A surge in non-spending.

Your Bi-weekly update on edible oils & fats by Aveno

Bi weekly September 4th 2023.

The first monthly EU food inflation decline in nearly two years in July was hopeful. Eurostat data showed food prices dropped from their peak in March this year, largely due to lower prices for dairy products, fresh vegetables, margarine and sunflower oil. But many branded food producers reported lower sales as consumers turned to cheaper alternatives. And in a recent interview on a French radio, a major retailer CEO said that high prices forced consumers to cut back massively on basic necessities, calling it a “tsunami of non-spending in France".

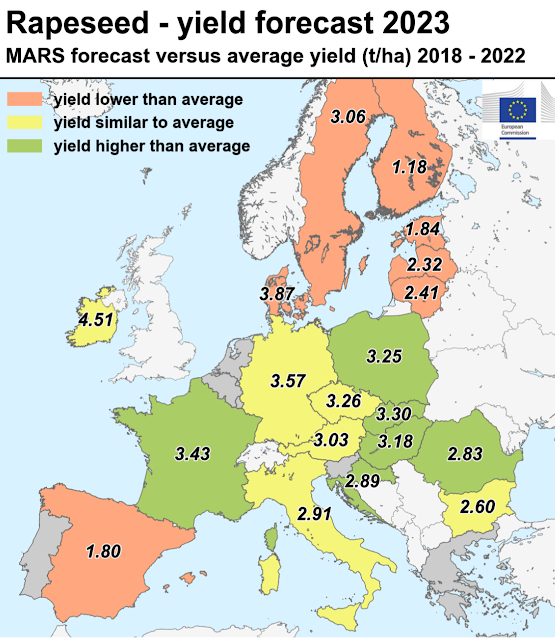

The EU Commission's latest report notes that weather conditions were generally negative for the yield of many crops. The situation varies depending on crop and region and one of the biggest weather victims in EU this year is olive oil. Due to persistent drought in Spain, especially the lack of rain in spring, olive oil production remains too low. There are nearly no alternatives outside EU as EU is the largest exporter of olive oil. Although sunflower oil with a high oleic acid content can be a valid alternative. Global olive oil supplies are seen dropping to a near 25-year low and after doubling vs. last season, origin prices may further soar above €10.000/mt.

Some food companies are also struggling to buy enough tomatoes as the severe drought that hit southern EU last and this year caused shortages, forcing buyers to look outside EU to buy tomatoes.

The price of pork also doubled in recent years and is now at an all-time high due to lower supplies. The nitrogen problem, ecological restrictions and other regulations, African Swine fever disease and deteriorating profitability, caused pork production to drop to its lowest in nearly 20 years. A structural reduction is in the works and already the number of pigs in the whole of EU is expected to fall more than 5%. Consumption is barely falling, making EU a potential net importer again in a not-too-distant future. In contrast China faces an oversupply and low prices. In both markets oilseed-meal demand for feed is seen dropping vs. a rise in oil demand.

Month-on-month or year-on-year inflation are one approach but cumulative inflation can no longer be ignored. And food inflation, which is double that of general inflation, is far from gone. Governments are eager to curb inflation and French authorities already intervened to freeze supermarket prices, Italy is also contemplating price ceilings, Portugal scrapped the value added tax on some foodstuffs, etc.

Of course, apart from tax inflation, governments have little control over the weather, cost of wages and energy and their inflationary impact. And the real cause of inflation does not lie with retailers, traders or producers. Basically, it's too much (worthless)money chasing too few goods.

Overspending governments and central banks printing money haven’t been much help. The only possible countermeasure is to limit the money supply by raising policy interest rates to levels that hurt economic growth. So far, the economy as shown some resilience and inflation has far from disappeared so further interest hikes are to be expected.

MARKETS

Palm oil

Generally, the seasonal palm oil production increase and stock growth remain a bit disappointing. The lagging negative effect on production of the El Nino weather pattern, later in the season, stays on everyone’s mind as the situation looks a touch tighter than before. In the marketing seasons 2022/23 and 2023/24 demand is projected to equal or exceed production. But that is ‘forecasting future demand’ and there is always a price to correct things. Moreover, the price and availability of other oils as well as macroeconomics will also impact where demand and price of palm is going.

Soybean oil

US consumption of biodiesel/HVO exceeds by far expectations, absorbing large amounts edible oils like soy, rape, tallow, corn, and tallow; and low bean oil inventories support US bean oil prices.But despite lower expectations for the new crop, following the 'Pro Farmer crop inspection tour’ and continued talk of yield losses due to drought and heat, the whole soybean complex closed lower in Chicago, last week. November beans had rebounded to over $14/bushel in response to perceived growing international demand and critical weather in the Midwest. But after a sharp rally, CBOT soybeans struggled to hold gains and fell back to $13.69 last Friday. October soybean oil had peaked at $0.67/lbs. on August 21st and retreated to $0.6475 last Friday.

Expected yield is less than 50 bushels per acre, probably closer to 49. If the field and the USDA’s September WASDE report confirm the much lower yields, there is a good chance for a bullish supply shock impacting the rest of the global oilseed complex. But it may be short-lived because after winter and all going well, a large harvest is already announced in Latin America. The US market remains “US-centered” with big premiums over European and South American markets.

