Too bearish?

Your Bi-weekly update on edible oils & fats by Aveno

Bi weekly March 20th 2023.

Bi weekly March 20th 2023.

Positive news regarding the extension of the Black Sea Corridor Agreement also contributed to price pressure. Only, Russia offered to extend the agreement on Ukrainian agricultural exports, which expired on March 18, for just 60 days compared to 120 in previous periods. The market is both reassured and disappointed.

In the wake of petroleum, the prices of edible oils and fats continued to fall and buyers kept sidelining. With an abundant supply of most oils and at the same time with decreasing purchasing power (inflation), the demand for human and animal consumption as well as for biofuels slowed.

Generally, the market sentiment is more balanced than bearish, price levels are still historically high and some think already that in the second half of the year the present bearish momentum could disappear. They see the Argentine drama taking place, expect global biodiesel demand to rise further, see the weather flags around the world, expect that Ukraine will produce 30% less sunflower seed and think present bearishness is exaggerated.

It is true that sunflower and rapeseed should not see a rise in production as we saw the previous harvest, palm production should not grow exceptionally and the global demand for biodiesel is expected to grow significantly. We'll see, said the blind man.

MARKETS

Weather concerns continue to play an important role for the price outlook in the second half of 2023. La Niña is weakening and forecasting computer models suggest that a rapid transition from La Niña to El Niño is possible this spring and summer. In the past, some rapid transitions led to weather problems in many parts of the world.

Extreme weather hit the east and west coasts of the U.S. with California under heavy rain with flood warnings in place.The Sierra Nevada Mountain range received more snow, adding to an already outstanding snowpack. With El Niño, Australia will also become drier and head towards "normal" harvests instead of record harvests.

From the Black Sea reports of extremely dry weather conditions in in Bulgaria and Romania raise concerns about winter crop conditions and the upcoming spring sowing campaign. France is suffering its worst drought in 64 years and has water usage restrictions, including crop irrigation in parts of the country. The Alps in EU received little snow this winter which may keep rivers in Italy and Germany dry.

Argentina's worst drought in 60 years is destroying crops and bankrupting farmers. Chile is also suffering, with the far south of the country experiencing its worst drought in 50 years. This list is not exhaustive and many more places in the world experience bad weather. There is some debate if this is all climate change related or not but fact is that a fast change from El Niña to El Niño does cause such conditions.

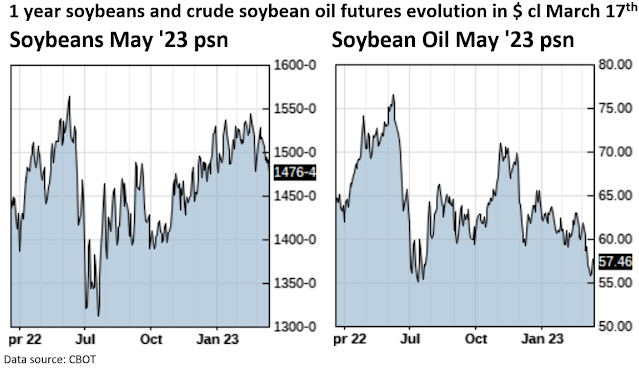

Soybean oil

Confidence in the Brazilian crop remains high and soybean oil followed lower petroleum prices. On the other hand, the Argentine crop has again been revised down to just 25-27Mmt from the initial estimate of 45 Mt. This steadily shrinking supply has yet to be fully discounted in soybean prices. The full impact of the drought will sink in in the coming months… meanwhile the market is already watching the weather for the next planting and growing period in North America because that will be very decisive for future price evolution.

Palm oil

The price of palm oil lost all the gains made the past weeks due to concerns over the economy, but at the moment remains around 4000 ringgit/mt in the futures market in Malaysia. On the whole, it remains more or less stable. This despite all the stories of flooding, low production, and low imports and export, stocks, etc.Rapeseed oil

Rapeseed oil plunged with the rest of oil markets and is not escaping the gravity that grasped the vegetable oil market. The price is about at a two-year low and on nearby, there is even an oversupply and low oil prices weigh heavily on rapeseed prices. The demand for oil remains very moderate and the price for physical oil was greatly discounted compared to the paper market. Little or no pull from export and biodiesel producers.

Sunflower seed oil

Crude sunflower oil is increasingly competitive, stable to slightly declining since mid-February and getting closer to the price of palm oil. The drop in EU rapeseed oil prices also impacted sunflower oil. Activity in the Black Sea market remained low due to the continuing downward price trend. Offers from Ukrainian, Romanian, Bulgarian and Russian producers and shippers are causing buyers to wait-and-see. Bulgaria has become EU’s largest importer of competitively priced sunflower seeds from Ukraine with a 40% share of total EU imports and has also increased its crush. Bulgaria is now good for 66% of total EU sunflower meal exports and 47% of EU sunflower oil exports.Bulgarian farmers, however, complain about imported sunflower seeds driving down local prices. On EU supermarket shelves, due to high stocks and poor demand bottled oil is discounted.USD, mineral oil and biofuels.

“It's the economy stupid!”

On both sides of the Atlantic, central banks are fighting inflation by raising interest rates, posing risks to economic growth. The fallout from recent events will inevitably lead to tighter credit conditions that will hamper growth and inflation which is expected to drop as economic conditions deteriorate, unless we get stagflation…

When they're not homeworking but in the office or on the floor, Wall Street gender neutral people often say: "interest rates will keep rising until something breaks". But once again no one saw it coming when the black swan smacked the money industry, leading to the closure of two leading banks. No one knows what other problems will pop up as interest rates rise to historic averages? Entire business models have been built on the belief that money is and will be free. Now we're back to basics: the only free lunch in this world is the cheese in a mouse trap!

An oversupplied EU biodiesel market along with a bearish gasoil market pushed EU biodiesel prices down over the past two weeks. The EU stock-build of fossil diesel before the sanctions on Russia came into force, imports from Asia and a surplus of rapeseed oil on top of weak diesel demand pushed biodiesel prices lower. Most biodiesel is blended with gasoil for road transport and a drop in demand for heating gasoil (mild winter with consumers saving on energy) and the economic downturn which led to a drop in demand for diesel for truck transport weighed on the market. Gasoil, essential for industrial economies, is cyclically sensitive, and demand falls when the economy deteriorates. Rising interest rates were bearish for diesel demand and in EU storage tanks are full. However, in May just as driving season starts, 15 U.S. refineries take (2 to 11 weeks) yearly maintenance downtime and then global diesel and gasoline supply may tighten somewhat again.

§§§

For questions or queries, please reach out to your regular AVENO contact

Don't forget to check out our previous bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats.

You can find all previous updates here

Newsletter sign-up

Sign-up here to receive our Biweekly directly into your inbox.

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.