Uncertainties erode confidence of bulls and bears.

Your Bi-weekly update on edible oils & fats by Aveno

Bi weekly November 13th 2023.

Weather linked risks, geopolitics and economic worries getting stronger.

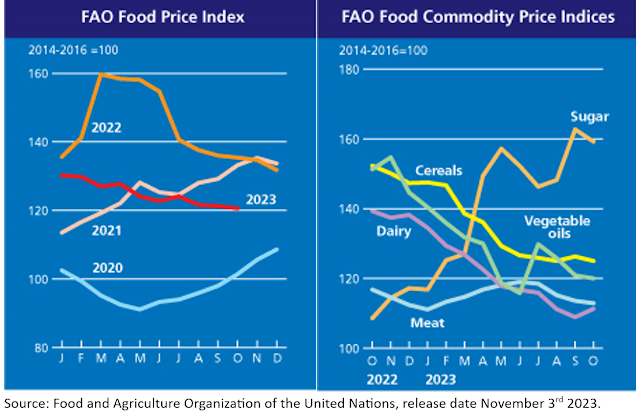

Weakening edible oils and fats markets fostered caution and hesitation amongst buyers leading to poor coverage which in turn could later become supportive to price recovery.Buyers have been receiving many negative signals: weak retail sales in the eurozone; receding German industrial production; Germany, the biggest economy of the zone is seen slipping into recession in the last quarter of the year; inflation problems are far from over; banks have been tightening lending conditions to businesses and consumers on both sides of the Atlantic; dissipating consumer confidence in the US paired with raising unemployment…

Danish shipping company Maersk recently announced it will continue cutting jobs, which started early in the year, to total about 10.000 layoffs, or 10% of the staff, in order “to cushion the impact of challenging market conditions”: dropping shipping demand, increased costs and lower profitability.

Unusual dryness in Brazil, which had the hottest and driest October in 25 years, particularly in the Mato Grosso region, raises concerns about the soybean crop and also Indonesia expects a negative impact on the palm oil production in 2024.

Elsewhere, El Niño dryness, combined with climate change, restricted shipping on some important rivers, including the Amazon, Mississippi and Rhine. But most striking is the situation in Panama where, following the driest period ever (41% less precipitation than normal), the Panama Canal Authority recently reduced daily transit volumes from normally 40 to 18 ships/day on top of draft restrictions.

Water levels of Lake Gatún, supplying the water for the passing of ships, fell to unprecedented levels. Each passing through the locks consumes about 200Kmt of water! Many bulk carrier and tanker owners already decided to use longer and more expensive alternative routes (via the capes and Suez), as container ships will use/pay up for the lion's share of the limited available slots in the coming months.

Since Russia, last July, withdrew from the ‘Black Sea Grains Initiative’ shipping and insurers worry about security in the region. With Ukraine and Russia targeting each other’s ports, some merchant ships have been caught in crossfire. Last week, while entering the port of Yuzhny, a Russian missile hit a bulk carrier picking up cargo for China.

Although Ukrainian authorities insist their “maritime export corridor” remains open for business and ships still enter and leave Ukraine on the route that runs along the coast and near NATO members Bulgaria and Romania, insurance prices keep going up and owners prefer sending older ships to the Black Sea.

Smart buyers know that the darkest hour of the night comes just before dawn and they always have a plan not to be caught off guard.

MARKETS

Palm oil

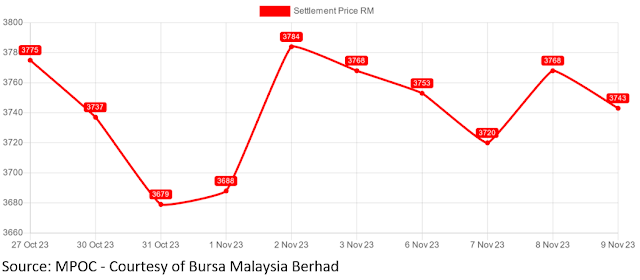

Palm oil continued its sideway up and down moves, dancing on the leg of the issues of the day: China is buying, the stocks are up, the exports are down, beans are up, beans are down, Indonesian biodiesel projections, El Niño effect on production in 2024, etc. but basically the market stabilized and palm oil is cheap.For several reasons (aging trees to be replaced, expensive fertilizer, labor shortages, deforestation issues, etc.) the dynamics of palm oil production have changed in Malaysia and Indonesia. The production growth decrease (it’s still been growing) has been somewhat compensated by production increases elsewhere (Africa, Latin America), and India is trying to develop a palm oil industry of their own. We are now leaving the peak production season behind us and stocks will start to drop. The coming monsoon season may mean less production too.

