Your Bi-weekly update on edible oils & fats by Aveno

Bi weekly June 26st 2023.

Drought is in the air, everywhere we look around.

In Panama, in the first five months of 2023 accumulated rainfall was 47% below historical average and the drought is likely to worsen with the onset of El Niño that tends to bring dry weather to Central America. In the 82 km long Panama Canal, maximum draft (normally 15.2 m) for ships using the most recent ‘neo-panamax locks’ has already been reduced by 2 m to 13.26 m and dropping. Normally heavy rainfall helps operations despite the loss of large quantities of water with each transit. The old locks use 197 million liters per passing and the new locks 182.000 mt of water, coming from the rapidly drying artificial lake Gatun. To save water, Canal Authorities think traffic may have to be cut abt. 20% from 36 to 28 ships daily.

This is one example of dry weather hampering supply chains. This year, also on other major waterways, like the Rhine in Germany, ships cannot be fully loaded.

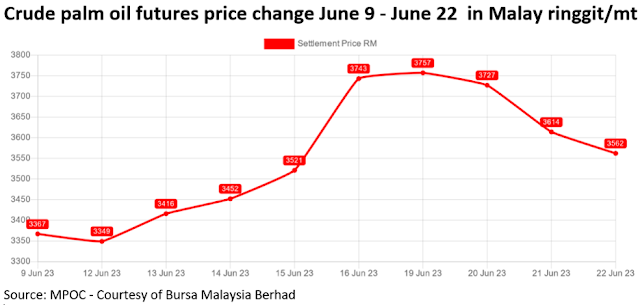

In week 24, palm oil futures shot up mainly on the back of US soybean oil strength as the market was pre-positioning itself ahead of the Environmental Protection Agency's (EPA) Renewable Volumes Obligation (RVO) announcement. Funds rushed in and nervous consumers extended coverage given the rally seen in all oils. Some water stress in Malaysia, dryness in the US and parts of EU, plus El Niño stories also helped pump up the jam.

Then a cold shower hit everyone in the neck last Wednesday, with the release of the EPA’s final decision on biofuel blending. Prices cooled quickly on the lower-than-expected changes in the EPA's final RVO rule: in Chicago, soybean oil futures traded limit down while in Malaysia, benchmark September palm oil futures closed at 3,614 ringgit/mt, down 3% or 113 ringgit/mt.

The current crop scare in the US might be premature and volatility has been mainly driven by fund activity, institutional and speculative money as they fear edible oil prices will appreciate in the future. Small sparks can cause big (price) explosions.

Impact of the armed rebellion, which started in the weekend, in Russia is hard to predict. Markets will probably (over)react defensively and wait for the dust to settle.

MARKETS

El Nino climate pattern, without El Nino conditions?

Meteorological services around the world have confirmed that an El Niño pattern is present or very likely would be by the end of the year. But all associated typical weather backlash has not yet been seen everywhere. The US National Oceanic and Atmospheric Administration (NOAA) confirmed El Nino arrived in the US, but thought it unlikely to feel any impact before the end of the year...

In the US, market reactions to the formation of an El Niño weather pattern have been turned upside down as the onset of the weather phenomenon has so far failed to trigger expected wetness. El Niño normally brings cooler, wetter weather to major growing regions of the US, along the Mississippi Delta and the southern Midwest. But so far hot, dry conditions prevailed. Those positioned for El Niño humidity were forced to rethink their positions and buckle up for a decline in final yields. Cooler and wetter conditions could have boosted yields and increased final production prospects. The crop needs rain in the coming weeks or prices will rise.

There are optimistic weather experts still believing we’ll see “a better agricultural production year in most of the middle latitudes worldwide” …

Humankind has lived through many weather markets

Markets anticipate future price development by looking at ending stocks or carry out of a commodity at the end of a season or period. These ending stocks, the result of unfolding supply and demand, are a moving target and continuously adapt to a lot of ongoing factors. Dryness will mostly influence the supply side negatively; wetness can help or hamper.

We’ve seen dryness in Panama in the past when at the same time Brazil had floodings in many areas. Although El Niño is certainly not the end of the world as we know it, it is something to follow up on. It’s all in the intensity and duration of the natural phenomenon. But never underestimate the force of weather as market driver. Weather uncertainties will certainly cause high price volatility in the coming months.

Meteorological services around the world have confirmed that an El Niño pattern is present or very likely would be by the end of the year. But all associated typical weather backlash has not yet been seen everywhere. The US National Oceanic and Atmospheric Administration (NOAA) confirmed El Nino arrived in the US, but thought it unlikely to feel any impact before the end of the year...

In the US, market reactions to the formation of an El Niño weather pattern have been turned upside down as the onset of the weather phenomenon has so far failed to trigger expected wetness. El Niño normally brings cooler, wetter weather to major growing regions of the US, along the Mississippi Delta and the southern Midwest. But so far hot, dry conditions prevailed. Those positioned for El Niño humidity were forced to rethink their positions and buckle up for a decline in final yields. Cooler and wetter conditions could have boosted yields and increased final production prospects. The crop needs rain in the coming weeks or prices will rise.

There are optimistic weather experts still believing we’ll see “a better agricultural production year in most of the middle latitudes worldwide” …

Humankind has lived through many weather markets

Markets anticipate future price development by looking at ending stocks or carry out of a commodity at the end of a season or period. These ending stocks, the result of unfolding supply and demand, are a moving target and continuously adapt to a lot of ongoing factors. Dryness will mostly influence the supply side negatively; wetness can help or hamper.

