Hesitation and reluctancy.

Your Bi-weekly update on edible oils & fats by Aveno

Bi weekly October 16th 2023.

Is the Middle East conflict a Game Changer?

With palm oil production peaking and increasing palm oil inventories, with ample global rapeseed and sunflower seed harvests nearing completion and the American soybean crop coming of the land, there is a lot of “oil weighing on the market”. But this is a normal annually occurring event at this time of year, after which stocks tend to go down till the next big push from South American soybeans comes, early in the next year.It felt like the entire oilseed complex was pressured by the US soybean crop, the present and future Brazilian soybeans and the increasing palm oil stocks. But especially ample sunflower seed oil offerings pushed edible oils and fats lower. Not to mention global subdued demand.

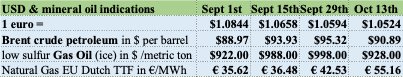

Of course, weather, geopolitics and economics which dictate the speed of the inventory drawdown are unpredictable. This past week we saw troubles in Israel exploding unexpectedly. Almost all went on hold. Energy prices firmed despite economic woes giving support to edible oils and fats which mostly all ended the week a bit firmer.

Fearing escalation and unpleasant surprises buyers and sellers hesitate to take positions and keep sidelining till the dust settles. But this geopolitical risk could also turn into another black swan event. Petroleum and its derivatives saw higher weekly closes due to escalating tensions coupled with additional Russian sanctions. A further escalation could have a domino effect across all markets, especially if energy supplies are threatened. The previous panic move when Russia invaded Ukraine showed that if one can't get something, he will often pay whatever it takes to get it, the price won’t matter. Precautionary hoarding or stockpiling can’t be ruled out either. Uncertainty subsists.

MARKETS

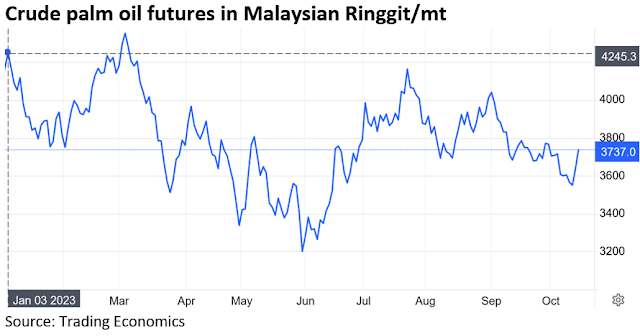

Palm oil

The continuing peak production season made palm oil stocks in origin grow which kept prices of crude palm oil under pressure. Malaysian palm oil stocks rose to their highest level since October 2022, mainly due to weakening demand as also edible oil stocks in India, China and other importing countries remain high.The latest palm oil statistics from the Malaysia Palm Oil Board last week showed strong palm oil production of 1.83Mmt in September and end month stocks at 2.31Mmt, a more than 9% stock increase compared to August. The market stayed largely “neutral” and expects crude palm oil futures, all the rest being equal, to trade in a range between RM3,600 and 4,000/mt, in fact continuing more or less moving sideways until…. demand picks up, production drops and stocks go down.

Soybean oil

In its October WASDE report, last Thursday, the USDA reduced the US soybean crop by 1.1 to 111.7Mmt. Yields were revised down to 3.3mt/ha. Soybeans closed higher after the release as the report fueled some short covering of some speculators taken by surprise. Although not a dramatic move upwards and more a signal that the earlier downward trend had halted. The USDA also raised the use of soybean oil for biodiesel production in the US. Heavy rains delay the harvest progress which should be around 50% by now.The spread between US and EU soybean oil dropped to about $113.

Generally, higher energy prices and the conflict in Israel were supportive and may dictate the future market direction until fundamentals kick back in, like the lack of export demand and the consequences of low water levels on the Mississippi.

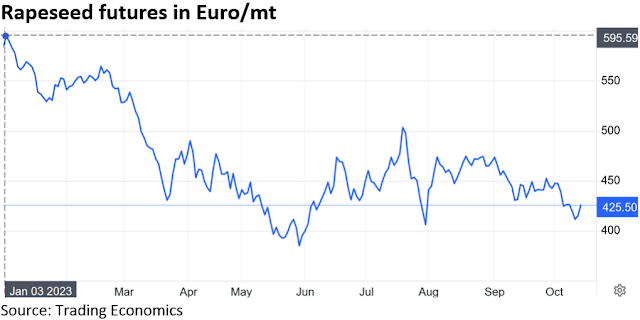

Rapeseed oil

In EU, during October, rapeseed futures trended lower quite fast until it stopped! Petroleum prices, which had fueled an earlier price recovery took a dive, putting renewed pressure on the entire biofuel sector and rapeseed complex. Also, seed imports from Ukraine weighed on the market despite continuous Russian attacks on more Ukrainian ports.The rise in petroleum prices following the attacks on Israel was apparently not yet enough to convincingly send rapeseed prices up again. Neither was the supportive USDA’s WASDE report (yet).

Rapeseed oil is affected by limited demand, both in EU and globally. Existing biodiesel contracts are presently being executed and that can cause spot physical crude and refined oil shortages. New demand is scarce and there are biodiesel plants in EU producing for the North American market.

Sunflower seed oil

The main driver for the sun market remained the ongoing harvests which seem to get bigger as they progress and little buying interest despite low prices. Russia has been discounting to get goods moving and Black Sea crude sunflower seed oil prices are even below crude palm oil prices. These low prices have been displacing palm oil demand in some countries and are an invitation to consume more.The Black Sea logistical uncertainty with Russia sabotaging Ukrainian exports is not reflected in the price as Russia keeps pushing exports on the market and Ukraine still manages to get its goods to market.

Butter

The average European butter price for week 40 was € 463/100 kg. In week 41 the Dutch price was €478, the French price €485. Prices nearing € 500 are killing demand.USD, mineral oil and biofuels.

Gas prices strengthened too to their highest level since February and Friday natural gas futures in EU exceeded € 55/MWh. Gas demand is up on cooler weather, geopolitical risks and ongoing strikes at Australian LNG facilities. Israel closed a major gas field over safety concerns and an investigation into a pipeline leak in the Baltic Sea raised doubts about the safety of the infrastructure.

Higher energy prices affect the processing cost of oilseeds crush and oil refining but also the farmer’s cost to grow food.

Biodiesel developments

At the “Indonesian Sustainable Energy Week 2023”, in Jakarta on October 10th, the Director General of New, Renewable Energy and Energy Conservation, highlighted the role of biomass in their decarbonization agenda. Indonesia committed to reduce GHG emissions and implemented programs to reduce dependence on fossil fuels. In 2022, the B30 biodiesel program helped reduced GHG emissions considerably. Beginning this year, the mandatory program for blending biodiesel with mineral diesel was rolled out nationally to reach 35% (B35) and that percentage is set to increase until reaching B100.Palm oil-based biodiesel gives is a cleaner, more environmentally friendly fuel blend than 100% mineral diesel, leading to significant reductions in GHG emissions and air pollution.

On October 9th, following the earlier adoption by the parliament, the EU Council officially adopted the revised EU Renewable Energy Directive (RED III). This directive targets the increase of renewable energy consumption to 42.5% of the overall consumption by 2030. It also regulates the use of renewables in transport and continues to discriminate against palm oil-based biofuels which will lead to more protests and actions from palm oil producers Malaysia and Indonesia against EU.

§§§

For questions or queries, please reach out to your regular AVENO contact

§§§

Previous bi-weekly updates

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats.

You can find all previous updates here

Newsletter sign-up

Sign-up here to receive our Biweekly directly into your inbox.

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.