Concerns are growing over logistic disruptions, related to low water levels in the Mississippi and to low water levels in the Panama Canal, where transit waiting time has increased to an average of 21 days. This could threaten US Gulf of Mexico exports, drive up costs and rearrange traditional trade flows to Brazil and to Pacific Northwest ports. How this translates in price and in the supply and demand picture, for now, remains an open question. US soybean exports usually take place in the September-February period and are easier via the Gulf with milder winter weather. Global soybeans and soybean oil supplies may stay a bit tight in coming months on reduced production forecasts in the US, till the new South American bean crops hit the market early 2024!

Rapeseed oil

In EU, after the harvest, the rapeseed complex is still looking for where to go. Rapeseed prices remained volatile as the market is split between a lack of demand from crushers and increasing tensions across the global edible oil complex. Rapeseed fell somewhat due to limited demand, while US soybeans and Canadian rapeseed firmed somewhat due to limited production.

The EU harvest disappointed a bit in terms of quality and yield and the EU Commission reduced its harvest estimate by 340Kmt to 19.1Mmt vs. last year’s 19.5Mmt. Prices of rapeseed, oil and meal underwent pressure from the new-crop and large carry-over stocks from last season. Not to forget the excellent Ukrainian harvest which partly offsets losses in Canada and Australia.

In Canada, ongoing harvesting confirms the lower yields after weeks of severe water shortages. StatsCan sees a crop of 17.6Mmt, compared to the 5-year average of 18.6Mmt. Canadian rapeseed prices tried to move higher in recent days but struggled to hold on.

Global demand for rapeseed oil is set to increase on exploding demand for biodiesel feedstocks in the US and better biodiesel margins in EU.

In Canada, ongoing harvesting confirms the lower yields after weeks of severe water shortages. StatsCan sees a crop of 17.6Mmt, compared to the 5-year average of 18.6Mmt. Canadian rapeseed prices tried to move higher in recent days but struggled to hold on.

Global demand for rapeseed oil is set to increase on exploding demand for biodiesel feedstocks in the US and better biodiesel margins in EU.

Sunflower seed oil

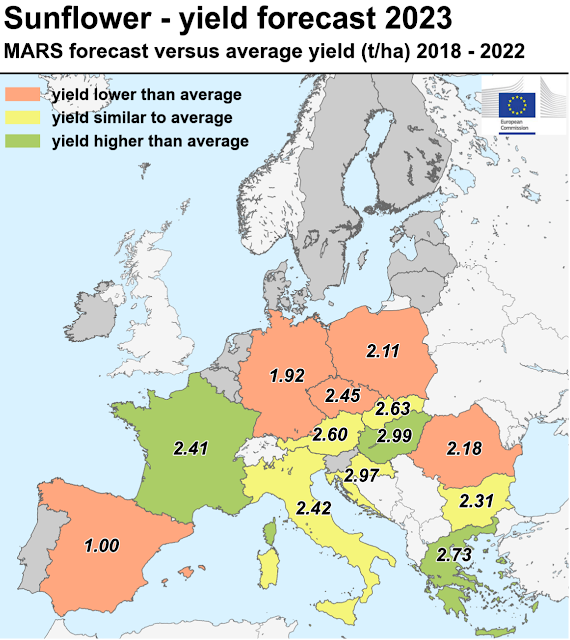

The sunflower is known for its low water requirements and that’s one reasons for growing it. Perhaps the most important reason in areas where water is limited in summer. It is between the beginning of flowering and the end of the achene (kernel) fill that water stress is most harmful. This year the Romanian crop suffered from dryness and has been reduced by abt. 400.000 mt. Most elsewhere, where it really matters, conditions were good to excellent and a big new crop is on its way to hit the market where buyers patiently wait for the, already competitive, prices to ease more.

USD, mineral oil and biofuels.

Friday Brent futures hit their highest level since January, supported by expectations that OPEC+ will extend production cuts through the rest of the year. In the US, Hurricane Idalia raised concerns over supply disruptions (potential more evacuations in the Gulf of Mexico after one producer stopped operations on 3 oil rigs). And the American Petroleum Institute also reported a massive inventory decline, suggesting demand for fuels from the world's largest consumer remains resilient. This bullish, US-focused scenario may change quickly as any impact from Idalia will be temporary and any bullish impact from the US economy could dissipate as well. Recent economic data was not encouraging for growth prospects in the US, and thus for petroleum consumption. Nevertheless, some analysts see petroleum go to $100/bbl. Economic news out of China, the biggest petroleum importer in the world, is also all over the place but above all uncertain.

Gasoil or diesel margins, supported by low inventories, soared this summer in NW EU to more than $35 over Brent, which is more than double it would normally be around this time of year.

Gasoil or diesel margins, supported by low inventories, soared this summer in NW EU to more than $35 over Brent, which is more than double it would normally be around this time of year.

Biodiesel developments

The “California Air Resources Board” reported in August that California for first time ever replaced 50% of diesel fuel by clean fuels in the first quarter of 2023. California’s Low Carbon Fuel Standard (LCFS) requires fuel producers to reduce the carbon intensity of fuel sold in the state and is largely responsible for this shift to cleaner alternatives, including renewable diesel, biodiesel, electricity, and hydrogen.

For questions or queries, please reach out to your regular AVENO contact

§§§

Previous bi-weekly updates

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats.

You can find all previous updates here

Newsletter sign-up

Sign-up here to receive our Biweekly directly into your inbox.

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.