Gliding or crashing into a recession?

Your Bi-weekly update on edible oils & fats by Aveno

Bi weekly May 15st 2023.

But not only Argentina is crying. The truth is many nations around the globe are trying to get a grip on inflation. The debate is in the open with shaming, blaming and newspeak like “greedflation”.

To combat inflation the Spanish government dropped the VAT (value added tax) from 10 to 5% on skyrocketing olive oil prices and announced financial aid to farmers to mitigate the impact of Spain’s ongoing drought. Many growers are reluctant to grow anything in such dry and hot conditions, potentially worsening food inflationary pressures.

In recent weeks, as well in EU as in the U.S., there were several reports on price fights between retailers and suppliers. Both (brand)producers and retailers want to retain customers and gain new ones in an environment where consumers have less to spend. In France a leading retailer provoked by saying they will start buying more outside France, in Belgium one announced to drop the price of 100 products, “as part of their continuing purchasing power campaigns”, after renegotiating with suppliers, while another, who "wants to protect their customers' wallets", opposed a food giant’s price hikes which led to some empty shelves in the stores.

Ongoing price wars in the retail sector may contribute to lower inflation and encourage consumers to consume more.And a lot of commodity prices came down from their highs a couple of months ago but a lot is still trickling down in the supply chain and the cost of a product is not solely the raw material price. Also, the number of units sold and margin per unit is more important than financial turnover.

If the number of loans drops sharply in a credit-dependent economy, a recession is on hand and so it looks like central banks may have to shift focus from fighting inflation to stimulating the economy. Some even dream of interest rate cuts and of (cheaper)speculative money coming back to the commodity sector. Which may increase prices and inflation…

Bi weekly May 15st 2023.

Global inflation

The statistical office of Argentina reported last week that year on year inflation in the country rose to a staggering 108.8% in April (monthly April inflation was 8.4%). The fragile economic situation has also been worsened by a historic drought since last year, which has reduced earnings from exports of e.g., soybean meal and corn.But not only Argentina is crying. The truth is many nations around the globe are trying to get a grip on inflation. The debate is in the open with shaming, blaming and newspeak like “greedflation”.

To combat inflation the Spanish government dropped the VAT (value added tax) from 10 to 5% on skyrocketing olive oil prices and announced financial aid to farmers to mitigate the impact of Spain’s ongoing drought. Many growers are reluctant to grow anything in such dry and hot conditions, potentially worsening food inflationary pressures.

In recent weeks, as well in EU as in the U.S., there were several reports on price fights between retailers and suppliers. Both (brand)producers and retailers want to retain customers and gain new ones in an environment where consumers have less to spend. In France a leading retailer provoked by saying they will start buying more outside France, in Belgium one announced to drop the price of 100 products, “as part of their continuing purchasing power campaigns”, after renegotiating with suppliers, while another, who "wants to protect their customers' wallets", opposed a food giant’s price hikes which led to some empty shelves in the stores.

Ongoing price wars in the retail sector may contribute to lower inflation and encourage consumers to consume more.And a lot of commodity prices came down from their highs a couple of months ago but a lot is still trickling down in the supply chain and the cost of a product is not solely the raw material price. Also, the number of units sold and margin per unit is more important than financial turnover.

There is no easy escape.

Early May, the Federal Reserve's "Senior Loan Officer Survey" said the banks became more restrictive in terms of lending behavior and that demand for credit was also falling. Shortly after, the ECB released its “Bank Lending Survey”, indicating the eurozone may be heading into recession faster than anticipated. In the first quarter, the number of loan applications rejected by banks increased, while the demand for loans decreased at the same time.If the number of loans drops sharply in a credit-dependent economy, a recession is on hand and so it looks like central banks may have to shift focus from fighting inflation to stimulating the economy. Some even dream of interest rate cuts and of (cheaper)speculative money coming back to the commodity sector. Which may increase prices and inflation…

MARKETS

Markets will continue to focus on economic data and trade cautiously until more certainty on the global economy takes hold. There is a lot of wait and see in the market and people tend to get defensive. Given the economy no one wants to go long until a clearer picture emerges. Just think of the fall out of the banking crisis in the U.S. and how the problems of the Black Sea corridor will turn out, not to mention the 90% potential for an intense El Niño event this year.

Palm oil

Malaysian palm oil futures continue to move sideways in a range around 4000 ringgits. After announcements of less production, less exports now the market weakened on expectations of higher production in Malaysia and Indonesia, poor demand and lower energy prices. Production of crude palm oil in Malaysia will rise starting in May and likely peak in Sept-Oct. It must be noted that the increased biodiesel production in Indonesia limits their export potential.Palm oil has remained fairly firm all along. All in all, the market is not bullish but neither is it very bearish so far. It might well be it has been mirroring itself, by habit, to U.S. soybean oil prices which command a huge premium over South America and EU due to high domestic policy driven demand for biofuels. Both oils, palm 80Mmt and soybean oil 60Mmt, account for 56% of global edible vegetable and animal oils & fats production.

