Your Bi-weekly update on edible oils & fats by Aveno

Bi weekly August 7th 2023.

Keep Calm and Carry On

The latest FAO global Food Price Index showed a slight rebound for the month of July, mainly caused by a sharp rise in vegetable oils prices. After months of declines vegetable oil prices rose on concerns over the production outlooks of soybeans in the US and rapeseed in Canada, olive oil in Spain, prospects of subdued palm oil production growth and renewed uncertainties about the exportable supplies out of the Black Sea region. Also, higher petroleum prices lent support to vegetable oil prices.Amid supply uncertainty, also India, the world's largest importer of vegetable oils, noticeably increased edible oil imports in July. This helped reduce palm oil stocks and supported palm oil prices, as well as soybean oil futures and helped reduce sunflower oil stocks.

Meanwhile in the Black Sea.

Intending to strangle Ukraine economically and to cut one of its sources of foreign exchange, Russia decided to bomb the port infrastructure along the Danube, just 200 meters from the Romanian border. And also, Black Sea ports infrastructure, as in Odessa. As Russia wants to gain market share, they sell all their stuff at a discount to reference markets, but do all to push up reference markets too. Some fear attacks on rail infrastructure for exporting grain and oilseeds through the western borders, too.This is leading merchant shipping to avoid the North and West sides of the Black Sea and insurers indicated that Black Sea war risk cover will no longer be offered. And so, nervousness in the markets increased after the Russian attacks, but without any real price surges as markets seem less concerned than before about such actions, believing that Ukraine has the time and ability to develop alternative export channels with the financial support of EU. It is an important and remarkable development that events supposed to support prices don’t!

Markets focus on the abundant Russian supplies (grains, oilseeds and vegetable oil) that Russia offers at a discount. If damages remain limited and local, commercial reality takes over and depresses prices.

The chairman of the Ukrainian Committee of Agricultural and Land Policy reassured about the country's storage capability despite damaged silos and blocked ports. Last year, in addition to loading and unloading equipment, Ukraine received field storage equipment to store "15Mmt of grain" for more than a year. These alternatives such as the "Australian silo bags" (huge polyurethane storage bags) or grain containers help manage the problems. Ukraine and Croatia also agreed on the possibility of using Croatian ports on the Danube and Adriatic Sea for exports. And it is important to realize that already 60% of exports passed via the “EU solidarity lanes”. Ukraine can roughly export 5Mmt of grain and oilseeds per month: 3Mmt through Danube ports, 1.2Mmt by rail, and 800,000 mt by road which comes close to the annual production of grains and oilseeds. But it is more complex and more expensive.

MARKETS

Palm oil

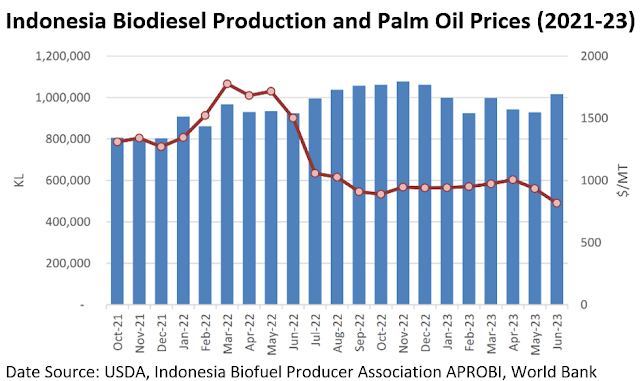

India and China have been buying palm oil again and palm oil prices benefitted support from higher petroleum and consequently higher gasoil prices which make it economically more attractive to use palm oil as feedstock for biodiesel. Indonesia’s domestic consumption of palm oil is seen moving up on higher use from the biodiesel industry following higher blending mandates and higher biodiesel exports. El-Nino weather patterns, which bring less rain than normal, were reported at weak-to-medium intensity and are expected to peak in August/September.

