A bull or a bear?

Your Bi-weekly update on edible oils & fats by Aveno

Bi weekly April 3th 2023.

Bi weekly April 3th 2023.

No price is too low for a bear or too high for a bull

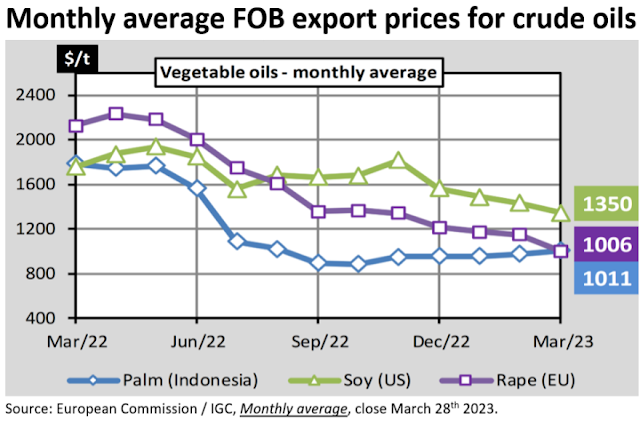

Prices dropped, dragged down by the threat of a global financial crisis. Petroleum prices went first and in their wake those of the oilseed complex. Mid-March, the banking problems in the U.S. got amplified by the Credit Suisse problems, which was bailed out urgently by its rival UBS on March 19th to limit the risk of contagion to other banks and ease concerns.Now the opposite movement seems to be set in motion, after rumors of a suspension of Russian exports of wheat and sunflower oil, Indonesia restricting palm oil exports, a recovery in petroleum prices, the return of demand and fading fears for a global financial crisis. It is difficult to judge the extent and duration of this recovery motion. A global slowdown in the economy has repercussions on all markets, including agricultural, so a lot depends on the economy and weather in the coming weeks and months.

There is a lot of talk and concern over inflation and debt and ‘external markets’ remain nervous till the financial turmoil resolves, although stock exchanges and petroleum rebounded. With stricter borrowing conditions and rising interest rates, the colossal need for cash/working capital for companies active in the supply chain also contributed to reduced (trading)demand and therefore prices.

Recently newspapers reported on a study (by AidData, the World Bank, Harvard Kennedy School and the Kiel Institute for the World Economy) on the "project of the century" which mutated from an infrastructure project to a financial bailout operation. For 10 years, China provided loans, especially to weaker financial countries, to develop its "Belt and Road Initiative". Today, China needs to help these countries out of their financial woes to protect its own banks from defaults and finds itself now in the risky business of international emergency loans. This on top of the domestic debt problems in their real estate sector.

Economic signals from China are mixed with the services sector doing reasonably well and the recovery in the industrial sector lagging behind. How much China will influence commodity prices in the coming months remains a question mark.

The Baltic Dry Index, a leading indicator of global economic activity (composite of dry bulk charter averages of the Capesize (40%), Panamax (30%) and Supramax (30%) indices of average prices paid for transporting dry bulk materials over 20 routes) fell to more normal historical levels. And when looking at the cost of shipping goods around the world, container indices have also dropped dramatically. This also means getting back to business as usual and there is room to grow again.

The outlook is confusing to say the least and market sentiment remains mixed with both short-term and long-term nervousness. How demand will evolve is always a wild card and sentiment is mainly psychological. In search for direction your optimism will be decisive for further price discovery. Where you born a bull or a bear?

MARKETS

Has market bottomed out (yet) and is it cheap or expensive?This depends on what one is comparing with and to what use. Versus a rival oil or versus prices of last 3 months or 3 years ago. Does the price allow one to lock in a margin?

Currently the weather is generally favorable for crops in EU, despite a lack of water in certain regions (Spain, Italy, Austria, Romania). Russian, Australian and Brazilian oilseed harvests are good. There is concern in India, after a heat wave followed by heavy rains which could have damaged crops. With the planting intentions in the U.S. the thing to watch is northern states that are facing historic snowfall and winter moisture, with winter storms coming and farmers not be able to get into the field until temperatures go up. If farmers will grow more corn or soybeans. But it is too early in the year to speculate on how weather will develop.