Soybean oil

The May 12th WASDE report set a bearish tone for future U.S. soybean markets as they evolve from tight drought stricken old crop supplies to a record production. The USDA forecasts a record production this year on higher yields; and higher ending stocks at 335M bushels (up 130M from last year) not only due to higher production but also from increased South American competition and an export cut of 40M bushels. New crop beans should drop fast below $12 and may even test $10 ($14.20/bushel average price in 2022/23). Brazilian beans still trade at a discount to U.S. beans.Looking back, such a carryout led to even lower prices when there even wasn’t heavy competition from South America. However, there was neither a so well developed and growing biodiesel industry in the U.S. either. What also changed, is that today the crush is more oil oriented than meal with doubtful demand (only 18% oil is extracted from beans). It remains to be seen how demand for oil and for meal evolve in the future. We may see low bean prices with high oil prices. Or we may see high bean prices with high meal prices and low oil prices.

The May WASDE report is the first look at the new crop balance sheet, assuming normal or favorable weather which no one can guarantee. There are still floods in the upper Mississippi and Red River areas till end May but so far, plantings evolve at a record pace and all going well we might even see an early harvest. The most challenging months for the crop are likely to be July and August.

The Brazilian harvest is just in and already markets are anticipating the next “Brazilian bumper crop” on acreage expansion. In the past 5 seasons the cumulative soybean planted area grew 20%.

Olive oil

Last week, in Spain, the prices of the liquid gold went up 10%. During the month of April, the upward trend in prices at origin was maintained on a daily basis, due to the severe drought and the rise in temperatures at the height of the flowering of the olive trees and fruit set. The situation is such that Spain made it illegal to work outdoors during heatwaves, after workers died from heatstroke. The heat during flowering dries out the flowers and without flowers there are no fruits and without fruits there is no oil. This weather catastrophe ruins the next campaign (2023/2024) after an already bad (2022/2023) season and will lead to further price increases. Despite high prices export demand remained strong.Rapeseed oil

Stocks of seeds are still plenty. A record carry out of over 1Mmt is expected in Australia and Indian farmers carry burdensome stocks too because crush margins are pressure down by imported oils. In EU the increasing harvest outlook could add further supply pressure as a large carry out is already expected at the end of this season. We are MJJ! May/June/July is the end of the season in EU and August is already new crop.In EU oil demand remains subdued mainly from biodiesel producers on high imported stocks of biodiesel which depress biodiesel margins. But also, petroleum companies have been using their “accumulated CO2 credit savings” instead of blending biodiesel with fossil diesel.

In Canada there are planting delays and unusual high temperatures and wildfires in Alberta cause concern. But nothing lost yet.

Sunflower seed oil

There have been tensions around Ukrainian agricultural imports, with “frontline” EU member states, Bulgaria, Hungary, Poland, Romania and Slovakia, looking to restrict UA imports as it depressed local prices. However, EU is working on a way to safeguard the suspension of EU import duties on UA exports of agricultural products (like wheat, corn, rapeseed, sunflower seed) and to let the “frontline states” be only transit countries to other member states.

USD, mineral oil and biofuels.

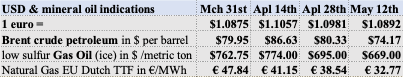

The euro slipped but found support from U.S. inflation slowing more than anticipated, which could decrease the interest rate differential between the two largest and most influential economies in the world. The ECB is expected to continue raising interest rates throughout the summer to tame inflation, while the FED might pause interest rate hikes to support the economy.

After OPEC+ announced, in the 1st week of April, it would cut production, Brent crude soared to $87.33/barrel on April 12th. A month later on Friday May 12th it closed about $13 lower on economic uncertainty. Rising U.S. jobless claims and weak Chinese economic data added salt and pessimism. Global diesel demand is down after months of worrying about shortages as demand was to outstrip supply. Worrying is over and demand is down so much it smells: recession.

Biodiesel developments

- The U.S. has been importing large quantities of biodiesel feedstocks.

- In U.S., renewable diesel production capacity is growing faster than oilseed crush capacity

- In the first quarter of the year China and Indonesia have been large exporters of biodiesel

- March onwards the biodiesel production picked up in Brazil

- Container freight rates are more attractive again than bulk shipments for shipping e.g., UCO and UCOME

- Large inventory of biodiesel in EU keeps margins depressed

§§§

For questions or queries, please reach out to your regular AVENO contact

Don't forget to check out our previous bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats.

You can find all previous updates here

Newsletter sign-up

Sign-up here to receive our Biweekly directly into your inbox.

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.