Is Putin trading wheat

Your Bi-weekly update on edible oils & fats by Aveno

Bi weekly May 1st 2023.

Bi weekly May 1st 2023.

The Grain Corridor.

A topic in the ag markets (wheat, corn, sunflower, rapeseed) is if the Black Sea Grain export Corridor gets extended or if Russia will close the door. There was also talk about Russia moving towards a nationalization of its agriculture because “food and international trade” are an element of big politics and an important component of Russian diplomacy. Although productivity under state control of the grain business in the old Soviet Union was never a winner. Despite the commotion global wheat prices continued to tumble.One American observer suspects Putin of holding a wheat trading position himself and therefore sending messages to drive markets up or down. But markets start to ignore this. The situation in some eastern EU countries (having banned Ukrainian agricultural products because they drive local prices down) indicates the "war in Ukraine" is weighing less in setting global prices of agricultural products. Markets have adapted, more production elsewhere and alternative trade flows emerged. Of course, the “world supply and demand” takes into account the presence and availability of Russian and Ukrainian grain and oilseeds but markets seem less nervous about it.

Weather conditions will continue to play a crucial role.

After a dry winter and a rainless February, many parts of EU experienced significant rainfall in March and April, which was beneficial in restoring soil moisture and groundwater levels. Drought conditions continued in northern Italy and worsened in Spain and Portugal.At the confluence of the Rock and Mississippi Rivers, about 230 km west of Chicago, Mississippi floodings, largely due to melting snow, are expected to peak, this week, at the 7th highest level ever. Iowa is expected to see water just 30cm below the all-time record of 1965. The floods cause high water tables for fertile soils along the Mississippi and are not a problem on farmland in the upper Midwest, but later downriver it could cause problems. The Mississippi is closed to traffic till mid-May, but there are no major export programs and barge freight has been under pressure for the past weeks, because there is no demand. Soybean growers say the biggest impact of this year could be on fertilizer shipments up north.

After three years of La Niña, El Niño is expected at the end of the year with an 80% certainty, raising fears of drought or excess water that could affect agricultural production in several countries. El Niño causes colder waters in Australia and Asia, droughts, mid-Pacific hurricanes and warming U.S. coastal waters, hence an increase in precipitation.Heavy rains and snowfall seen in California this winter could become even heavier. South America may see excessive wetness in Peru or Ecuador and drought in Colombia, and a water shortage in parts of Central and South America. El Niño could also amplify droughts, intense heat waves and fires, and the Indian monsoon, essential for agricultural production, could be weakened.

Lack of rain caused water levels to drop in two artificial lakes that supply the Panama Canal linking the Atlantic to the Pacific. Rainwater, the source of these reserves, supply the locks, which can be up to 26 m above sea level. In 2022, abt. 14,000 ships with 518Mmt of cargo (abt. 6% of global shipping) used the canal. Authorities had to limit the draft of the Neo-panamax vessels, the largest to pass through the canal, for the 5th time this dry season (Jan-May). In one month’s, time one lake lost 7 m of water. Panama had a lack of rain within the limits of a normal dry spell but El Nino is likely to further reduce rainfall in the second half of the year.

After three years of La Niña, El Niño is expected at the end of the year with an 80% certainty, raising fears of drought or excess water that could affect agricultural production in several countries. El Niño causes colder waters in Australia and Asia, droughts, mid-Pacific hurricanes and warming U.S. coastal waters, hence an increase in precipitation.Heavy rains and snowfall seen in California this winter could become even heavier. South America may see excessive wetness in Peru or Ecuador and drought in Colombia, and a water shortage in parts of Central and South America. El Niño could also amplify droughts, intense heat waves and fires, and the Indian monsoon, essential for agricultural production, could be weakened.

Lack of rain caused water levels to drop in two artificial lakes that supply the Panama Canal linking the Atlantic to the Pacific. Rainwater, the source of these reserves, supply the locks, which can be up to 26 m above sea level. In 2022, abt. 14,000 ships with 518Mmt of cargo (abt. 6% of global shipping) used the canal. Authorities had to limit the draft of the Neo-panamax vessels, the largest to pass through the canal, for the 5th time this dry season (Jan-May). In one month’s, time one lake lost 7 m of water. Panama had a lack of rain within the limits of a normal dry spell but El Nino is likely to further reduce rainfall in the second half of the year.

MARKETS

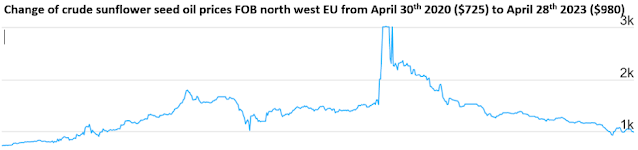

After vegetable oil prices hit all-time highs a year ago, they fell steadily the following months. The reasons were increased palm oil exports from Indonesia, good harvests and falling demand. Prices are now much lower than before the Russian invasion of Ukraine. Not to be underestimated recession fears have increasingly been downplaying commodity prices. Besides potential adverse weather the supply side is presently not an issue and the demand side is sending mixed signals.

Soybean and palm oil markets drifted lower but for the price outlook, growing conditions for rapeseed, sunflower sowing conditions and plantings in the U.S. and Canada are now in focus. Not to mention the seasonal upward trend in palm oil production which peaks around September.

