Your Bi-weekly update on edible oils & fats by Aveno

Bi weekly July 24th 2023.

Chaos in the Black Sea.

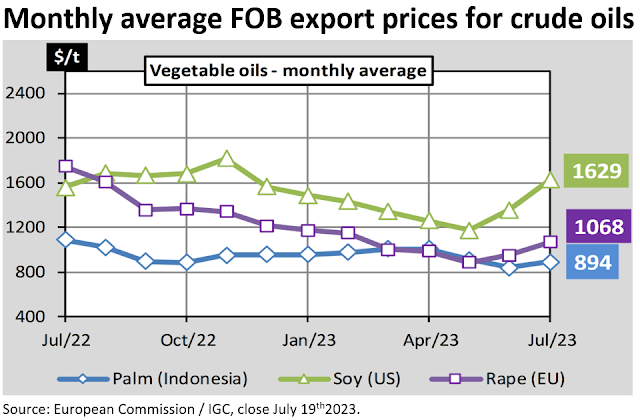

Market sentiment changed quite a lot on more potential weather-related production losses and on dangerous chaos in the Black Sea. But also record biodiesel production and consumption in the US continued to support the American soybean complex which in turn supported all edible oils and fats of the world.Moscow was expected to pull out of the Black Sea Grain Initiative but tensions in the Black Sea escalated when Russia attacked Ukraine's port infrastructure, warning that any vessel traveling to Ukraine will be treated as hostile as they may be carrying weapons.

Kyiv replied that ships sailing to Russian or to occupied ports of Ukraine may all be considered carrying weapons as well and Kyiv has the military means to enforce a blockade of Russian B/S ports.

Noteworthy is that Russia benefitted record profits from its agricultural exports, as Russia increased its market share and endeavored to keep prices artificially high. On top, Moscow friendly nations, China and India are the world’s largest importers of agricultural products.

Ukraine set up export alternatives, overland through EU, via their Danube ports and a temporary shipping route via Romania. And although the world is somewhat less dependent on Ukraine than before the war, Russia can target those routes too. Shipping companies continuously re-evaluate the changing “seascape” and associated risk. Worse would be if the world gets cut off from both UA and Russian Black Sea exports of grains, oilseeds, vegetable oils and fertilizers. Short term there are no acute problems or shortages but the crisis needs to be defused quickly.

MARKETS

A mixed bag

As there are more sellers than buyers, butter prices, coming from €722/100 kg last September, tumbled to around €430-440 today. On the opposite there are more buyers than olive oil sellers and prices keep going higher on the next global production deficit in 2023/24 following the ‘2022/23 disaster season’. Less than 3 months from the new campaign it is hard to find good quality olive oil.In Peru prices for high quality fish oil rallied to new highs as it is near impossible to buy anything and the 2023/24 season looks more bullish than ever before. Fish feed producers are (partly) replacing fish oil in their formula by cheaper and available omega-3 rich vegetable oils such as linseed oil and rapeseed oil.

In spite of decreasing animal numbers for slaughter around the world (more pronounced in some countries than others and differs on species) and consequently lower production of animal fats, in EU prices of animal fats are tumbling due to subdued offtake for biodiesel and oleo chemicals production. In the US prices remain high. Over time this could result in a change in trade flows and perhaps EU could supply animal fat to the US biodiesel industry.

In the US the crush of soybeans is set to grow, driven by a growing biodiesel/renewable/HVO production and it looks like players on the CBOT (Chicago board of trade) are into too much introverted navel-gazing. The CBOT seems to be only reflecting the situation in the US without the global picture in mind. Being a global reference, this supports all vegetable oils. But the market always wins and, in the end, everything balances out to the benefit or detriment of something or someone, which in the end is the end consumer.

Palm oil

Palm oil futures in Malaysia firmed to 4000 Malaysian ringgit/mt on strength in soybean oil, improved export demand, slow stock growth and Black Sea uncertainty. Even though Malaysian production might grow less, the biggest producer Indonesia seems to be more dynamic in growing the business. And there is Thailand and Latin America slowly but steadily adding to the supply.Soybean oil

The market is in weather market mode and under the psychology of the Black Sea situation. The USDA’s updated balance sheets (WASDE report) on July 12th, kept projected record yields at 52 bushels of beans per acre (3.5mt/ha) unchanged but lowered this year’s bean production by 5.7Mmt to 117Mmt on lower acreage. A sharp downward revision of new crop demand (by cutting export and crush demand), resulted in new crop ending stocks at 300M bushels or 8.16Mmt.The new US crop is far from made and a lot of weather still needs to be played out before the harvest is in the bin! Higher prices indicate the market thinks there is more downside to the yield figure although August rains usually make the soybean crop. The 30-day outlook from the National Oceanic and Atmospheric Administration indicates August would turn cooler and wetter. Despite a lower US crop, a global soybean surplus for the 2023/24 season is still in the pipeline.

