Ready to go back up?

Your Bi-weekly update on edible oils & fats by Aveno

Bi weekly October 30th 2023.

What will make prices move?

In the past months, most prices of oilseeds, oil meals and vegetable oils, trended lower driven by much lower sunflower seeds and rapeseed prices, while soybeans tried to hold ground.Dry weather, resulting in lower soybean production in the US, was offset by US harvest pressure, an expected record production in South America in 2024, tempered global import demand and a firming US dollar.

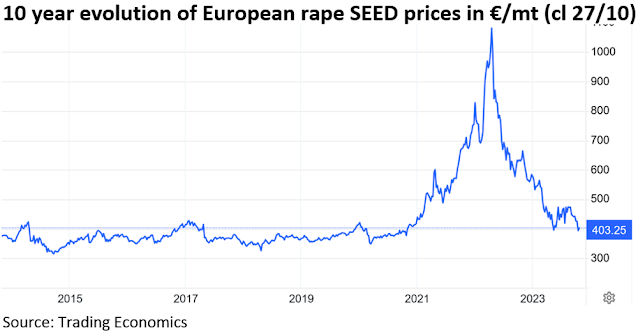

The drop in price of sunflower seed was mainly driven by higher-than-expected productions in Russia and Ukraine. And rapeseed prices fell on abundant supplies in EU and the Black Sea region.

Most vegetable oils too remained under pressure: Palm oil prices fell mainly on high seasonal productions in Southeast Asia and competition from other oils like sunflower oil which traded at an unusual discount. Global sunflower oil prices fell sharply, pressured by an ample sunflower seed harvest and strong selling activity. And global rapeseed oil prices fell due to the continued push of global exports. Then soybean oil prices followed the movement, helped by weakening biodiesel margins in the US.

Analysts continuously watch if global agricultural production keeps pace with global population growth to fulfil demand and keep prices under control because in commodity land, a slightly lower production growth of 1 or 2% or any other imbalance can trigger exponential price increases.

While in developed economies the food consumption of oils & fats is pretty inelastic, global demand is more difficult to assess than the global supply. In some African countries (e.g., Niger, Chad, Sudan…), economic growth is slower than population growth impoverishing their population year after year.

According to the World Bank, global food price inflation continues to impact global demand. For instance, Nigeria is struggling with high food inflation but also other countries such as Turkey and Argentina are also in the inflation spotlight. Too many developing countries have built unsustainable debts, whilst higher interest rates and a stronger dollar are negatively affecting their economic development. Such bearish headwinds may weigh heavily on global edible oils & fats demand.

In EU, not so much a potentially lesser consumption but more a declining production (and export) of meat can considerably change the oilseed landscape. Less slaughtered animals mean less animal fat production for biodiesel, petfood, oleo chemicals, and as food fats. Less animals also require less compound feed and thus less “oilseed meals” (= less oil production). More chickens will eat more, mostly imported, soybean meal but less pigs require less domestically produced rapeseed meal which is less suited for chicken meat and eggs production. This can alter future economics and product flows.

India has built big stocks of sunflower seed oil and, in winter months, prefers not to buy palm oil which needs heating for easier handling. In South East Asia, El Nino is, so far, milder than anticipated which is a lesser threat to future palm oil production. And in Latin America there are pockets of dryness while other regions got excessive rains.

How the future will unfold is hard to say. Still, weather events like El Niño, conflict in the Middle-East, Black Sea region or elsewhere, energy price evolution, economic collapse or boom, environmental and climate policies… could all be(come) determining factors for a very constructive narrative.

As bearishness settled in, short term, for some oils, we may see still lower prices as there seems to be no catalyst for an uptrend, notwithstanding the market already priced in most “bearish news”. There are currently no real big stories but it might well be that the market is bottoming out and then the only move is up!

MARKETS

Palm oil

Palm oil prices are expected to continue to experience pressure of rival oils, inventory buildup in producing countries and muted demand from China and India but may find support from more expensive gasoil via biodiesel productions in palm oil producing countries like Indonesia, Malaysia and Thailand and still even in Southern EU despite some European resistance (deforestation directive etc.). The market kept moving a bit up and a bit down resulting in a kind of long-term moonwalk side glide.

Soybean oil

The U.S., harvest is about 80% complete and soybean prices appear stuck despite daily fluctuations. Farmers might be done selling for a while and will wait for higher prices, thinking there is money to be made in storing. But the question is, what could drive prices higher?Soybean processors stayed very active on both sides of the Atlantic. In the US crush margins remain well supported by structurally higher demand for vegetable oils (biodiesel) and despite a record crush, NOPA reported soybean oil stocks in the US, last month, at their lowest level since Dec. 2014!

