Where are we heading?

Your Bi-weekly update on edible oils & fats by Aveno

Bi weekly August 18th 2023.

What remained largely underexposed is the dramatic increase in the consumption of edible oils and fats in the US in recent months, and the potential fallout. This demand increase, much bigger than the increase in production, generated a sharp increase in domestic prices, fewer exports and more (growing)imports.

The escalation of hostilities in the Black Sea gave a lot of spectacle, but few significant price increases, though underlying concerns about export potential persist. As the fighting intensified with both parties increasingly attacking each other's ships and infrastructure, Russia's attempts to strangle Ukraine's exports increased the risk of involving a NATO member in the conflict.

Ukraine had to turn to the Romanian port of Constanta for help but here, too, Russians appear to be disrupting shipments (also with mines). The Romanian government wants to double the monthly throughput of Ukrainian grain in Constanta to 4Mmt in the coming months. Meanwhile shipping intelligence shows ships sailing to the Black Sea. The war is likely to continue into next year and possibly beyond 2024 and no one can predict what will happen to the Black Sea supply chain in the future.

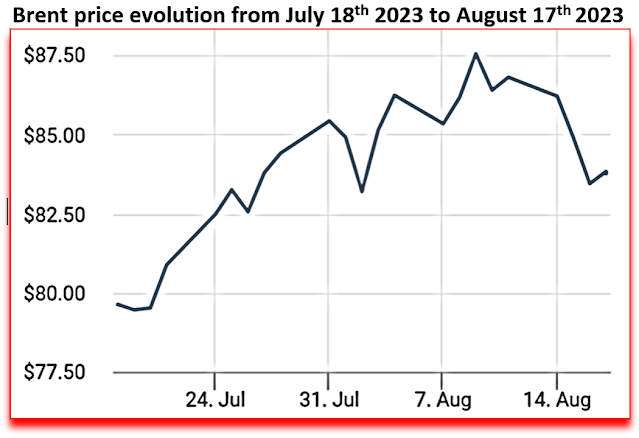

Inflationary and recessionary fears are far from over and it could be the market is still in holiday mood and keeps the fireworks for September, after rethinking the outlook for commodities, when everyone is back in school.

MARKETS

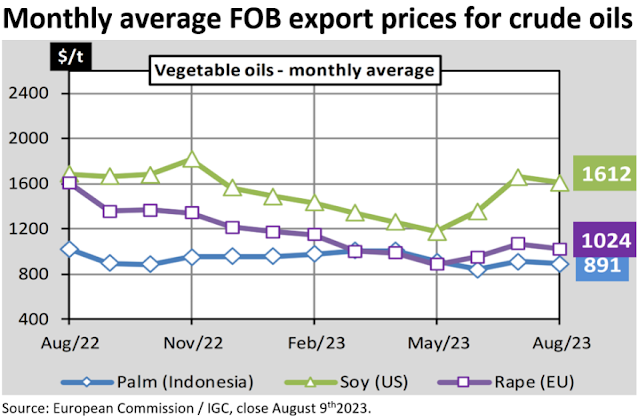

Palm oil

Indonesia, Malaysia and EU pulled together in a working group to clarify issues related to the implementation of the EU Deforestation Regulation (EUDR) which increases traceability and due diligence requirements for importing palm oil and other products. At a kick-off meeting in Jakarta, “the working group agreed on a work plan covering topics such as small-scale operators, national certification systems and scientific data on deforestation”. At the same time a publication mentioned that in order to protect national interests and protect the interests of ‘smallholders’, the Indonesian Trade Minister received a direct mandate from the president to “launch an all-out fight against the EUDR until its revocation by the EU”. To be continued.

The market had been overvalued for some time and the August rains led to much improved crop conditions in US this week similar to last year at this time. But there is also some negativity in the commodities sector due to the general deterioration of the economy; fears of inflation and recession are not yet over.

With Argentina expected to recover from this year’s drought and Brazil bound for another record crop (estimated at 165.9Mmt vs 157.3M this year by crop consultant Celeres) supplies will be enough to fulfill demand in the 2023/24 marketing year. Certainly, for beans and meal, but soybean oil could remain tight in light of the demand for production of biodiesel/HVO in the US.