On its own palm had little power to move up due to high global production of rapeseed and sunflower seed oil, although for now the downside potential seems limited. The futures market had moved up but after July 24thcorrected, settling at MYR 3859 on August 4th.

Soybean oil

Beans, meal and oil lost strength and maybe it is too soon to turn the page away from the weather market but cooler and wetter US weather calmed market sentiment and made some already forget earlier dryness. Last Monday’s Crop Progress report pegged 83% of the US soybean crop blooming and 47% setting pods, both ahead of normal. Commitment of Traders report showed managed money/spec/funds reduced their net long position by 26,246 to 94,493 contracts in soybeans futures and options as of August 1st. However, US soybean oil stocks dropped due to less crush and high demand for biodiesel production. The booming biodiesel production in the US remains a bullish factor for soybean oil.Rapeseed oil

In EU, past dry weather caused more damage than anticipated and the recent wet weather has delayed the harvest in some regions. In addition, a shortage of drying capacity has arisen. Canada continues to suffer from dryness and heat leading to reductions in production estimates. Some beneficial rains passed over the Canadian Prairies the past days, but some areas received less than 50% of normal rainfall in July making the outcome of this year's Canadian crop uncertain.

Quite a bit of Russian oil has been exported to China and the high gas oil prices make biodiesel more interesting, which may support the market in the long term.

Sunflower seed oil

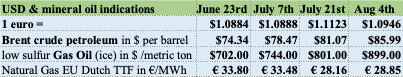

So far there are no real weather concerns over de crop and on paper supply looks more than plenty for everyone. But this is making abstraction of crippled export capacities in the Black Sea region which accounts for 60% of world sunflower oil production and 75% of exports. Nevertheless, the low prices demonstrate a certain optimism and confidence about the alternative export routes from Ukraine. Russia is sitting on big old crop stocks and has been offering oil at aggressive discounts. In week 31 Ukrainian sellers of sun oil were quite active offering ‘September 23 sun oil’, which pressured prices and kept Black Sea levels below the NW EU Six Ports market.USD, mineral oil and biofuels.

The central banks of the US and the Eurozone have both raised their key rates by 0.25% to 5.25 - 5.50% and 3.75 - 4.25% respectively. In July, US inflation was 3%, European inflation was 5.30% and the US economy continues to outperform the EU economy.There is doubt about the economy. Both EU and the US we have not (yet) slipped into a deep recession and there are both positive and negative signals. The fact that the economy is not in recession is for some an argument for further rate hikes. While weak economic activity in some sectors contributing to disinflation would discourage further rate hikes. Expectations though remain that central banks around the globe will keep increasing interest rates to fight stubborn inflation forces. This could slow economic growth and reduce energy demand.

In an attempt to boost its underperforming economy, at the end of July, China's National Development and Reform Commission pushed strongly to strengthen domestic consumption and the private sector by, among other things, raising household incomes. We’ll see.

Petroleum prices rose to new highs on a tightening supply (extended voluntary production restrictions by Saudi Arabia and Russia) and rising demand. Goldman Sachs bank observed that global petroleum demand in July, hit a record 102.8M barrels/day on stronger economic growth in India and the US, offsetting a downward revision in Chinese consumption. In the US, summer equals "driving season" with a higher demand for transportation fuel and the government also started replenishing the “Strategic Petroleum Reserves”, while end July, the American Petroleum Institute reported an estimated 15.4M barrel inventory drop.

Biodiesel developments

After a limited roll-out in February, the Indonesian government started implementing the 35% biodiesel blending mandate nationwide on August 1st. Up from 30%, there have been several false starts for higher blending, held back a few times by high palm oil prices and the need to invest in additional distribution infrastructure. An export tax on palm oil helps compensate the eventual cost difference between fossil- and bio-diesel. The POGO spread (palm oil gas oil spread) is currently in negative territory.

§§§

For questions or queries, please reach out to your regular AVENO contact

Don't forget to check out our previous bi-weekly updates!

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats.

You can find all previous updates here

Newsletter sign-up

Sign-up here to receive our Biweekly directly into your inbox.

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.