Mercatus, quo vadis?

(Market, where are you going?)

Your Bi-weekly update on edible oils & fats by Aveno

Bi weekly May 29th 2023.

Bi weekly May 29th 2023.

The bearish sentiment is counterbalanced by caution. Markets have come down quite a lot, with much of the bearish news priced in, and we are about to enter the volatile traditional summer weather markets with a potential game changer like El Niño in the pipe. Then there still is the war in Ukraine in the back of everybody’s mind.

But the bold are already preparing for a rally when destocking is done and economies pick up again!

MARKETS

Animal fats

In France a recent report caused some turmoil in ag-circles as a reduction in the cattle herd is allegedly necessary to comply with international climate and environmental agreements. This also plays in other member-states. French herds continue to decline and cattle slaughter fell sharply in April. In Spain the biggest concern now is the drought driving up feed costs and currently leading to the slaughter of calves. Newspapers reported more than 20 days of waiting due to congestion in slaughterhouses. In Germany, household purchases of beef fell by almost 15% compared to 2022 due to reduced purchasing power, pork and poultry purchases increased.Declining slaughtering of cattle and pigs, in EU, and the continued (worldwide) growing demand for animal fats from the advanced biodiesel producers continues to disturb flows and support prices. Demand from the oleochemical sector is subdued by the poor economic environment but usage of tallow in the U.S. (and elsewhere) is to increase further for the production of biofuels, making the U.S. a net importer of tallow instead of an exporter. Animal fat prices remain at historically high levels and command a premium over palm oil.

Fish oil

Fish oil production is bound for record lows, especially in Peru where the start of the season has been delayed, reducing the number of fishing days before weather makes it impossible to fish in July/August. Any origin fish oil prices North West EU increased 11% in a week and the spread with rapeseed oil keeps widening. Feels very bullish.Butter

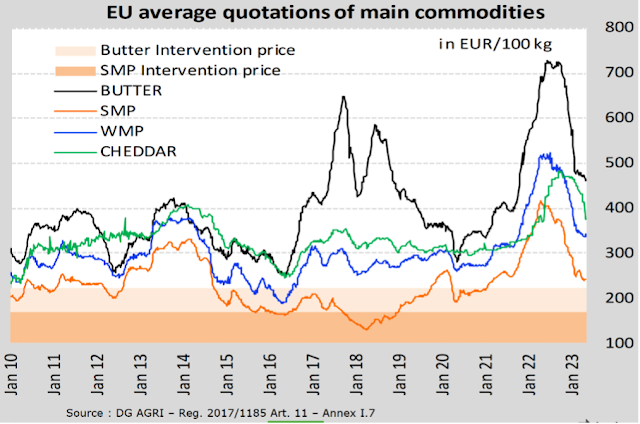

Weak market activity and high stocks, likely to continue rising as EU production typically peaks in May, weigh on prices. Buyers sideline and the little buying interest is mostly on deferred with bids far below offering prices. Still, slight upward price movements seem to indicate the bottom may have been reached. Price declines also trickled down to retail but prices are now expected to stay stable, moving sideways, given that stocks have yet to be reduced. In week 20 the EU average butter price was 34% lower than one year ago at €465/100 kg.

Soybean oil

U.S. soybean production this year still looks promising and bean futures have been under pressure. Global soybean meal demand this season is showing the largest decline ever as it is being replaced by rape and sun meals but also the declining pork production in EU is reducing animal feed demand. In the U.S. there is also a shift to use more (Canadian) rapeseed oil instead of soy oil for biodiesel production. So far, globally there are more than enough beans for everyone and the weather in the US will determine soybean complex values in the next months. Overall demand for beans/meal/oil remained weak.Rapeseed oil

In EU much of the bearishness in the rapeseed complex is priced in and we may see more stable markets despite global economic concerns. Seed prices are at or below full cost to growers whom withdrew from selling in the hope for better prices later. Just as the EU crop-monitoring agency MARS announced its rapeseed yields estimate of 3.34mt/ha which added to the negative sentiment and may drive SEED prices lower in the long term. So far, the weather is good across EU and we are only weeks away from the start of the harvest. There is a large carry out and a new 20Mmt crop coming, limiting the upside potential for seed. With ample seed supplies and poor biodiesel margins, funds hold a record short position in MATIF rapeseed futures.Canada received rains and cooler weather and accelerated spring plantings. This eased earlier weather concerns.

In EU rapeseed oil prices are under pressure due to heavy EU supplies and at an unusual discount to palm oil prices in Rotterdam. This season global rapeseed oil production is expected at a record 29.4Mmt or 13% more than in 2021/22.

Palm oil

Palm oil price came under pressure and continue to lose ground on higher productions and on news about weak export demand. For instance, India has huge inventories and chose to import more soft oils than palm; imports are to fall to a 2-year low. Although this season China is expected to massively increase its imports of oils and fats versus last year, it remains to be seen. Meanwhile Indonesia is taking steps to increase its export competitiveness as increasing Indonesian production will oversupply the domestic market while low petroleum prices limit the use of palm oil as feedstock for biodiesel. Bullish stories like the slowing down of production growth and potential lower yields down the road…, etc. don’t translate in higher prices (yet) as soft oils keep the pressure. Futures moved sideways below MYR 4000 at the lower end of the range fluctuating around MYR 3400-3500.Sunflower seed oil

The “Black Sea export deal” was finally extended for another 60 days and global crush is to remain high. Russia is coming on strong as an exporter of crude sunflower seed oil and the oil is looking for new homes in Africa and South East Asia. Global oil production is still expected to increase this season with declining oil prices, pressured by the accumulation of global stocks and weak demand. Black Sea market is still at a discount versus North West EU.USD, mineral oil and biofuels.

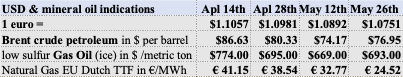

The Euro slipped further and it is unclear how the interest rate hike contest between EU and U.S. will play out. In the U.S. salaries, consumer spending and inflation numbers fuel expectations of another Federal Reserve rate hike in June…

In EU natural gas prices dropped to their lowest since May 2021, below €25/MWh, due to large inventories coming from lower consumption and an increased supply of liquefied natural gas (LNG). A weaker than expected economic activity with Germany in recession and the recovery of the Chinese economy weaker than expected weigh on energy prices. Various producers increased their production and like the U.S. and Australia, they began investing in more LNG projects making it harder to find buyers for long-term contracts.

Biodiesel developments

With additional production capacities coming on stream in the U.S. a steep production increase is expected and tensions may start to build in the coming months. Also, Brazilian and Indonesian production are set to increase significantly.

§§§

For questions or queries, please reach out to your regular AVENO contact

Don't forget to check out our previous bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats.

You can find all previous updates here

Newsletter sign-up

Sign-up here to receive our Biweekly directly into your inbox.

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.