We’ve seen dryness in Panama in the past when at the same time Brazil had floodings in many areas. Although El Niño is certainly not the end of the world as we know it, it is something to follow up on. It’s all in the intensity and duration of the natural phenomenon. But never underestimate the force of weather as market driver. Weather uncertainties will certainly cause high price volatility in the coming months.

Palm oil

Palm oil mostly follows and profits from other markets while exports continue to be disappointing. FH June Malaysian exports dropped 17% compared to FH May. So, the market is looking for direction supported by production, inventory buildup and exports numbers. The weather and El Nino and the slowed down production growth due to aging trees and lack of replanting and plantation care do not yet outweigh poor demand.

Soybean oil

Soybeans are in a full-blown weather market putting in a weather premium in a big way. How explosive can the hot weather become? Is the question. According to the National Drought Mitigation Center, 57% of the soybean crop across the U.S. is now suffering from dryness which is reflected in declining crop conditions. Although the USDA said that on 18th June, 54% of the US crop is called good to excellent (-5% vs. previous week) with 92% of beans emerged, compared to 81% on average. The USDA will come with its annual Acreage Report on 30th June, updating planted acres in 2023.

Rains are in the forecast and we might see profit taking but although it is much too early to bury the crop, it will take a lot to restore subsoil moisture to comfortable levels.

In the soy complex meal is the sick man with global demand not growing enough to swallow a growing meal production which is driven by growing oil demand. Dryness supported bean prices and disappointing biodiesel news from the EPA weakened oil prices. Hopefully we get some good rains after which we can see more clearly which direction the complex is heading in.

In the soy complex meal is the sick man with global demand not growing enough to swallow a growing meal production which is driven by growing oil demand. Dryness supported bean prices and disappointing biodiesel news from the EPA weakened oil prices. Hopefully we get some good rains after which we can see more clearly which direction the complex is heading in.

Rapeseed oil

EU Matif and Canadian seed markets reacted up to the recent weather market and lack of farmer selling. But as we move into full harvest mode in EU and with weak oil demand, prices went lower again. Rapeseed oil prices dropped on declining seed prices and lower US bean oil prices. Further weather developments around the globe and harvest progression will guide the market. Improved demand from EU biodiesel producers might support oil prices in weeks and months to come.

Sunflower seed oil

The recent first production estimates for the Oct 23/Sept 24 season look promising with 56Mmt global seed production vs. 53.6Mmt in 2022/23 (Russia -5%, Argentina +7%, Ukraine +13%, EU +13%). This is weather permitting and all going “normal” in Russia and Ukraine. This year’s carry out is less than in the previous “abnormal year” when UA had to overcome major export problems. Oil prices stayed relatively low and stable especially in the Black Sea region in order to speed up moving seed and oil in view of further potential obstructions from the raging war. There is some concern over availability and premium over classic of high oleic sunflower seed oil; but it feels too early to judge on that.Olive oil

Prices are skyrocketing and for the first time ever the Aveno price index for olive oil hit tilt (the state a pinball machine is in when the mechanism stalls and comes to a stop after the machine has moved). In Spain prices go through the roof as it looks more and more likely that dryness will limit next season’s production to below average and keep ending stocks very tight, way below average.Following a dramatic campaign with low production, the Spanish Ministry of Agriculture collected data from October 2022 to March 2023 showing average monthly exports 30% below last season. The decline in export volumes was more pronounced in intra-Community trade, with Italy jumping out. Compared to the average of the last four seasons, exports to 3rd countries fell 19%, exports to member states decreased 37%. Spanish imports from Greece and Turkey increased sharply, while those from Portugal and Tunisia decreased.

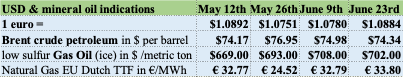

USD, mineral oil and biofuels.

Global economic recession risk remains high and rising interest rates curb lending and investments. Also, little support should be expected from debt-laden governments. The general recovery in demand forecast for the second half of the year is not yet in sight and a significant economic slowdown is reflected in the utilization rate of production capacities. Demand for chemicals fell globally and recently, in EU, this cyclical sensitive industry announced layoffs, cost cutting, plant closures and issued profit warnings due to very weak demand in combination with continuing destocking by customers. Meanwhile further monetary tightening and hawkish messaging from major central banks hurt the global economic outlook and demand for energy.

Biodiesel developments

What has been a relief to some was disappointing to the American biofuel industry. The EPA finalized the US Renewable Volumes Obligations for 2023-25 with biofuels blending ambitions lower than expected. The American Soybean Association feels the “EPA’s final rule will limit growth in soy-based biofuels over the next three years and leaves farmers and biofuels industry partners reeling.” It undercuts investments in crush capacity expansion and biomass-based diesel production.This weighed on global oilseed and vegetable oil markets. But despite headwinds Oil World’s most recent forecast sets global biodiesel production in calendar year 2023 at 56.22Mmt, up 4% vs. 2022. The biggest growth is seen in the US, Brazil and Indonesia. In EU in the 2nd half of this year it is expected that biodiesel production will pick up on phasing out palm oil and curbed biodiesel imports.

§§§

For questions or queries, please reach out to your regular AVENO contact

Don't forget to check out our previous bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats.

You can find all previous updates here

Newsletter sign-up

Sign-up here to receive our Biweekly directly into your inbox.

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.