More headwind than tailwind, it seems.

Your Bi-weekly update on edible oils & fats by Aveno

Bi weekly April 17th 2023.

Bi weekly April 17th 2023.

Everything calms on the surface.

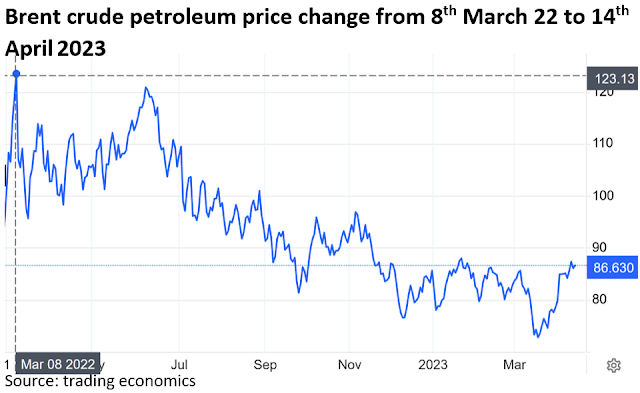

Everything seems to be calmly moving on but beneath the surface there is a lot of bubbling making the market nervous and undecisive. There’s a lot of underlying economic anxiety with the banking crisis that is not over yet. Harder to get credit for business weighs on growth, petroleum prices are firming and the IMF just reported that they see a sharp increase in the risk of a crash landing for the global economy (softer in EU than in U.S.).Geopolitics are also impacting agricultural markets: tensions around Taiwan, Iran, and with no end in sight to the war in Ukraine reduced plantings in Ukraine mean other countries need to produce additional oilseeds. There is speculation about Russian export bans and Russia wanting to end the “grain export corridor deal”.

El Niño forecast to return.

Then there is the continuous talk by different national Institutes of Meteorology suggesting that sea surface temperatures will cross the El Niño threshold by August. The naturally occurring El Niño phenomenon usually causes dryer and warmer weather in the northern U.S. and heavy rains and floods on the Gulf Coast and in the Southeast. In EU, it can lead to colder, drier winters in the north and wetter in the south. Brazil as well as India may become drier and palm oil production could also be negatively affected (with a time lag) and Indonesia and Australia could be hotter and drier with a greater probability of wildfires.According to the U.S. National Oceanic and Atmospheric Administration (NOAA), global temperature normally increases by about 0.2C° which could now mean breaking the crucial 1.5C° global warming limit. But all these effects might only fully work through in 2024. Some caution is in order, although in the meantime everything seems to be flowing smoothly.

MARKETS

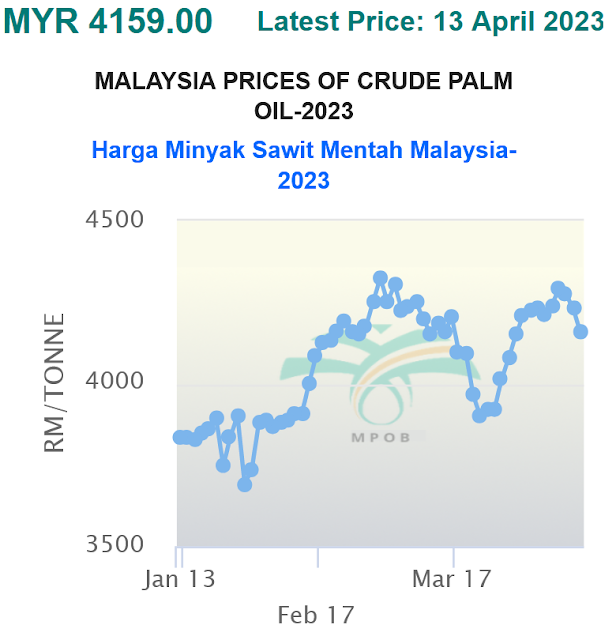

In the first week of April, petroleum had its best daily performance (Brent +6.31%) in about a year after OPEC+ announced it was cutting production by 1.16M barrels/day, beginning in May through the end of 2023, as a "precautionary measure" to stabilize the price of petroleum.In the U.S. soybean oil prices continued to adjust to the previous Friday USDA stocks + acreage reports and rising energy prices. In Malaysia crude palm oil futures rebounded on higher energy values and gains seen in CBOT soy oil futures. In EU rapeseed oil got support from soy and palm oil as well as the rising energy complex. And so, prices reached levels far from buying interest to e.g., ease the rapeseed oil or sunflower oil carry out.

When panic faded petroleum prices were capped by growing fears of demand destruction due to economic distress.

