Your Bi-weekly update on edible oils & fats by Aveno

Bi weekly July 10th 2023.

Of the Black Sea Grain Initiative or a new beginning?

Uncertainty around the exports of Ukrainian grains, oilseeds and oil is fading after months of discussions. The latest threat from Russia, which sees no reason to extend the “Black Sea Grain Initiative” beyond July 17th is mostly being ignored by the market. Ukraine has been working overtime to strengthen export capabilities via routes other than the Black Sea, including rail and road.Officials recently said 12 terminals are under construction on the banks of the Danube, Europe’s longest river, which will become the key outlet for Ukrainian exports to avoid Russia interfering with or blocking Black Sea shipments. As Ukraine now wants to send most of its exports through the Danube ports it is pushing to deepen the reopened Bystre Canal in the Danube delta to allow larger vessels. The 171 km long “Rhine–Main–Danube Canal” in Bavaria, Germany, connects the North Sea (Rhine delta) and Atlantic Ocean to the Black Sea (Danube Delta). So, once up and running, rapeseed and sunflower seed should reach most European operators without too much hassle.

From the beginning of the Black Sea Grain Initiative end July 2022 till about now, the U.N. says, over 32Mmt of grains, oilseeds and vegetable oils have been shipped from three eligible UA ports to 46 countries in Asia, Africa and EMEA. China, the single largest receiver under the plan, took 25% of this volume including 370.000 mt of sunflower seed oil.

Big news would be a prolongation of the export deal as most operators gave up on the export corridor after the explosion of an ammonia (fertilizer) pipeline from Russia to Odessa and Russia having built an alternative outlet route for this ammonia. And Russia repeatedly sabotaging and delaying the inspections of ships carrying Ukrainian goods under the initiative.

MARKETS

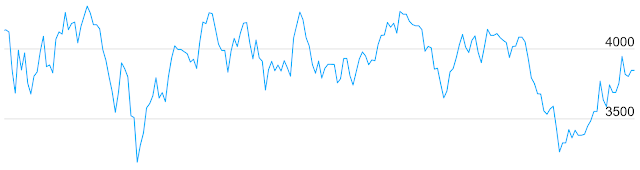

A lot is hinging on weather and much remains uncertain except the nervousness about the weather. There is a lot of talk and speculation about it but scientists won’t know for a couple of months how hard El Niño will hit us.After the sell off, following the bearish EPA announcement on biodiesel mandates, end June, the US soybean complex rebounded on a bullish USDA WASDE report. And on the back of firming US soybean oil, most other oils strengthened. Meanwhile we’re starting to see some cracks and corrections and profit taking on somewhat improved growing conditions. But all that could be short lived. Volatility is the new reality.

Palm oil

Lately, the BMD (Bursa Malaysia Derivatives) saw a sharp rally driven by a strong soybean oil performance in Chicago supported by the USDA’s planted acreage and stocks reports. Although crude palm oil is now more or less competitive against every other vegetable oil on the global market, the lack of export demand and a better than anticipated local labor situation is helping producers to build up inventory. Also, Indonesia is competing to find extra demand. And as production and stocks grow, the question in the back of everyone’s mind is about production next year, after the production peak: what about the negative lagging El Niño effect, on production in 2024? Should producers stay proud and sit on their stocks or sell?

Phasing out the use of palm oil as feedstock for EU biodiesel and the new “EU deforestation and labor laws” are not helping the demand side. Overall, the upside potential may stay limited as stocks continue to build. The market structure, in a carry, indicates stocks weigh on the nearby and need to be carried to forward positions, which is rather more bearish than bullish.

This changed the market sentiment and within a week, bean prices appreciated more than 12%, to the highest level in just less than a year. Recently firming petroleum prices gave support to the complex as this supports biofuels.

Next Wednesday is USDA Crop Production and WASDE report day. The market will react to whatever comes out of it. But having said all that, the global soybean situation is one with adequate supplies and at the moment demand is the biggest headwind for US beans with Brazilian beans still trading at a discount to US beans.

Brazil’s exports remain strong and China has drastically reduced U.S purchases due to high stocks. A high crush in China (= more soybean oil production and less palm olein imports) is bearish for palm oil.

Phasing out the use of palm oil as feedstock for EU biodiesel and the new “EU deforestation and labor laws” are not helping the demand side. Overall, the upside potential may stay limited as stocks continue to build. The market structure, in a carry, indicates stocks weigh on the nearby and need to be carried to forward positions, which is rather more bearish than bullish.