Bean and bean oil prices weakened on the still increasing Brazilian crop which is about done. Brazilian farmers are forced to sell as there is not enough storage capacity and there is less Chinese demand which pushes bean prices lower. However, the downward movement got tempered by the Argentina-soybean-disaster-crop and by the high demand for HVO/biodiesel feedstock in the U.S.

Crude soybean oil prices in the U.S. command a premium of $300 over FOB Brazil, and $150 over Fob Dutch Mill. The U.S. has become a net importer of bean oil! The U.S. is importing tallow, UCO, rapeseed oil as well as biodiesel/HVO from EU and Canada. All oil produced in the U.S. stays in the U.S. and the excess soybean meal is being exported. Beans may continue to trend lower as there is less crush in EU, China and Argentina but oil stays then supported.

Soybean and palm oil markets drifted lower but for the price outlook, growing conditions for rapeseed, sunflower sowing conditions and plantings in the U.S. and Canada are now in focus. Not to mention the seasonal upward trend in palm oil production which peaks around September.

Palm oil

Malaysian palm oil futures declined due to, among other things, disappointing export figures, which resulted in the lowest price since late March. Even though the price dropped after moving up, it remains relatively firm and continued trending sideways. The current premium over Black Sea sun oil and South American bean oil is rather uncommon but so far strong. It may be that Indonesia eases export restrictions sooner than later and in 2023 the projected global palm oil production goes up 1.7Mmt to 80.8Mmt (82% Malaysia + Indonesia) but it also seems that some market participants fear future El Niño dryness could negatively impact production. With a normal ‘time lag’ this only plays in 2024 but buyers as well as sellers might be pricing, rightly or wrongly, in anticipation of…Soybean oil

Crude soybean oil prices in the U.S. command a premium of $300 over FOB Brazil, and $150 over Fob Dutch Mill. The U.S. has become a net importer of bean oil! The U.S. is importing tallow, UCO, rapeseed oil as well as biodiesel/HVO from EU and Canada. All oil produced in the U.S. stays in the U.S. and the excess soybean meal is being exported. Beans may continue to trend lower as there is less crush in EU, China and Argentina but oil stays then supported.

Fish oil

With El Niño popping up in South American pacific waters, there were reports that schools of fish are already migrating to cooler water and below the maximum length of fishing nets. It is expected that fish oil with high omega 3 content will remain scarce.Olive oil

This year, Spanish olive oil production ends below 700,000 tons. Italy, Portugal and France also recorded significantly lower production volumes, meaning that global production is around 40% lower than the previous year's production.High prices lead to lower demand. Currently, there is no rain in sight in southern Spain, which is urgently needed for the next harvest. Temperatures are already quite high and producers are being careful not to lower prices until growing conditions for the next harvest become more positive.Rapeseed oil

On the MATIF rapeseed remains volatile but without a new story to provide some excitement the market could continue to drift lower. The new crop this year in EU-27 looks good: 6M ha yielding on average 3.3 mt/ha give us a crop of 19.8Mmt coming from 19.29Mmt last year and only 16.98 in 2020.In a saturates market oil demand remains weak and demand for biodiesel production in EU remains disappointing despite many member states phasing out the use of palm oil for biodiesel production. Generally, there is an uncertain diesel demand tied to economic headwinds and the market is flooded with large UCOME/biodiesel imports from China that are eligible for double counting to meet CO2 reduction targets. It was interesting to see recently American authorities refusing two shipments of 'fake' UCO totaling 80Kmt. Labeled as UCO, they turned out to be "UCO-splashed" palm oil. Following EU’s push for more green fuel that has helped build an industry in China of collecting, recycling and shipping waste such as used cooking oil and UCOME, a flood of biofuels now threatens EU producers and raises fears of fraudulent exports/imports. With increasing Chinese exports to EU, the scrutiny of biodiesel supplies has intensified.

Sunflower seed oil

Spot crude sunflower oil, FOB Black Sea, fell to its lowest in 2.5 years at $840/mt, despite the threat of closing the export corridor. Maybe someone wants to get rid of some stocks before the door closes. But also, stocks in Russia are getting more burdensome by the day. In Argentina the harvest ended with an estimated production of 3.7MnT, which added extra weight. EU carries large stocks of both seed and oil and the Commissions intervention on the import ban in nearby EU countries from Ukraine will be closely followed up.

USD, mineral oil and biofuels.

The eurozone economy was boosted by growth in the services sector hiding a weakening manufacturing performance. In manufacturing, costs are trending lower as supply chain issues improve and new orders decline. Many industries are still in the phase of de-stocking and spring cleaning. Inflation in services is easing at a slower pace due to rising wages. For the ECB, this remains the main concern in the fight against inflation.

Energy markets came under pressure with petroleum weakening on continued concerns over the global economic recovery and the EIA reporting higher than expected inventories in the U.S.; EU natural gas futures dropped below €40/megawatt hour and on the last friday of April closed abt. 20% lower than end March on weak demand and ample supply.

§§§

For questions or queries, please reach out to your regular AVENO contact

Don't forget to check out our previous bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats.

You can find all previous updates here

Newsletter sign-up

Sign-up here to receive our Biweekly directly into your inbox.

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.