Brushing off bullishness.

Your Bi-weekly update on edible oils & fats by Aveno

Bi weekly September 18th 2023.

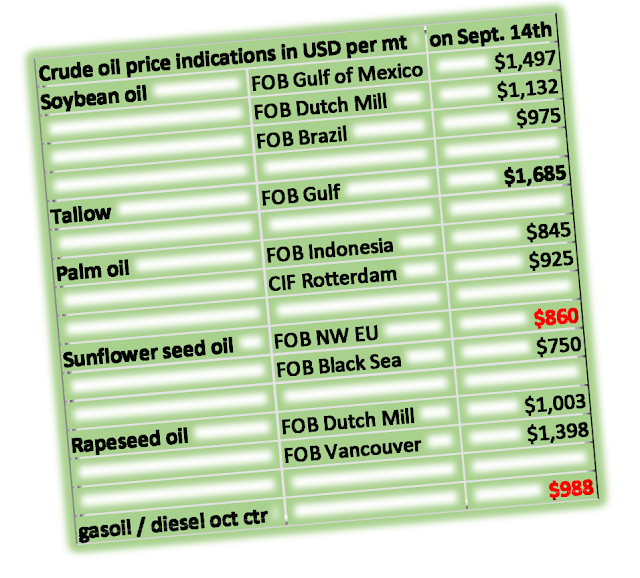

The past two weeks were marked by a new monthly WASDE report from the USDA on the soybean crop conditions and by the Malaysian Palm Oil Board communicating on productions, exports and stocks. Both items were perceived as bearish by the market. On top of that ample supplies of rapeseed oil in EU and huge inventories and new crop sunflower seeds added to the bearish sentiment. Some edible oils dropped again below the price of fossil gasoil.

Having said that, the surplus we see, is there but it is a relatively small surplus. As prices are low and petroleum is going up, it may well be that biofuels swallow up that surplus quite quickly (e.g., biodiesel exports from Indonesia to…) and rebalance the supply and demand. In any case edible oil prices will find support from higher (gasoil) petroleum prices.

MARKETS

Palm oil

Palm oil futures tumbled on news that inventories in Malaysia expanded by the most in 2 years on stronger-than-expected production and weaker exports. Stocks jumped 23% in August from a month earlier to 2.12MMT according to the MPOB.With destination markets well covered, meaning less exports expected and production (peak production period) and stocks growth expected to go on through September, palm prices may stay under pressure. Palm may have to price itself more competitively vs rival oils in order to find a home for stocks that will be built in origin in the coming period.

Soybean oil

In the US beans went lower following a bearish WASDE report and the market wonders if there are further yield cuts to be expected. That may well be, but meanwhile global demand for soybeans remains subdued also and the US prices are still too high vs. the competition. Market will be cautiously waiting and monitor the crop as it comes from the field. The main thing in the US is the growing demand for biofuel feedstock. Soybean oil is part of that.Tallow

In the US consumption of tallow is exceeding domestic production and the price premium over crude palm oil is at a record high! This growth in consumption is on account of demand from biofuel producers.In EU beef and pork production have been on a declining trend and so is tallow and lard production. According to EUROSTAT data 8.9% fewer pigs were slaughtered in the first half of this year than in the first half of 2022. In Denmark, the number of pigs available for slaughter even dropped by 19%! The decline for cattle in EU was more moderate: 3.6% less than in the previous year. And prices in EU stayed below the prices in US. Something is going to happen somewhere, sometime!

Rapeseed oil

In EU, rapeseed prices experienced downward pressure from increasing palm oil inventories and the Canadian rapeseed harvest. Canadian rapeseed prices fell to their lowest level since early July, pressured by the current crop. Palm oil prices fell sharply after the MPOB pegged Malaysian stocks at 2.12Mmt, the highest since February. At the same time, US soybean futures moved lower in Chicago, mainly in response to more favorable weather forecasts for the second half of September. Although the USDA lowered its US soybean crop estimate by 1.6Mmt (112.8Mmt vs. 116.4 in 2022), the adjustment was already anticipated by the market.EU is currently seeing renewed purchasing interest, especially from the biodiesel industry, in a context of higher petroleum/gasoil prices. And rapeseed oil in animal rations and for human consumption also saw renewed interest from the market.

Sunflower seed oil

In north west EU, from the highs at the start of the war in Ukraine in February-March 2022, crude non winterized sunflower seed oil prices steadily dropped to $838/mt on September 15th. Black Sea sun oil is even being offered at a $110 discount.

In France the first sunflower harvested fields gave a generally satisfactory yield. Maturation in 2023 is later than in 2022, but many plots, particularly throughout the south of France, are ready for harvest, the last intense heat having accelerated the drying of the plots. The Ministry of Agriculture forecasts a “record production estimated at 2.1 Mt in 2023. In Ukraine and in Russia the harvest is even more abundant and becoming “burdensome”, weighing heavily on markets.

USD, mineral oil and biofuels.

The euro dropped to its lowest level in six months, fueling imported inflation as imports become more expensive. The ECB has raised interest rates for the tenth time in a row, from 3.75% to 4%, and indicated it will suspend monetary tightening, although inflation remains too high. The ECB predicts average inflation in the eurozone will be 5.6% in 2023, 3.2% in 2024 and 2.1% in 2025. In the US, stronger than expected economic data reinforced the case for a prolonged period of even higher interest rates. All in all, despite some headwinds here and there, economies, so far, stayed resilient. There are elections coming up in EU, US and elsewhere, and often in the spirit of ‘après nous le déluge' everything is being done to keep everybody happy.

For questions or queries, please reach out to your regular AVENO contact

§§§

Previous bi-weekly updates

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats.

You can find all previous updates here

Newsletter sign-up

Sign-up here to receive our Biweekly directly into your inbox.

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.