Soybean oil

Much to everyone's surprise, the USDA revised down its soybean acreage estimate by more than 1.5Mha compared to its first forecast in March, a decline of 4.5% compared to last year. Three months of below-normal rainfall in the Midwest keeps weighing on yield expectations. Widespread rainfall across the Midwest in the past week, didn’t fundamentally change the overall US drought picture with 60% of soybeans still considered to be in drought. Beans still have a chance of recovering as the most moisture-sensitive period is later in the summer.This changed the market sentiment and within a week, bean prices appreciated more than 12%, to the highest level in just less than a year. Recently firming petroleum prices gave support to the complex as this supports biofuels.

Next Wednesday is USDA Crop Production and WASDE report day. The market will react to whatever comes out of it. But having said all that, the global soybean situation is one with adequate supplies and at the moment demand is the biggest headwind for US beans with Brazilian beans still trading at a discount to US beans.

Brazil’s exports remain strong and China has drastically reduced U.S purchases due to high stocks. A high crush in China (= more soybean oil production and less palm olein imports) is bearish for palm oil.

Rapeseed oil

Rapeseed prices climbed in the wake of US soybeans, while weather conditions in Canada were again deteriorating. But prices struggled to sustain levels above €450. With favorable weather ahead, harvest in EU is picking up speed which may add more short-term pressure.

Coming from €761/mt on May 16th 2022, the ‘August 23 SEED position’ on MATIF settled on May 30th at €385. Last Friday July 7th it was €439.75/mt.

Since June 1st crude rapeseed OIL came of its low and gained some €160/mt in the FDM (fob Dutch mill) reference market which is in a carry. In the last half of 2023 rape-based biodiesel production is expected to pick up which would support the oil leg.

Sunflower seed oil

Not much commercial activity going on as EU market coverage seems to be more than sufficient for the time being. Supermarkets seem to be well covered with bottled oil from eastern EU producers. And cheap Black Sea oil continued to displace some palm demand in export markets.Olive oil

Given these circumstances of a very low supply of olive oil and the associated price increases, it is expected that the situation could deteriorate further. Spanish traders are talking of “prices that could soon reach stratospheric levels”.USD, mineral oil and biofuels.

The FED and the ECB are convinced that the economy and the labor market need to cool down more to meet inflation targets. Higher intrest rates will have a negative impact on economic growth and company results. Many economists still expect a recession in the US.

The International Energy Agency forecasts global petroleum consumption to rise this year by 2Mbbl/day to an all-time high of 101.9Mbbl/day. Yet, amidst poor demand, OPEC+ is trying to support prices through production cuts. These cuts could eventually eliminate the surplus inventory that has built up over the past couple of months and as inventories gradually tighten, prices could get support. Question is when overstocks will be gone and if higher prices will kill demand or not.

To safeguard its position as leading ship fueling hub, Singapore is investing in a new fuel future with LNG, biofuels and methanol as key alternative fuels in the offering now and ammonia fueling by 2026. Singapore wants to facilitate the green shipping transition and already helped several operators trial alternative fuels. This year biofuel take-up has been noticeable and there are projections of biofuels supply reaching 5Mmt/year in Singapore by 2030. Having a major biodiesel/hvo producer based in Singapore, the republic, squeezed between Malaysia and Indonesia, has already been an important importer of biodiesel feedstock including animal fats and UCO. It is expected to grow the imports of feedstock and of biofuels.

Biodiesel developments

According to data from the International Maritime Organization (IMO) the international maritime bunker (fuel for ships) market is estimated at roughly 230Mmt/year and 17 bunkering locations around the globe account for abt. 60% of the supply. The top location for fueling the world’s merchant fleet is Singapore with a 36% market share of those 60%. The Amsterdam-Rotterdam-Antwerp (ARA) area supplies about 11% of that and third is Fujairah (U.A.E.) with a 6% market share. With that the shipping industry accounts for nearly 3% of global CO2 emissions and last Friday, in London, IMO adopted a revised strategy to reduce greenhouse gas emissions from international shipping. The basket of measures includes biofuels and a phased reduction in GHG intensity of marine fuels.To safeguard its position as leading ship fueling hub, Singapore is investing in a new fuel future with LNG, biofuels and methanol as key alternative fuels in the offering now and ammonia fueling by 2026. Singapore wants to facilitate the green shipping transition and already helped several operators trial alternative fuels. This year biofuel take-up has been noticeable and there are projections of biofuels supply reaching 5Mmt/year in Singapore by 2030. Having a major biodiesel/hvo producer based in Singapore, the republic, squeezed between Malaysia and Indonesia, has already been an important importer of biodiesel feedstock including animal fats and UCO. It is expected to grow the imports of feedstock and of biofuels.

§§§

For questions or queries, please reach out to your regular AVENO contact

Don't forget to check out our previous bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats.

You can find all previous updates here

Newsletter sign-up

Sign-up here to receive our Biweekly directly into your inbox.

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.