Palm oil

Around Easter Malaysian Palm Oil Board data showed that all Malaysian palm oil stocks shrank 21% in March to 1.67Mm. Crude palm oil stocks dropped even by 23% to under 900,000 tons. Production rose 2% but not enough to offset the increase in exports by more than 31% to reach 1.49Mmt.

The market is accustomed to see palm oil at a reasonable discount to liquid oils and thus finds palm oil too expensive. But of course, that is not a law of physics. Exports out of Malaysia in the first 10 days of April fell drastically which led to a more bearish sentiment. But palm is expected to continue trending sideways in the coming months, all the rest remaining equal of course.

Soybean oil

In the April 11th World Agricultural Supply and Demand Estimates (WASDE) report the USDA kept the U.S. soybean supply and use forecasts for this season unchanged vs. last month. The 2022/23 global soybean supply and demand forecast reduces global soybean production by 5.5Mmt to 369.6Mmt on lower Argentina (lowered 6Mmt to 27Mmt on hot and dry weather in March) and Uruguay crops, partly offset by higher production for Brazil which is increased 1Mmt to 154Mmt (other observers think it may even reach 157 vs 129-130Mmt last year). Global soybean ending stocks were raised marginally on higher stocks for China and Brazil but mostly offset by lower Argentina inventory. In China, authorities reiterated their wish to reduce the use of soybean meal in the animal feed. Prices of beans, oil and meal in different regions differ very much and more than usually. Better planting weather in the U.S. brought some bearishness.Butter

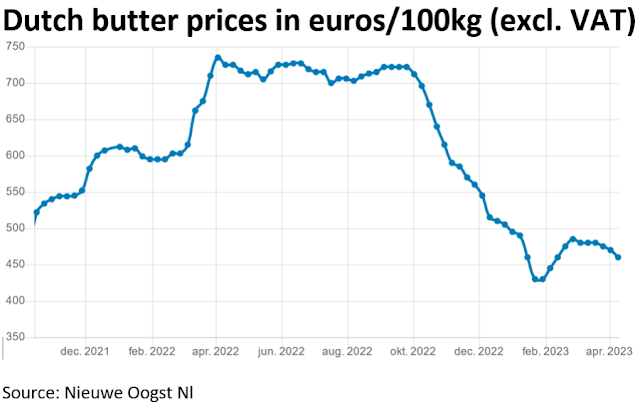

In recent months butter sales volumes in retail decreased nearly 30% in the Netherlands and UK and about 20% in Germany and France, confirming the general downward trend in retail sales volumes in the Eurozone. This underpins the image of consumers plagued by high inflation and an uncertain economic outlook. If retail sales are not the place to look for signs of an improving economy, dwindling volumes do not reenforce the picture of a strong economic recovery either. In week 14 average EU butter prices were at 474 €/100 kg or -0.3% in the last 4 weeks while Dutch prices were about 15€ lower.

Rapeseed oil

Very little activity, slow demand and a huge surplus of seed and oil continue to weigh and crude oil prices drifted lower again once more even below palm oil prices in Rotterdam.Sunflower seed oil

Very little activity, slow demand and a huge surplus of seed and oil continue to weigh.USD, mineral oil and biofuels.

The € rose to its highest level in a year and is expected to strengthen further. A weaker US$ is usually supportive to prices of dollar-commodities as they become more affordable for “non-dollar buyers” and one may need more dollars to cover production costs. Someone said “it’s only a matter of time before recession fears translate into a reversal of interest rate policy in the U.S. and a lower dollar”. This could materialise quickly as 2024 is an election year in the U.S. and everything will be done to keep the boat afloat.

Pavlov’s dogs.

OPEC+ strives to maximize prices and producers fear the banking crisis may negatively affect demand. They also see the U.S. didn’t refill strategic reserves (thrown on the market to ease prices after the Russian invasion in Ukraine) when prices were tumbling in March. Some expect petroleum prices to rise further in the coming months; and in a conditioned reflex Pavlov’s dogs see edible oil supported by petroleum because biodiesel may become more attractive (although crude and distillates have different dynamics and can move in opposite directions).In reality OPEC+ sees dwindling demand. Higher energy prices spur inflation which drives interest rates further up. This slows the economy and the higher petroleum prices weigh on global economic growth (especially in crude importing economies like EU, China, Japan). Demand for petroleum may then weaken further and OPEC+ must slash more production and edible oils may rise further. If the problem is weak demand the solution is not measures to further weaken demand by weighing on economic growth. On voluntary production cuts, the market could have countered with lower prices! “Man, man, man. Miserie, miserie, miserie…“, added Fernand Costermans.

§§§

For questions or queries, please reach out to your regular AVENO contact

Don't forget to check out our previous bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats.

You can find all previous updates here

Newsletter sign-up

Sign-up here to receive our Biweekly directly into your inbox.

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.