Soybean oil

After the WASDE report on August 11th showing a decline in bean acreage and yield (50.9 bpa vs 52.0 last month), markets drifted lower. In Chicago, beans lost nearly 26 cents in November, meal fell $12.30 in September, and soybean oil fell 126 points. While soybean production was reduced by 95M bushels, demand was also reduced by 26M bushels, causing ending stocks to drop to 245M bushels, the lowest since 2015/16.The market had been overvalued for some time and the August rains led to much improved crop conditions in US this week similar to last year at this time. But there is also some negativity in the commodities sector due to the general deterioration of the economy; fears of inflation and recession are not yet over.

With Argentina expected to recover from this year’s drought and Brazil bound for another record crop (estimated at 165.9Mmt vs 157.3M this year by crop consultant Celeres) supplies will be enough to fulfill demand in the 2023/24 marketing year. Certainly, for beans and meal, but soybean oil could remain tight in light of the demand for production of biodiesel/HVO in the US.

Rapeseed oil

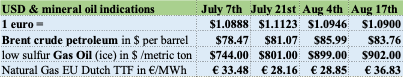

Rapeseed drifted lower to rebound later on weak Canadian production potential and Canada having sold an export parcel. The resumption of harvests in EU and favorable conditions for the first sowings of 2023 (after the harvest) capped the gains, as did the downward correction in the price of petroleum in the wake of pessimistic macroeconomics. But Matif rapeseed futures recovered all losses seen after the USDA report.

In Canada, harvest will start with reduced production prospects due to the dry conditions of recent months and the Australian oilseed federation now estimated their 2023 crop at 5.59Mmt which is 30% below last year’s record. Both are too expensive for the EU market and according to the EU Commission, cumulative imports since July 1st, amounted to 249Kmt compared to 678Kmt in the same period last year. The strength and speed of new crop Ukrainian exports to EU are eagerly being watched, also by farmers holding on to their seed!

Oil is finding support from higher seed prices and the growth in palm oil exports.

Sunflower seed oil

Overall, there is a neutral to bearish bias on high stocks and excellent future supply prospects. Hence there was poor buying interest. Even though in some markets sun oil is replacing soybean oil, rapeseed oil and very expensive olive oil. Black Sea oil is clearly on a downtrend on very low demand. The N.W.-EU 6-ports market makes a premium over Black Sea oil but the new crop market structure is also in a carry, indicating burdensome stocks to carry. The 4th quarter showed crude sun oil prices below those of crude rapeseed oil.Linseed oil

After fish oil and olive oil soaring to unprecedented levels, now also the prices of linseed and linseed oil have the potential to grow to unseen highs. After years of good and ample crops, prices of linseed dropped to levels too low to attract farmers to grow linseed. Today seed prices are going higher on perceived scarcity and on prospects of a 15% reduction in linseed production as farmers chose to grow better paying crops. In a weaker economy the demand for linseed oil from technical markets was subdued but because fish oil is so expensive and not available, buyers are purchasing linseed oil as a replacement source of omega-3 fatty acids. Unknown, old crop, stocks in China maymitigate the shortage a bit but China is far away.USD, mineral oil and biofuels.

Biodiesel developments

In the July 2022 - June 2023 period, EU-27 imported about 20% less palm oil than during the previous 12 months; mainly due to a decreased palm oil use as feedstock for the production of biofuels. Member States have to phase out ‘palm oil biofuels’ from their national blending mandates or greenhouse gas reduction quotas by 2030 and Germany, France, Italy, Austria, Belgium and Sweden have already excluded palm oil-based biofuels. It is expected that rapeseed oil will gain more importance as raw material alternative complying with the EU’s renewable energy directives.The US has been importing more oils and fats, including animal fats, and exporting less oils and fats in order to keep up with the growing demand from the booming biofuel industry. Something to keep watching in the coming months.

§§§

For questions or queries, please reach out to your regular AVENO contact

§§§

Previous bi-weekly updates

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats.

You can find all previous updates here

Newsletter sign-up

Sign-up here to receive our Biweekly directly into your inbox.

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.