In the background the USDA seems to underestimate the growth of renewable diesel, sustainable aviation fuels and the number of crush facilities coming online. Record biodiesel/HVO production has also been boosting soybean oil off take. The crush is going to want soybeans and biofuel producers will want (soybean)oil. What is less clear at the moment is whether the demand (and supply) will be for soybean oil and or other oils and fats, like more rapeseed oil.

This is important as traditionally soybean oil strength spills over to other markets. Last week crude soybean oil in the US was $431/mt more expensive than in EU and $551 higher than FOB Brazil. When will traders, who bring goods from places of abundance to places of shortage, take action?

Rapeseed oil

The upward momentum was accentuated by Russia’s withdrawal from the secure corridor agreement in the Black Sea. And the airstrikes on Odessa, in particular, sent seed and oil prices up as Ukraine is an important supplier to EU. MATIF august futures for seed went above €500 but by the end of the week settled at €470/mt or just €10 more than one month ago.

The global rapeseed production for 2023/24 has been revised downwards versus previous estimates and versus the 2022/23 season, but so far supply is bigger than previous season. Meanwhile, farmers hold back new crop sales hoping to cash more war and weather premiums.

With rape oil markets poorly covered, some buyers stepped in, fearing further upside price movements, as oil prices followed a higher MATIF and rising EU biodiesel demand. Also in the US, the Energy Information Administration (EIA) forecasts higher rapeseed oil demand through their revised biodiesel blend targets for 2024. In EU, as new crop seeds get to the mills, often after the annual maintenance downtimes, more physical oil will hit the market as is already being felt in Germany and we may also see crush switching from soybeans to rape.

On July 20th, Canadian rapeseed oil prices FOB Vancouver were at a premium of $290/mt over FDM (fob Dutch mill). Needless to say, eventually one will ascend or one will descend. High prices always attract goods! A recovery of the Canadian crop may still weigh on prices.

Sunflower seed oil

Even if seed supply gets a touch tighter than previous season (on lower carry in) it continues to be ample. Total 2023/24 supply is expected at 61Mmt! The International Grains Council (IGC) projected a global harvest of 56.9Mmt which OIL WORLD puts at 55.82Mmt. Favorable growing conditions in parts of EU helped yields considerably and a 10.5Mmt harvest in EU-27 would be about 15% better than previous year. Ukraine might be anything between 12 and 15Mmt and Russia could be 15 to 16.5Mmt. The crops are not yet made and still have to pass a critical phase but if all goes well the market can continue to relax.On Black Sea tensions there were no or few sellers and higher global soybean oil prices supported the SFO market. Though we have seen lots of sun seed and oil from Russia go to India, there are still large stocks in Russia looking for a home.

USD, mineral oil and biofuels.

The Euro performance is affected by inflation and the differing approaches of the Fed and the ECB to monetary policy.Eurozone inflation was 5.5% in June, after peaking at 10.6% in October. Easing Eurozone inflation reduces ECB rate hike expectations but inflation is far from tamed. It is expected the ECB will raise interest rates on July 27th.

Apparently, petroleum markets are shedding off the bearish global economic outlook. Brent rose above $80/barrel, after US inflation data suggested the FED may have fewer interest rate hikes in store for the world's largest economy.The consumer price index (CPI) slowed to 3% in June from 4% in May. In addition, petroleum supply decreased due to lower output from Saudi Arabia and Russia. If the upcoming rate hike on July 26th will be enough to “consolidate American disinflation” remains an open question.

In EU, natural gas prices fell as Norwegian natural gas supplies increased after the end of gas field maintenance shutdowns and demand from industrial activities remained toned-down.

Biodiesel developments

On July 11th, European Parliament adopted the final FuelEU Maritime initiative which “proposes a common EU regulatory framework to increase the share of renewable and low-carbon fuels in the fuel mix of international maritime transport without creating barriers to the single market.”And at a recent meeting, member states of the International Maritime Organization (IMO) adopted the IMO 2023 strategy to reduce greenhouse gas emissions from shipping and strengthened targets for tackling harmful emissions. One option is using biofuels, which have the advantage of 'drop-in' capability in the existing fleet, meaning they can easily replace fossil fuels.

§§§

For questions or queries, please reach out to your regular AVENO contact

Don't forget to check out our previous bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats.

You can find all previous updates here

Newsletter sign-up

Sign-up here to receive our Biweekly directly into your inbox.

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.