel margins are good, and the crush is expected to continue running at full capacity.

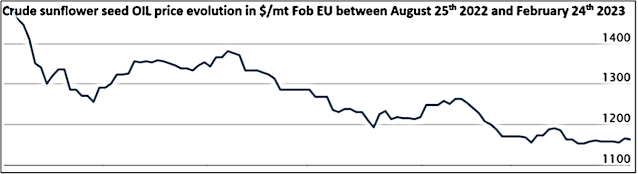

Sunflower seed oil

Before the war Ukraine was the world's largest sunflower oil exporter and supplied 50% of the volume, much of which was for major vegetable oil consumers like India and EU. Today Ukraine is the top sunflower seed exporterand Russia could become the new leader in the sunflower oil trade. The USDA projected that Russia is now to surpass Ukraine in sunflower oil exports as the war reduced the UA crushing capabilities. Exports of sunflower seeds soared to total 2.75Mmt in 2022 compared to less than 100Kmt a year before the war. About 70% went to the EU and 20% to Turkey. This makes Ukraine by far the leading exporter of seeds with 45% of world trade.

At the end of this season, seed ending stocks should be much lower than last season. With the ongoing war, the question is whether Ukraine will be able to repeat an 11Mmt crop and what will be the outcome of the negotiations to extend the Black Sea Grain deal?

High oleic sunflower oil is much cheaper than last season but plantings of the new crops will be in focus for the coming months, as in the current situation farmers may not invest in uncertain extras to plant high oleic acid sunflower seeds. It will therefore be necessary to rely only on France for the supply of oleic and to follow closely on the weather and on what the French farmers will sow!

USD, mineral oil and biofuels.

§§§

For questions or queries, please reach out to your regular AVENO contact

Don't forget to check out our previous bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats.

You can find all previous updates here

Newsletter sign-up

Sign-up here to receive our Biweekly directly into your inbox.

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.