And with El Niño impacting negatively the production in South East Asia in the coming months, paired with an increased global demand for biofuel production, no one wants to be caught short when markets start moving. Taking a position, covering or not covering remains risky. The million-dollar question is: when will the smoldering fire light the fuse? Meanwhile crude palm oil prices are expected to remain stable, trading in a range below RM4,000/mt.

Soybean oil

Last month, in Chicago, the oil leg of the complex weakened while beans, at first moving sideways, strengthened on worries about the next South American crop: excess water in the south of the country but heat and dryness in Mato Grosso and Mato Grosso do Sul, together good for 34% of Brazil's soybean production. This resulted in planting delays and reduced crop estimates for 2024. However, Brazil's optimistic crop agency, Conab, still raised its forecast to 162.42Mmt, from their previous estimate of 162Mmt. Nevertheless, the concerns prompted some bean buying, for export, in the US.Meal prices rose further on depletion of supplies from Argentina and a record crush in the US which is struggling to meet demand. These high meal prices allow India, which booked quite some export business, to be competitive with meal on the world market.

Crushing for meal produces a lot of spot oil which needs to find a home, pressuring prices down. Overall, prices should stay supported until more clarity about the total scope of the weather problems in South America emerges.

Rapeseed oil

Rapeseed prices recovered recently, after soybeans returned to their highest levels since mid-September. But the recovery was smoothened by an EU biodiesel industry that was once again hit by the fall in petroleum + gasoil prices in a stagnant economic environment. This may pressure seed and oil prices for positions after Christmas.Physical oil on nearby is tight because of unwinding existing contracts in the food and biofuels space. In EU crude rapeseed oil is cheaper than soybean oil but expensive versus palm and sunflower seed oil.

Sunflower seed oil

Besides some logistical constraints in the Black Sea region which were a bit supportive to prices, nothing much changed fundamentally. Shipments from Ukraine remain irregular and the risk of ships getting attacked or in the crossfire or running on a mine remains real. The market is waiting for further farmer selling. Black Sea crude sunflower seed oil is at a discount of only $55/t versus the North West EU six ports market which itself is $50 below FDM crude rape oil. Sunflower seed oil remains very affordable as it still needs to compete for demand in the (global) market. And Russia too keeps pushing hard to give the world a taste of their sun oil.USD, mineral oil and biofuels.

There’s been a lot of downward pressure on petroleum prices due to fears of a drop in global energy demand, following disappointing economic outlook figures from EU, China and the US.

Biodiesel developments

Is demand growth set to outstrip supply growth of edible oils and fats? Some analysts certainly take it into account and see this shaping up in 2024 as feedstock demand for biofuel production is seen increasing strongly in Indonesia, Brazil and the US. Other countries, e.g., India, are also increasing their biofuel production. Any adverse consequences from weather conditions around the globe, on edible oil production, will only reenforce any supply and demand imbalance.§§§

For questions or queries, please reach out to your regular AVENO contact

§§§

Previous bi-weekly updates

There is some complexity to the business we daily operate in. To help understand the business of being an edible oil and fat producer we've launched a bi-weekly newsletter.

Every two weeks we will share an update about edible oils and fats.

You can find all previous updates here

Newsletter sign-up

Sign-up here to receive our Biweekly directly into your inbox.

Disclaimer

Unless otherwise mentioned the crude oil values quoted in these documents are prices landed in EU without import duties, handling, storage, financing, refining, packing, transport or any other cost related to bring the product to market. They are used as market trend illustration. Substitution of oils is possible but different oils have different fatty acid profiles and are not all interchangeable for all applications. One can make biodiesel from all oils and fats but one cannot make mayonnaise from coconut oil. This document is exclusively for you and does not carry any right of publication or disclosure. This document or any of its contents may not be distributed, reproduced, or used for any other purpose without the prior written consent of AVENO. The information reflects prevailing market conditions and our present judgement, which may be subject to change. It is based on public information and opinions which come from sources believed to be reliable; however, AVENO doesn’t guarantee the correctness or completeness. This document does not constitute an offer, invitation, or recommendation and may not be understood, as an advice. This document is one of a series of publications undertaken by AVENO and aims at informing broadly a targeted audience about the edible oils & fats market. AVENO’s goal is to keep this information timely and accurate however AVENO accepts no responsibility or liability whatsoever with regard to the given information.