Soybean oil

After a drop, soybean prices started to rise again. In Chicago, soybeans recovered from a bottoming sell-off as the market was awaiting last Friday's inventory and acreage report. These reports often result in price volatility. And indeed, soybean prices (and oil) went higher on the March plantings report in combination with the stock report, but are still lower than a month ago. Analysts had projected acreage increases in corn as well as soybeans which the USDA did not, and this in combination with the USDA’s lower than expected corn and soybean stocks on March 1stmakes some think soybean prices could see some excitement this year. Caution is needed: it is still early in the year and it is intentions, it is also a typical U.S. situation. The big swings will come from U.S. biodiesel demand development and Chinese bean demand, both of which are uncertain at the moment.There is little change in South America, with showers spread over Argentina, only to stabilize the crop and not improve it. Poor crop prospects are offset by Brazil's record crop, now around 70% harvested and Brazil is drier which speeds up harvesting.

In Brazil, the National Energy Policy Council (CNPE) increased the biodiesel blending mandate from 10 to 12% starting in April, with the mandate increasing by 1%/year to reach 15 % in 2026. Former President Bolsonaro had decided to lower the blending rate to 10% and keep it at the same level in order to slow the rise in fuel prices. Lula is considered a “pro-renewable president”.

Palm oil

In EU the price of palm oil exceeded the price of rapeseed oil last week for the first time in years. Mainly as a result of market interventions by the Indonesian government. Anyhow in Malaysia, though working somewhat upwards, futures remained below 4000 RM/mt and generally palm oil continued trending sideways. Will we have to wait for real price action after Ramadan ends and if and when seasonal production uptrend kicks in? Time will tell.

Rapeseed oil

Fundamentally no big changes occurred, there is still a massive global and EU surplus of seed and oil. After a big sell-off, seed prices recovered and players are now reducing oversold positions. The market is still looking for additional demand to help reduce the large supply for the rest of this season. In EU rapeseed oil prices dropped below palm for the first time in years due to oversupply and weak demand. Nevertheless, all must be looked at in relation to other oils which, like rape, are still (not inflation adjusted) priced at historic high levels. So, the question remains if they can go lower, all together or on their own? And what oil will lead the dance?

Laurics

Laurics (palm kernel oil and coconut oil) remain cheap due to high stocks. Demand from the oleochemical industry (production of fatty alcohols and fatty acids) remains depressed. For coconut oil, stricter EU legislation on petrogenic hydrocarbon residues (MOSH/MOA) in products could reduce EU demand for coconut oil in the near future.Sunflower seed oil

Also sun oil prices rebounded but high stocks of seed and oil in EU and weak demand keep a lid on price increases. The strength other oils provided support even if market activity remained low. Sun was a follower as new fundamental inputs are lacking and buyers sideline. The next thing to watch is the plantings in EU this spring and weather developments in key sowing/growing area’s.USD, mineral oil and biofuels.

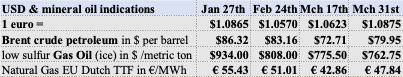

During the 1st quarter the euro grew stronger. With inflation data driving the ECB's interest rate policy and investors expecting that U.S. rates are approaching a peak the USD went for a second quarterly losing streak. Data from eurozone countries with higher than expected inflation reinforces expectations of more rate hikes by the ECB, driving the euro to overshoot $1.10 soon.Although energy costs dropped, supporting economic activity, there is still no disinflation and food inflation is expected to remain high. Despite falling global food commodity prices, cost increases of recent months (wages, energy, profit margins, etc.) will continue to be passed through and gradually trickle down to (retail)consumers in the coming months. Already household consumption is down in all product categories, with a particular strong drop in food spending.

At the recent HORECA fair in Ghent, a topic of discussion was that (meat)snacks have become so expensive that there have never been so few orders taken down by the major snack producers. Some complained about Brand-producer greediness, the difference with the Private Labels has grown too big. If some A brand products became 20% more expensive, but not 20% tastier than B brands, which only experienced price increases of less than 10% this would inspire restaurateurs to only use so-called B brands, so that their prices remain affordable. Customer retention, not letting high prices chase them away, has come to the forefront as a genuine concern.

Global biodiesel production is expected to grow less than anticipated mostly on account of Argentina, Brazil and doubts on Indonesia’s planned implementation. Tension raises between (unpredictable) government policies and economics; but biodiesel is not going away! It is what it is and will be what it will be.

§§§

For questions or queries, please reach out to your regular AVENO contact

Don't forget to check out our previous bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats.

You can find all previous updates here

Newsletter sign-up

Sign-up here to receive our Biweekly directly into your inbox.

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.