The good crush margins also reflect a strong demand for soybean meal because Argentinian crushers are running at only a third of capacity after the drought cut their crop by more than half…. Argentina is normally a big exporter of soybean meal.

Both the demand for oil as for meal limits the downside potential for beans!

Soybean oil did follow lower petroleum prices and saw temporarily subdued demand from biodiesel producers but then hit some support levels which triggered some buying in the US where the market still makes a $300 premium over Brazil and $70 over FOB Dutch Mill.

Maybe higher water levels in the Mississippi could generate some extra export demand and support bean prices. Or maybe weather concerns in Brazil could trigger Chinese bean buying in the US.

In Argentina plantings will begin early November and soil moisture looks OK making some hope for a good crop in excess of 46Mmt. But in parts of Brazil farmers stopped plantings because it is too hot and dry. Other parts of Brazil experienced excessive rainfall. It is too early for a Latin America weather scare but this situation could perhaps shave their optimistic record production forecast!

Rapeseed oil

Rapeseed and oil prices had regained positive momentum on a jump in petroleum prices following the Hamas-Israel conflict. But fundamentally the EU seed market remained characterized by limited demand for crushing and increased competition from oilseeds from Eastern Europe and Australia. Canadian seeds remain too expensive. Then seed prices slipped downwards again in a context of low demand and good availability, helped by correcting lower energy prices. Seed market seems oversold and prices moved close to farmer break-even point.Lower EU rapeseed oil demand and a generally good vegetable oil supply weighed on spot and forward prices.

Sunflower seed oil

Ukraine and Russia continue to compete for the world market, which could keep pressuring prices in the coming months. There are reports of record Russian sun seed processing and despite regular logistical nervousness and uncertainties in the Black Sea it is expected that Ukrainian exports to EU and elsewhere will remain strong. FOB Black Sea crude sunflower seed oil is $115 cheaper than in NW EU making it attractive on the world market for discount buyers.Olive Oil

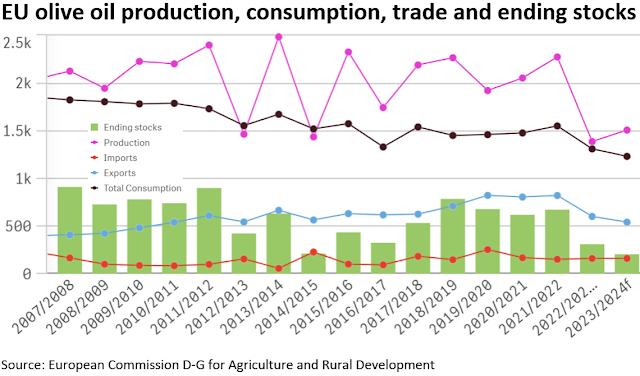

The production problems in EU, due to drought in last and this year’s growing season, led to drastically higher prices and a lower domestic consumption following and strengthening a previously established downward trend. In the case of olive oil, for some applications, alternatives, like (hi-oleic) sunflower seed oils and rapeseed oil, are mostly much better priced. This year’s only slightly better production expectations on top of last season’s very low ending stocks add to supply tightness and still higher prices that will have to kill export and domestic demand to rebalance the market.

USD, mineral oil and biofuels.

Economists are still wondering how deep the higher interest rates will cut in the economy and how much it will hurt and for how long. In the US the job market and consumer spending seem to stay strong whilst EU is clearly sinking into recession.

Some have forecast three-digit petroleum prices for months, but it didn’t happen (yet?). After firming strongly on geopolitical worries, energy markets trended lower again but for Brent, $87 seemed to be a resistance level to rebound from, still Brent stayed way below levels seen a month ago as economic concerns outweighed everything else. Refiner’s margins are thin and in the physical market there were reports (Reuters) of a higher number of unsold cargoes than would be typical for this time of year. Ahead of the weekend, concerns that the Israel-Gaza conflict could disrupt global supplies added a renewed war premium to crude oil prices. More fireworks may be expected after Israel moved into Gaza this weekend.

Biodiesel developments

In Brazil, APROBIO, the Association of Brazilian Biofuel Producers, recently advocated, from 2024 onwards, a gradual (predictable and legally certain) increase from 12 to 20% mandatory blending of biodiesel with fossil diesel. The technology is there and low transition costs without forcing fleet renewals, is good for both a low CO2e and material usage footprint. Today’s production capacity is almost double the current demand. An official said he has analyzed requests to include mandatory blending levels of biodiesel in a new law, the “Fuel of the Future bill (PL 4516/23)”, creating a new reporting framework for the biofuel sector. Higher Brazilian biodiesel production would leave less oil for export.§§§

For questions or queries, please reach out to your regular AVENO contact

§§§

Previous bi-weekly updates

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats.

You can find all previous updates here

Newsletter sign-up

Sign-up here to receive our Biweekly directly into your inbox.

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.